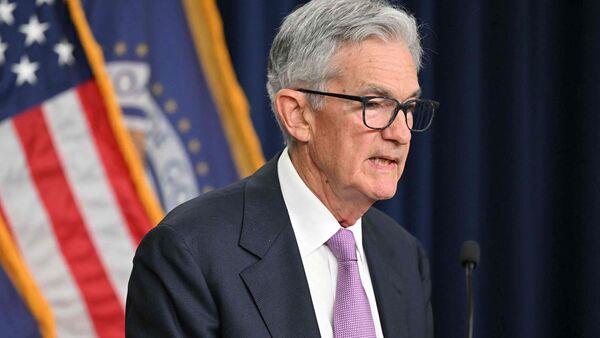

US Fed Rate Cut: Full Text Of Monetary Policy Statement By FOMC

The Federal Reserve has held its policy rate in the 5.25-5.50% range since July 2023 as inflation rose to a 40-year high level, but is now approaching the central bank's target.

Here is the full text of the monetary policy stance announced by the Federal Open Market Committee in its statement on September 18, 2024:Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have slowed, and the unemployment rate has moved up but remains low. Inflation has made further progress toward the Committee's 2 percent objective but remains somewhat elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee has gained greater confidence that inflation is moving sustainably toward 2 percent, and judges that the risks to achieving its employment and inflation goals are roughly in balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.

Also Read | US Fed lowers policy rate by 1⁄2 percentage point from 23-year high; 5 takeaways In light of the progress on inflation and the balance of risks, the Committee decided to lower the target range for the federal funds rate by 1/2 percentage point to 4-3/4 to 5 percent. In considering additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‐backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective. Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment