Latin America Data Center Construction Market Investment To Hit $4.40 Billion By 2030 – Boost In Submarine & Inland Connectivity Driving Market Growth – Arizton

"Latin America Data Center Construction Market Research Report by Arizton"

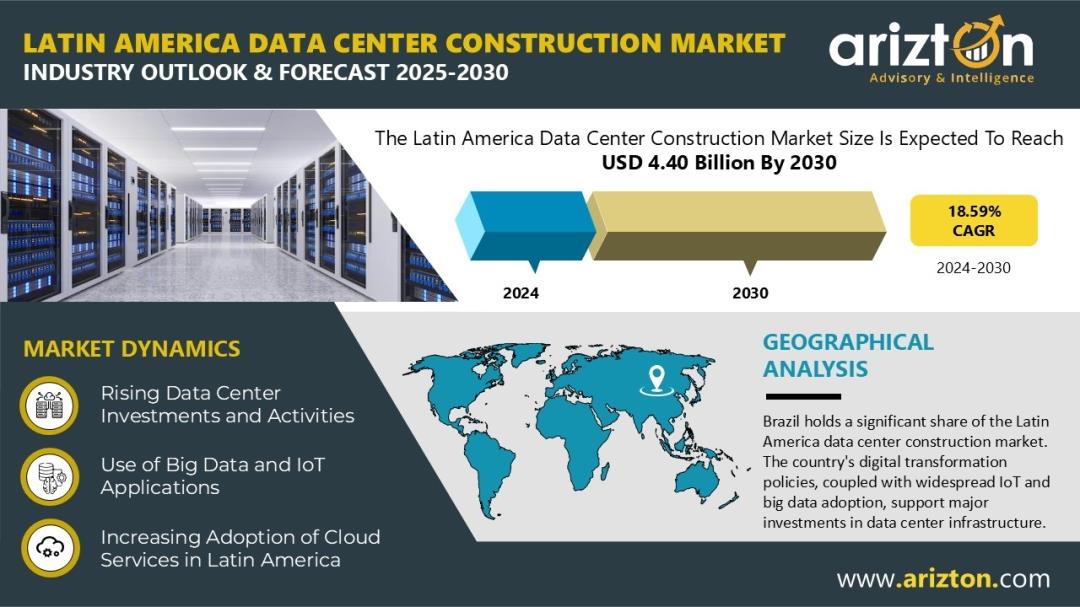

According to Arizton's latest research report, Latin America data center construction market is growing at a CAGR of 18.59% during 2024-2030.

To Know More, Click:

Report Summary:

Market Size - Investment (2030): USD 4.40 Billion

Market Size - Investment (2024): USD 1.58 Billion

CAGR - Investment (2024-2030): 18.59%

Market Size - Area (2030): 1,888 Thousand Square Feet

Power Capacity (2030): 450 MW

Historic Year: 2021-2023

Base Year: 2024

Forecast Year: 2025-2030

Regional Analysis: Infrastructure, Electrical Infrastructure, Mechanical Infrastructure, Cooling Systems, Cooling Technique, General Construction, Tier Standards, and Geography

Geographical Analysis: Brazil, Chile, Colombia, Mexico, Argentina, and Rest of Latin America

Growth of Latin America Data Center Infrastructure Market

The Latin American data center infrastructure market is experiencing significant growth across various segments, including power, mechanical, and general construction. Key players in power infrastructure, such as ABB, Eaton, and Schneider Electric, are focusing on innovations like lithium-ion batteries, fuel cell technology, and intelligent PDUs to enhance efficiency. Redundant power systems, including 2N and N+1 configurations, and the adoption of diesel generators and DRUPS systems are expected to drive market revenue growth.

In mechanical infrastructure, sustainable cooling technologies and free-cooling systems are gaining popularity, particularly in regions with colder climates. Data centers are increasingly using energy-efficient cooling solutions and incorporating real-time analytics for maintenance.

The construction sector is also witnessing growth, with companies like AECOM and Afonso França Engenharia leading data center development projects. These trends point to continued innovation and competition, creating significant revenue opportunities in Latin America's expanding data center market.

Enhancement in Submarine & Inland Connectivity in Latin America

Latin America is experiencing significant improvements in submarine and inland connectivity, with substantial investments and strategic collaborations aimed at upgrading infrastructure and expanding digital access. Over 80 submarine cables currently connect the region, with 8 to 9 more expected to be deployed by or after 2025.

A major initiative is the Humboldt Cable System, a groundbreaking project connecting Chile to the Asia Pacific region. In partnership with Chile's Fondo de Infraestructura and H2 Cable, this submarine cable will span around 14,810 kilometers, linking Chile to Sydney, Australia, and other key locations in Asia Pacific. It is set to be operational by 2026.

Additionally, Liberty Networks and Gold Data have teamed up to develop a subsea cable network that will link the US with Mexico and Latin America. This project, featuring the GD-1 and LN-1 cables, will offer one of the lowest-latency routes between the US and Mexico, enhancing connectivity to emerging data hubs in Colombia, Panama, and the Caribbean.

The Rise of AI and Automation in Latin American Data Centers

The Latin American data center market is undergoing a significant transformation driven by Artificial Intelligence (AI) and automation technologies. This shift is enhancing operational efficiency, sustainability, and security across the region. Major companies like Kyndryl, Google, and Microsoft are leveraging AI-powered tools to optimize IT infrastructure and operations.

Key Developments by Country:

Brazil: The Brazilian AI Strategy, launched in 2021, promotes investments in AI, research, and development, while focusing on responsible AI usage. In September 2024, Microsoft committed to investing $2.7 billion to expand AI infrastructure, and Cassava Technologies is launching its AI unit in the region.

Chile: Chile's AI policy, established in 2019, covers AI development, adoption, and ethics. It addresses privacy, cybersecurity, and regulation, with a budget of less than $1 million annually.

Colombia: The Colombian AI strategy, formed in 2019, prioritizes digitalization and societal challenges, with a budget of $1 million to $5 million per year. Claro Colombia is investing over $200 million to expand its fiber optic network for AI adoption.

Mexico: Mexico's AI policy, Agenda Nacional Mexicana de IA, aims to support AI's role in industry and international leadership, with a $1.3 billion investment from Microsoft in AI infrastructure.

Argentina: The AI National Plan, valid until 2029, addresses sustainable AI development and R&D investments, with an annual budget of $5 million to $20 million.

Uruguay: Uruguay's Digital Government AI Strategy focuses on advancing AI governance and digital citizenship, with a budget of under $1 million. Google is investing $850 million in a new AI-powered facility.

AI in Data Center Operations:

AI is revolutionizing energy management in data centers by reducing operational costs and environmental impact. Ascenty, for instance, uses AI-driven predictive analytics to reduce downtimes, while companies like Scala Data Centers, Google, and EdgeConneX use AI-powered cooling systems to minimize water and energy consumption. AI also plays a critical role in enhancing security by detecting unusual network activity, with AWS deploying automated threat detection systems.

The increasing adoption of AI and automation in Latin American data centers is reshaping the job market. There is a growing demand for skilled professionals in AI, data analytics, and cybersecurity, contributing to the region's evolution into a hub for smart data centers.

Investment Overview in Latin American Data Center Construction Market

The Latin American data center market is experiencing strong investment growth driven by rising demand for digital services, cloud computing, and AI applications. Key cities like São Paulo, Querétaro, and Santiago are leading the charge, while emerging markets in Colombia and Argentina show promising potential. Major global cloud providers, including Amazon Web Services (AWS), Google Cloud, and Microsoft Azure, are heavily investing in hyperscale facilities to meet cloud service demand.

In September 2024, AWS announced a $1.8 billion investment to expand its Brazilian data center through 2030. Leading colocation providers such as Ascenty, Scala Data Centers, KIO Networks, and Equinix are also making significant strides, with Ascenty focusing on renewable energy. New entrants like Ada Infrastructure, CloudHQ, and Layer 9 Data Centers are further fueling competition. Global players like Oracle, IBM, and Huawei are also expanding their cloud data center footprints in the region.

Brazil's Data Center Market Sees Strong Growth

Brazil's data center market is witnessing significant growth, fueled by the increasing demand for cloud computing, digital transformation, and emerging technologies like AI and IoT. São Paulo continues to be the primary hub for data center expansion, hosting numerous existing facilities and many more in development. This growth is bolstered by substantial investments from both local and global players and favorable government policies.

Several major players are making notable investments, including Microsoft's commitment to expanding cloud and AI infrastructure in the country, as well as AWS's significant investment to boost its data center operations. Scala Data Centers is also expanding with new projects in multiple regions. Other key developments include Tecto Data Centers launching new facilities and Elea Data Centers acquiring additional properties for future growth.

The market is increasingly shifting toward Tier III and IV data centers, driven by the demand for higher standards in reliability, security, and advanced technology. As companies continue to invest in cutting-edge infrastructure, Brazil's data center sector shows no signs of slowing down.

Buy this Research @

Post-Purchase Benefit

-

1hr of free analyst discussion

10% off on customization

The Report Includes the Investment in the Following Areas:

Infrastructure

-

Electrical Infrastructure

Mechanical Infrastructure

General Construction

Electrical Infrastructure

-

UPS Systems

Generators

Transfer Switches & Switchgear

PDUs

Other Electrical Infrastructure

Mechanical Infrastructure

-

Cooling Systems

Racks

Other Mechanical Infrastructure

Cooling Systems

-

CRAC & CRAH Units

Chillers Units

Cooling Towers, Condensers, and Dry Coolers

Other Cooling Units

Cooling Technique

-

Air-based Cooling

Liquid-based Cooling

General Construction

-

Core & Shell Development

Installation & Commissioning Services

Engineering & Building Design

Fire Detection & Suppression

Physical Security

DCIM/BMS Solutions

Tier Standards

-

Tier I & Tier II

Tier III

Tier IV

Geography

-

Brazil

Chile

Colombia

Mexico

Argentina

Rest of Latin America

Competitive Landscape

Key Data Center Support Infrastructure Providers

-

ABB

Alfa Laval

Assa Abloy

Axis Communications

Bosch Security Systems

Caterpillar

Cummins

Daikin Applied

Delta Electronics

EATON

Honeywell

Johnson Controls

Legrand

Mitsubishi Electric

Munters

Panduit

Piller Power Systems

Rolls-Royce

Schneider Electric

Siemens

STULZ

Vertiv

Prominent Construction Contractors

-

AECOM

Afonso França Engenharia

Constructora Sudamericana

Cundall

DLR Group

Fluor Corporation

Gensler

Grupo PML

HDOS

Holder Construction

Hyphen

Jacobs Engineering

KMD Architects

Mendes Holler

Modular Data Centers

PQC

Quark

Racional Engenharia

Soben

Syska Hennessey Group

The Weitz Company

Turner Construction

Turner & Townsend

Zeittec

Prominent Data Center Investors

-

Actis (NextStream)

Amazon Web Services

Angola Cables

Ascenty

Ava Telecom

Blue NAP Americas

Cirion Technologies

Claro

DHAmericas

Digicel

EdgeConneX

Elea Data Centers

Equinix

EVEO

Google

GTD

HostDime

InterNexa

IPXON Networks

KIO Networks

Mexico Telecom Partners

Microsoft

Millicom (Tigo)

ODATA (Aligned Data Centers)

OneX Data Center

Oxygen

Quântico Data Center

Scala Data Centers

SONDA

Takoda Data Centers

Telecom Italia Sparkle

Tecto Data Centers (V)

Win Empresas

New Entrants

-

247 Data Centers

Ada Infrastructure

CloudHQ

Layer 9 Data Centers

MDC Data Centers

Surfix Data Center

Key Questions Answered in the Report:

What is the growth rate of the Latin America data center construction market?

How big is the Latin America data center construction market?

What is the estimated market size in terms of area in the Latin America data center construction market by 2030?

What are the key trends in the Latin America data center construction market?

How many MW of power capacity is expected to reach the Latin America data center construction market by 2030?

Check Out Some of the Top Selling Research Reports:

Latin America Data Center Colocation Market - Industry Outlook and Forecast 2024-2029

Data Center Construction Market - Global Outlook & Forecast 2024-2029

Why Arizton?

100% Customer Satisfaction

24x7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton's report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment