403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Middle East LNG Exports To Top 200Mn Tonnes By 2050 Qatar's Projects To Drive Growth: GECF

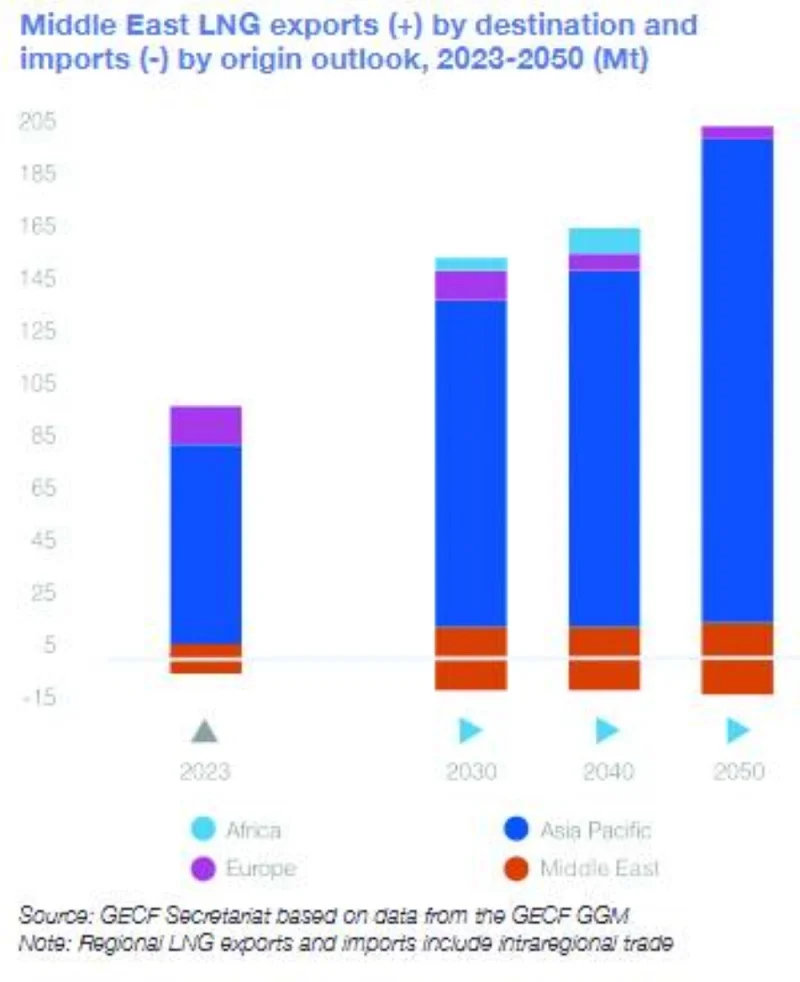

(MENAFN- Gulf Times) Middle East region contributed 96mn tonnes to global LNG exports, accounting for 23% of the worldwide total in 2023, according to Gas Exporting Countries Forum (GECF).

Qatar was the top global LNG exporter shipping 78mn tonnes. Asia remained the dominant market, receiving 75% of Qatar's LNG.

By 2050, LNG exports from the Middle East are projected to reach 202mn tonnes, driven largely by expansion efforts in Qatar. It is expected for the Middle East to significantly increase LNG net exports to 188mn tonnes by mid-century.

In its Global Gas Outlook 2050, GECF said that in recent years, the Middle East has seen a notable increase in natural gas demand, driven by population growth and the subsidisation of gas prices.

These subsidies were designed to promote economic development, support energy-intensive industries, and share the benefits with the local population.

At the same time, the region's vast natural gas reserves have created opportunities for expanded trade.

While LNG exports to Asia and Europe have been the main focus, regional gas trade – both within the Middle East and beyond – has also involved smaller volumes transported through export pipelines.

These include pipelines connecting Qatar to the UAE and Oman, Iran to Iraq and Turkiye and Armenia and Azerbaijan.

According to GECF, the key driver of the Middle East's natural gas exports is expected to be the growth in LNG supplies, with Qatar at the forefront.

Qatar's position as a leading global LNG exporter is set to strengthen further, with 2024 marking the continued expansion of its liquefaction capacities.

Qatar aims to nearly double its LNG production capacity, increasing output by approximately 85% from the current 77mtpy to 142mtpy by 2030.

This ambitious growth, led by the North Field Expansion project, will be implemented in three phases – through the North Field East (NFE), South (NFS), and West (NFW) expansion projects – and could contribute to a global oversupply later in the decade.

This significant expansion will underpin Qatar's continued and sustainable economic growth, aligning with the Qatar National Vision 2030.

In 2023, the Middle East's net gas exports reached 139bcm. Projections suggest a substantial increase, with total net exports expected to rise to 289bcm by 2050.

Long-term LNG imports are expected to grow to 14mn tonnes by 2050, with Kuwait accounting for around 50% of this growth.

Asia Pacific will remain the primary destination for Middle Eastern LNG. By 2050, the Asia Pacific region is expected to receive over 178mn tonnes, representing around 90% of the region's total LNG exports.

Exports to Europe will decline significantly by mid-century reflecting Europe's shift towards alternative energy sources. Africa's role as a destination will diminish following a rise by 2030.

The Middle East remains 100% self-sufficient in LNG imports, underscoring its dominant supply position. This trend highlights the growing Asia-centric nature of Middle Eastern LNG exports and a declining reliance on European markets, GECF said.

Qatar was the top global LNG exporter shipping 78mn tonnes. Asia remained the dominant market, receiving 75% of Qatar's LNG.

By 2050, LNG exports from the Middle East are projected to reach 202mn tonnes, driven largely by expansion efforts in Qatar. It is expected for the Middle East to significantly increase LNG net exports to 188mn tonnes by mid-century.

In its Global Gas Outlook 2050, GECF said that in recent years, the Middle East has seen a notable increase in natural gas demand, driven by population growth and the subsidisation of gas prices.

These subsidies were designed to promote economic development, support energy-intensive industries, and share the benefits with the local population.

At the same time, the region's vast natural gas reserves have created opportunities for expanded trade.

While LNG exports to Asia and Europe have been the main focus, regional gas trade – both within the Middle East and beyond – has also involved smaller volumes transported through export pipelines.

These include pipelines connecting Qatar to the UAE and Oman, Iran to Iraq and Turkiye and Armenia and Azerbaijan.

According to GECF, the key driver of the Middle East's natural gas exports is expected to be the growth in LNG supplies, with Qatar at the forefront.

Qatar's position as a leading global LNG exporter is set to strengthen further, with 2024 marking the continued expansion of its liquefaction capacities.

Qatar aims to nearly double its LNG production capacity, increasing output by approximately 85% from the current 77mtpy to 142mtpy by 2030.

This ambitious growth, led by the North Field Expansion project, will be implemented in three phases – through the North Field East (NFE), South (NFS), and West (NFW) expansion projects – and could contribute to a global oversupply later in the decade.

This significant expansion will underpin Qatar's continued and sustainable economic growth, aligning with the Qatar National Vision 2030.

In 2023, the Middle East's net gas exports reached 139bcm. Projections suggest a substantial increase, with total net exports expected to rise to 289bcm by 2050.

Long-term LNG imports are expected to grow to 14mn tonnes by 2050, with Kuwait accounting for around 50% of this growth.

Asia Pacific will remain the primary destination for Middle Eastern LNG. By 2050, the Asia Pacific region is expected to receive over 178mn tonnes, representing around 90% of the region's total LNG exports.

Exports to Europe will decline significantly by mid-century reflecting Europe's shift towards alternative energy sources. Africa's role as a destination will diminish following a rise by 2030.

The Middle East remains 100% self-sufficient in LNG imports, underscoring its dominant supply position. This trend highlights the growing Asia-centric nature of Middle Eastern LNG exports and a declining reliance on European markets, GECF said.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment