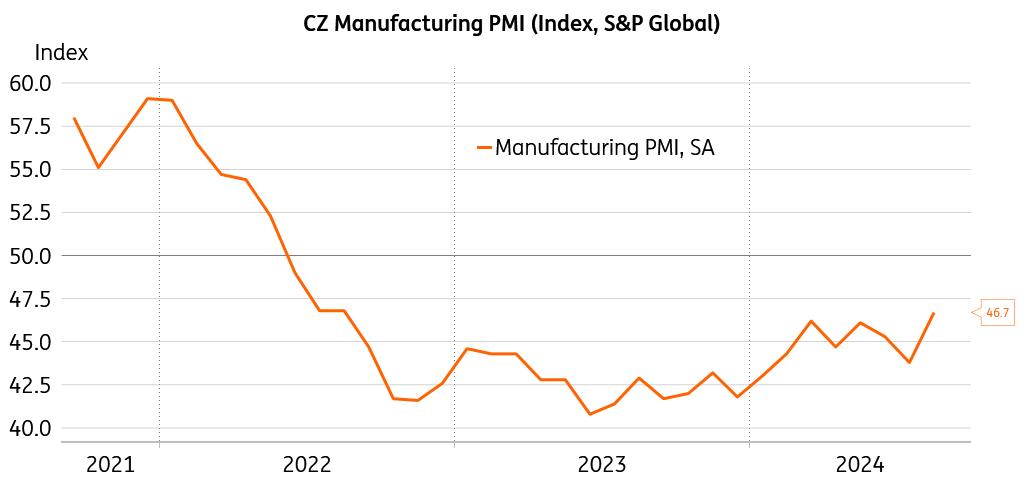

Czech Manufacturing PMI Better Than Expected But Remains Sluggish

The manufacturing PMI improved in August to 46.7 (from 43.8 in July) and exceeded market expectations. The index remains below the 50-point contractionary threshold but recorded its strongest level since September 2022. The deterioration eased across categories – output, new orders, employment, and purchasing. At the same time, Czech manufacturers reported continued weakness in demand across Europe as the main challenge. Still, some Czech companies saw improved demand linked to Asian and African markets.

Pyrrhic PMI reading signals less contraction

S&P Global, Macrobond

Higher shipping rates and material prices, among other things, pushed up overall costs along the supply chain. Vendors reported issues related to shipping freight and disruptions at ports. Meanwhile, the struggle for future sales amid tepid demand implied a further downgrade of selling prices. The pressure to maintain price competitiveness is elevated as Czech firms continue to reduce employment and streamline inventories.

Improved confidence suggests better times aheadThings look a bit rosier when looking ahead, as the one-year outlook improved noticeably in August. The rate of deterioration softened markedly in new orders and export prospects. Manufacturing might receive some boost throughout the coming year after a mediocre performance up to now, with business confidence crawling up to the highest point in three months. Firms report a further shortage of skilled labour, while the general scarcity in this segment of the labour market raises incentives to start hiring with sales expectations lifting off.

A healthy contribution of the manufacturing sector is vital to the Czech Republic's economic recovery. We shall see whether this still-contractionary-but-above-market-expectations PMI reading is a Pyrrhic victory or an onset of a new trend toward the 50-point expansionary borderline. The Czech industry has been in limbo for quite some time, while anything better than subdued economic performance requires a convincing turnaround. This is, however, far from certain, as the structural issues remain a drag, so we keep our expectations of a sub-potential 1% GDP outlook for this year.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment