Uniswap Community Allocates $165.5 Million To Propel Ecosystem Expansion

The Uniswap community has approved two governance proposals, allocating a total of $165.5 million to bolster the development of its ecosystem. This substantial funding is directed towards advancing the recently launched Unichain Layer 2 network and Uniswap v4 protocol, as well as initiating new liquidity incentive programs.

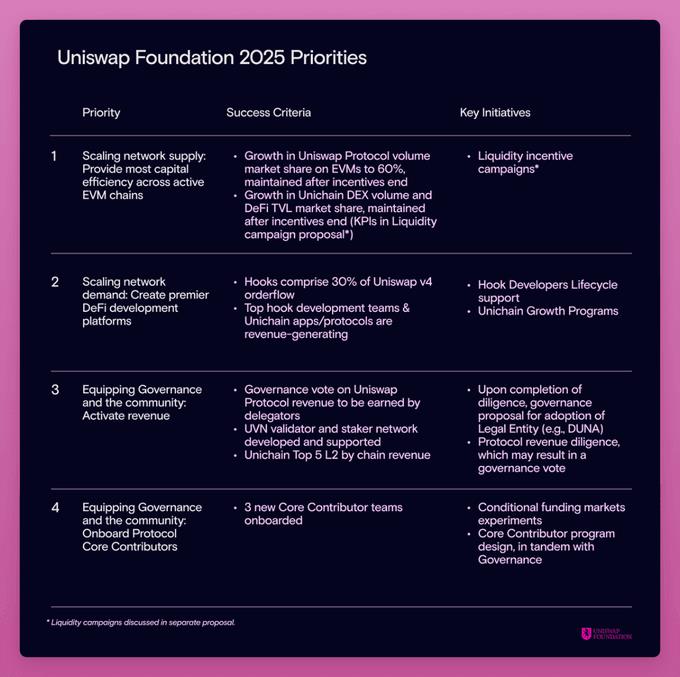

The first proposal earmarks $95.4 million for the Uniswap Foundation's grants budget, accompanied by an additional $25.1 million designated for operational expenses over the next two years. These funds aim to enhance capital efficiency, activate revenue streams, and attract active contributors to the platform. The second proposal allocates $45 million to support liquidity incentives, a strategic move to attract new users and sustain ecosystem growth through developer-centric activities.

Gauntlet, a Web3 risk management protocol, has been entrusted with managing these liquidity incentives. They have deployed and configured an Aera vault on the mainnet for the Uniswap Foundation, injecting over 7.5 million UNI tokens, valued at approximately $52 million at current prices. This initiative is designed to draw in new users and maintain growth across both networks.

The approval of these proposals also lays the groundwork for the long-discussed 'fee switch' mechanism. This feature would redirect a portion of protocol fees, currently earned by liquidity providers, towards UNI token holders. The Uniswap Foundation has indicated that it will proceed with the necessary legal steps to activate this switch, aligning the interests of governance members with the protocol's long-term success.

The community's decision to allocate substantial funds to ecosystem development reflects a strong commitment to increasing the network's scalability and creating new opportunities for growth. The foundation's long-term goal is to transition Uniswap from a decentralized exchange into a platform that can also cater to developers, bringing significant value to the Uniswap community.

See also Coinbase's Regulatory Approval Signals Return to Indian Crypto MarketUniswap v4, launched in mid-January 2025, introduced the concept of 'hooks'-contracts that allow developers to customize interactions within pools, swaps, and fees. The launch of Unichain, built on the Optimism tech stack, further enhances Uniswap's scalability by providing a Layer 2 network capable of supporting more transactions at lower fees.

The activation of the fee switch represents a significant step in Uniswap's ongoing efforts to align the interests of its governance members with the protocol's long-term success. Over $1 billion in annualized fees have been generated by the Uniswap protocol, and this shift would allow token holders to capture a portion of that revenue.

This development has had a positive impact on the market perception of Uniswap's native token, UNI. Following the announcement, the price of UNI experienced a notable surge, reflecting growing optimism among investors regarding the platform's future prospects.

Arabian Post – Crypto News Network

Notice an issue? Arabian Post strives to deliver the most accurate and reliable information to its readers. If you believe you have identified an error or inconsistency in this article, please don't hesitate to contact our editorial team at editor[at]thearabianpost[dot]com . We are committed to promptly addressing any concerns and ensuring the highest level of journalistic integrity.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment