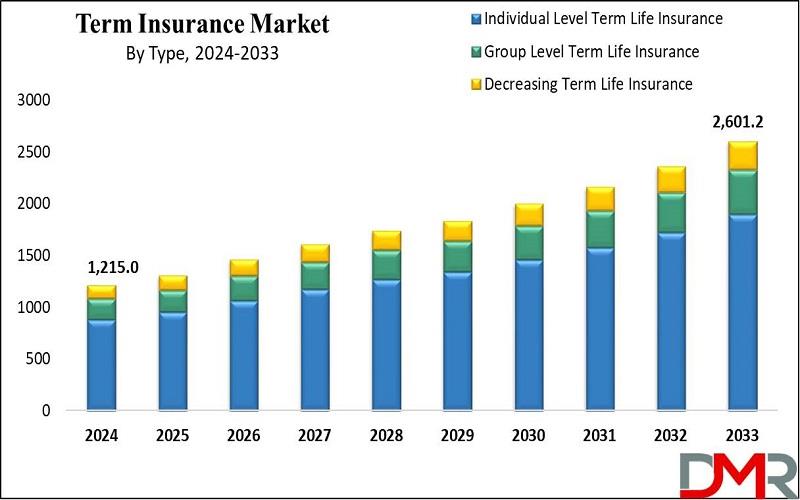

Term Insurance Market Is Expected To Grow At 8.8% CAGR With Reaching A Market Value Of USD 2,601.2 Bn By 2033, : Dimension Market Research

| Report Highlights | Details |

| Market Size (2024) | USD 1,215.0 Bn |

| Forecast Value (2033) | USD 2,601.2 Bn |

| CAGR (2024-2033) | 8.8% |

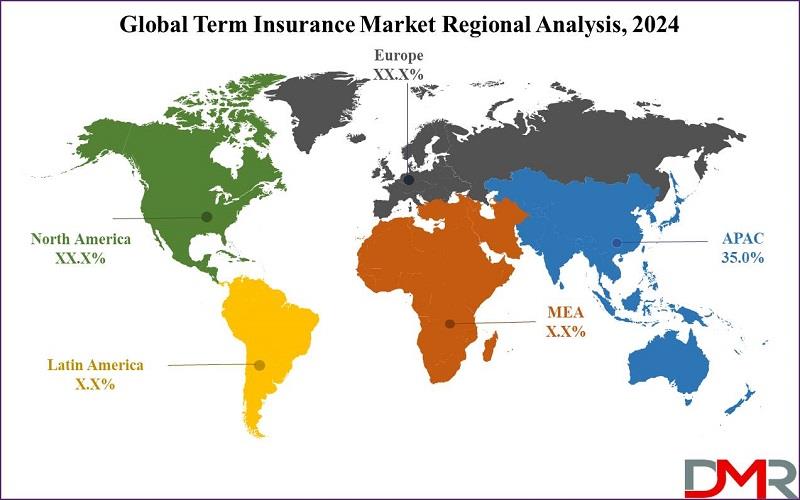

| Leading Region in terms of Revenue Share | Asia Pacific |

| Percentage of Revenue Share by Leading Region | % |

| Historical Data | 2018 - 2023 |

| Forecast Data | 2024 - 2033 |

| Base Year | 2023 |

| Estimate Year | 2024 |

| Segments Covered | By Type, By Distribution Channel |

| Regional Coverage | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Term Insurance Market Segmentation

By Type

- Individual Level Term Life Insurance Group Level Term Life Insurance Decreasing Term Life Insurance

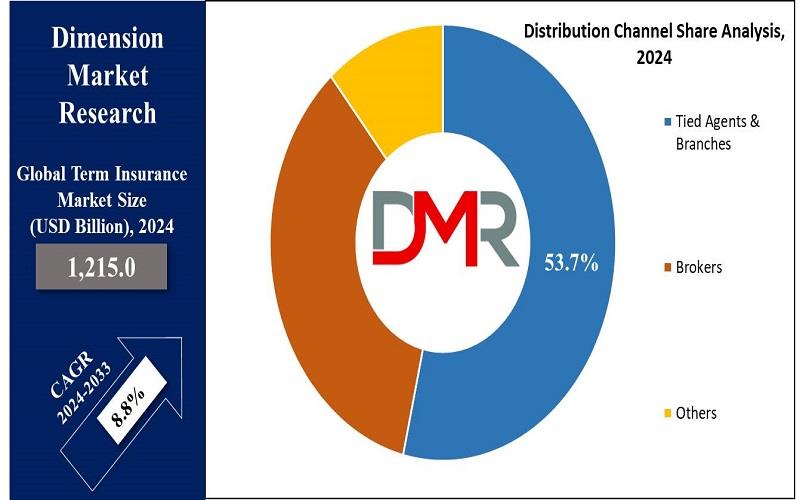

By Distribution Channel

- Tied Agents & Branches Brokers Others

Purchase the Competition Analysis Dashboard Today:

Regional Analysis

Asia Pacific is expected to drive major growth in the term insurance market, contributing over 35% of revenue by 2024. Factors like large population, rising awareness in countries like India & China, and supportive government policies supporting industry development.

Further, Europe shows promising growth due to regulatory reforms & economic uncertainties prompting a focus on financial security. Both regions benefit from technological development and increased competition, emphasizing term insurance's role in financial planning & protection amid growing risk awareness.

Click to Request Sample Report and Drive Impactful Decisions:

By Region

North America

- The U.S. Canada

Europe

- Germany The U.K. France Italy Russia Spain Benelux Nordic Rest of Europe

Asia-Pacific

- China Japan South Korea India ANZ ASEAN Rest of Asia-Pacific

Latin America

- Brazil Mexico Argentina Colombia Rest of Latin America

Middle East & Africa

- Saudi Arabia UAE South Africa Israel Egypt Rest of MEA

Browse More Related Reports

- Pet Insurance Market is expected to reach a market value of USD 11.8 billion in 2024 and is projected to show subsequent growth by reaching a value of USD 54.6 billion in 2033 at a CAGR of 18.6% in the forthcoming period of 2024 to 2033. Travel Insurance Market is expected to reach a market value of USD 25.3 billion in 2024, globally, which will further grow to USD 95.9 billion by 2033 at a CAGR of 16.0%. Healthcare Insurance Market is expected to project a market value of USD 2,584.8 billion in 2024 which will further reach USD 5,120.9 billion in 2033 at a CAGR of 7.9%. Generative AI in Customer Services Market is expected to reach a value of USD 490.4 million by the end of 2024, and it is further anticipated to reach a market value of USD 3,673.7 million by 2033 at a CAGR of 25.1%. Educational Tourism Market size is expected to reach a market value of USD 416.8 billion in 2024 which will further increase and will reach USD 1,301.6 billion in 2033 at a CAGR of 13.5%. Education & Learning Analytics Market size is expected to reach a market value of USD 13.0 billion in 2024 which is further anticipated to reach USD 79.7 billion in 2033 at a CAGR of 22.3%. Mobile Banking Market is expected to reach a value of USD 2.2 billion by the end of 2024, and it is further anticipated to reach a market value of USD 11.2 billion by 2033 at a CAGR of 20.0%. Europe Creator Economy Market is expected to reach a value of USD 13.4 billion by the end of 2024, and it is further anticipated to reach a market value of USD 84.1 billion by 2033 at a CAGR of 22.6%. NLP in Finance Market is expected to reach a value of USD 5.7 billion in 2023, and it is further anticipated to reach a market value of USD 57.5 billion by 2032 at a CAGR of 29.2%.

Recent Developments in the Term Insurance Market

- February 2024: The Nagaland government unveiled a fully-funded life insurance scheme to reduce financial burdens from the sudden loss of family breadwinners. February 2024: LIC of India launched LIC Index Plus, a unit-linked life insurance plan providing both insurance cover and savings, with bonus additions. January 2024: Kotak Mahindra Life Insurance launched a unit-linked term plan, T.U.L.I.P, providing life coverage up to 100 times the annual premium. December 2023: ABSLI introduced "ABSLI Salaried Term Plan," a tailored protection solution for salaried professionals, providing personalized cover options, like a Return of Premium feature. November 2023: Zurich Insurance Group planned to acquire a 51% stake in Kotak General Insurance for USD 488 million, with potential additional investment. August 2023: India's government implemented a tax rule impacting life insurance policies with high premiums, making traditional plans less appealing to risk-averse investors.

About Dimension Market Research (DMR) :

Dimension Market Research (DMR) is a market research and consulting firm based in India & US, with its headquarters located in the USA (New York). The company believes in providing the best and most valuable data to its customers using the best resources analysts into work, to create unmatchable insights into the industries, and markets while offering in-depth results of over 30 industries, and all major regions across the world.

We also believe that our clients don't always want what they see, so we provide customized reports as well, as per their specific requirements to create the best possible outcomes for them and enhance their business through our data and insights in every possible way.

CONTACT: United States 957 Route 33, Suite 12 #308 Hamilton Square, NJ-08690 Phone No.: +1 732 369 9777, +91 88267 74855 ...

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment