Morphine Market To Reach USD 32.81 Billion By 2032 Amid Rising Demand For Pain Management And Cough Suppressant Applications | SNS Insider

| Report Attributes | Details |

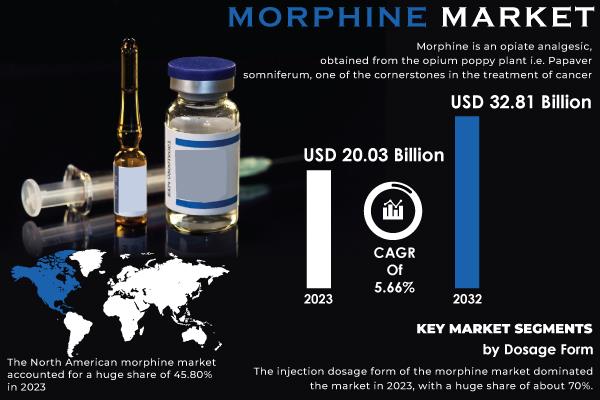

| Market Size in 2023 | USD 20.03 Billion |

| Market Size by 2032 | USD 32.81 Billion |

| CAGR | CAGR of 5.66% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | . By Dosage Form (Injection, Oral, Other Dosage Forms) . By Application (Pain Management, Diarrhea Suppressant, Cold & Cough Suppressant, Others) . By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Others) . By End User (Hospitals & Clinics, Ambulatory Surgical Centers, Others) |

| Key Drivers | . Rising Chronic Pain Conditions and Innovations in Drug Delivery Technologies Fuel Demand |

If You Need Any Customization on Morphine Market Report, I nquire Now @

Segment Analysis

By Dosage Form:

Injection dosage form accounted for a maximum market share of around 70% of morphine in 2023. The major cause behind this is the quick action as well as the long duration of pain relief these injections bring about, making them the most preferred type of dosage form among medical professionals who are managing acute as well as chronic cases of pain. In addition, an increased prevalence of neurological disorders, which usually generate substantial pain, has created a huge demand for injectable morphine preparations in hospitals as well as clinics.

However, the oral dosage form is expected to be the fastest-growing segment in the forecast period. Oral medications are gaining more ground due to ease of administration and better compliance among patients. Long-term pain management through oral morphine - the doctors' preference - increasingly contributes to growing this segment, especially in home care settings.

By Application:

In 2023, the application of morphine in pain management became the largest. Application-wise, almost 80% of the market share can be attributed to increasing chronic pain conditions, postoperative pain, and cancer-related pain. The aging population coupled with rising cases of orthopedic disorders ensures the robust demand for morphine in this application.

The application of the cold and cough suppressant will be the most rapidly growing segment for the forecast period. There is enhanced awareness about the efficacy of morphine in dealing with severe cough symptom experiences, especially those patients diagnosed with respiratory infections. Increasingly, healthcare providers are coming to appreciate their role in symptom management, and thus, morphine use is increasing as a therapeutic intervention in cases of bad cough.

Regional Outlook

Dominant Region: North America

North America accounted for the largest share of the morphine market in 2023. This region has dominated mainly due to a high prevalence of chronic pain conditions, coupled with an increasing trend of surgeries and cases of cancer. The United States is particularly one of the countries with an established healthcare infrastructure and a growing geriatric population, which is driving up the demand for morphine. In addition, North America's pharmaceutical industry leaders are developing new morphine drugs that are changing the very face of the market in the region. Purdue Pharma and Mallinckrodt Pharmaceuticals, among others, are actively pursuing research in morphine reformulations in the U.S. market.

Growth Hotspot: Asia-Pacific

Asia-Pacific is likely to be the fastest-growing region for morphine-based products over the forecast period. The region's growth is mainly attributed to the increasing cases of chronic pain and respiratory disorders in countries such as China and India. Sustained healthcare investment, capacity building of pharmaceutical manufacturing, and increased awareness of the benefits of morphine for managing pain and cough also contribute to the growth of the market in this region. Multinational companies, including Pfizer and Novartis, are extending operations in the Asia-Pacific region because demand is morphing with morphine-based treatments.

Buy Full Research Report on Morphine Market 2024-2032 @

Recent Developments

- In August 2023, Mallinckrodt received approval from the FDA for its new oral morphine sulfate formulation that offers longer pain relief. In December 2023, Teva announced it had increased its injectable morphine production in Europe due to increased demand. In June 2024, the company launched a fast-acting morphine syrup that targets patients with severe cough symptoms from respiratory infections. In April 2024, the company launched a generic version of injectable morphine. Such a launch provides an opportunity to increase access to pain management treatments in growing markets. In February 2024, Endo International expanded its pain management portfolio with a new transdermal patch for the treatment of chronic pain, based on morphine.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.2 PESTLE Analysis

4.3 Porter's Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends, (2023), by Region

5.3 Application Volume: Production and source volumes of pharmaceuticals.

5.4 Healthcare Spending: Expenditure data by government, insurers, and out-of-pocket by patients.

6. Competitive Landscape

6.1 List of Major Companies, by Region

6.2 Market Share Analysis, by Region

6.3 Product Benchmarking

6.4 Strategic Initiatives

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Morphine Market Segmentation, by Dosage Form

7.1 Chapter Overview

7.2 Injection

7.3 Oral

7.4 Other Dosage Forms

8. Morphine Market Segmentation, by Application

8.1 Chapter Overview

8.2 Pain Management

8.3 Diarrhea Suppressant

8.4 Cold & Cough Suppressant

8.5 Others

9. Morphine Market Segmentation, by Distribution Channel

9.1 Chapter Overview

9.2 Hospital Pharmacies

9.3 Retail Pharmacies

9.4 Online Pharmacies

9.5 Others

10. Morphine Market Segmentation, by End User

10.1 Chapter Overview

10.2 Hospitals and Clinics

10.3 Ambulatory Surgical Centers

10.4 Others

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Speak with O ur E xpert A nalyst T oday to G ain D eeper I nsights @

[For more information or need any customization research mail us at ... ]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Akash Anand – Head of Business Development & Strategy ... Phone: +1-415-230-0044 (US)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment