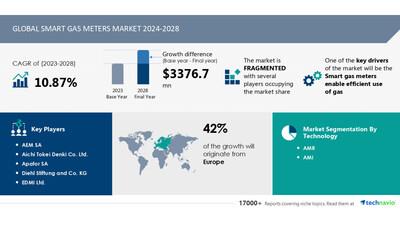

Smart Gas Meters Market Size Is Set To Grow By USD 3.37 Billion From 2024-2028, Smart Gas Meters Enable Efficient Use Of Gas Boost The Market, Technavio

| Smart Gas Meters Market Scope |

|

| Report Coverage |

Details |

| Base year |

2023 |

| Historic period |

2018 - 2022 |

| Forecast period |

2024-2028 |

| Growth momentum & CAGR |

Accelerate at a CAGR of 10.87% |

| Market growth 2024-2028 |

USD 3376.7 million |

| Market structure |

Fragmented |

| YoY growth 2022-2023 (%) |

9.53 |

| Regional analysis |

Europe, North America, APAC, South America, and Middle East and Africa |

| Performing market contribution |

Europe at 42% |

| Key countries |

US, Germany, UK, China, and Japan |

| Key companies profiled |

AEM SA, Aichi Tokei Denki Co. Ltd., Apator SA, Diehl Stiftung and Co. KG, EDMI Ltd., Fanna Technology, Flonidan AS, GenesisGas, Holley Technology Ltd., Honeywell International Inc., Hubbell Inc., Itron Inc., Landis Gyr AG, Pietro Fiorentini Spa, Raychem RPG Pvt. Ltd., Sagemcom Broadband SAS, Wasion Holdings Ltd., Xylem Inc., Yazaki Corp., and ZENNER INTERNATIONAL GMBH and CO |

Market Driver

Utilities are transitioning from traditional manual meter checks to advanced wireless smart gas meters, driven by the need for more accurate data and real-time pricing information. This shift is part of a larger trend towards upgrading utility infrastructure, which includes the adoption of a smart energy network. This network consists of sensors and controllers, a communication network, and data management and analysis systems. Sensors and controllers include AMI and AMR meters that measure flow, pressure, energy usage, and quality. The communication network uses technologies like SCADA, Wi-Fi, and cellular to collect and transmit data to the utility. Data management and analysis processes the information to optimize operations and make informed decisions for resource management. The global market for smart gas meters is expected to grow significantly due to this trend towards advanced metering solutions.

Smart gas meters are gaining momentum in the market due to their accuracy and dependability. With businesses reopening and the economy's strength returning, electrical utilities are focusing on adoption. These meters offer real-time data communication through NB-IoT and high connectivity, enabling automated grid management and energy efficiency initiatives. The implementation of smart gas meters is a cost-benefit analysis for both gas utility providers and consumers, reducing energy consumption costs and enhancing safety. Emerging standards, such as Picarro and Sensirion's SGM6200 series, are prioritized for their functional benefits. The installation process is streamlined, and current infrastructure can support these developments. Natural gas suppliers are prioritizing the elimination of conventional meters, focusing on BCM (billion cubic meters) drill-down data collection from manufacturing plants and drilling activities. The climate target is another driving factor, as gas utility providers aim for operational security and safety in gas heating systems and gas supplies. Prioritized alarms and ongoing pipeline monitoring ensure a reliable and efficient system.

Discover 360° analysis of this market. For complete information, schedule your consultation -

Book Here!

Market

Challenges

-

The installation cost of smart gas meters is higher than traditional meters, with a return on investment realized in five to eight years. However, the benefits do not always justify the investment for smaller utilities due to the substantial capital required. Integration with networking technology for connecting smart electricity and gas meters adds to the expense. Replacement costs for old meters also contribute to the high capital investment. These factors limit the growth of the global smart gas meters market, with operational costs including metering, communications, and consumer education.

The Smart Gas Meters market is witnessing significant growth due to the prioritization of energy efficiency initiatives in electrical utilities and residential buildings. The elimination of manual meter reading and high connectivity through

NB-IoT and other technologies offer functional benefits, including real-time data collection and prioritized alarms. Gas utility providers are investing in technologically advanced solutions, such as the SGM6200 series from Sensirion and Picarro's methane emission detection systems, to improve accuracy and operational security. However, challenges remain, including the implementation and installation process, gas companies' costs, and the slow economic recovery. The emergence of start-ups and the ongoing pipeline monitoring requirements add to the complexity. The fuel switch from oil to natural gas and the increasing population density in urban areas also contribute to the growing demand for smart meters. The manufacturing plants of companies like Temetra, U6 gas meter from SMS PLC, and the Sensirion SGM6200 series are working to meet the shipment volume demands while ensuring safety and ultra-low current consumption. The integration of smart meters into smart grids and the development of emerging standards, such as NB-IoT, are crucial for the future growth of the market.

For more insights on driver and challenges

-

Request a sample report!

Segment Overview

This smart gas meters market report extensively covers market segmentation by

-

1.1 AMR

1.2 AMI

-

2.1 Hardware

2.2 Software

-

3.1 Europe

3.2 North America

3.3 APAC

3.4 South America

3.5 Middle East and Africa

1.1

AMR-

Automatic Meter Reading (AMR) systems enable seamless communication between gas utilities and their customers by automatically collecting and transferring gas consumption, diagnostic, and status data from smart gas meters to a central database. This eliminates the need for manual meter readings, ensuring accurate billing and providing clients with valuable insights into their gas usage patterns. Gas companies are increasingly adopting AMR technology as it offers real-time gas usage data, enabling billing based on actual consumption instead of estimates. Additionally, AMR systems can detect leaks, tampering, low batteries, and reverse flow, and log meter events and gather interval data for various applications such as gas consumption profiling, time-of-use billing, demand forecasting, and remote shutoff. These advantages make AMR systems a preferred choice over traditional gas meters, driving the growth of the global smart gas meters market.

For more information on market segmentation with geographical analysis including forecast (2024-2028) and historic data (2017-2021) - Download a Sample Report

Learn and explore more about Technavio's in-depth research reports

The global Flow Meter market is poised for significant growth, driven by increasing demand for accurate and efficient fluid measurement across industries such as oil & gas, water & wastewater, and chemicals. Key players are innovating with advanced technologies to enhance accuracy and reliability.

Simultaneously, the Smart Home M2M market is expanding rapidly, fueled by rising consumer interest in interconnected home systems and automation. Enhanced connectivity and improved IoT solutions are expected to drive substantial market growth, offering smarter and more efficient home management solutions\

Research Analysis

The Smart Gas Meters market is experiencing significant growth due to the adoption of advanced technologies that offer accuracy and dependability. These meters enable drill-down data analysis, facilitating energy efficiency initiatives and reducing energy consumption costs for both residential buildings and electrical utilities. The market is witnessing the elimination of conventional meters in favor of smart ones, driven by the economy's strength and the climate target. Communication technologies like NB-IoT ensure real-time data transmission, enabling automated grid management and ongoing pipeline monitoring. Emerging standards, such as those set by Sensirion's SGM6200 series, ensure operational security and safety. Drilling activities in regions like Berwick-on-Tweed contribute to the market's expansion. The market is expected to continue growing as more businesses reopen and focus on energy management.

Market Research Overview

The Smart Gas Meters market is experiencing significant growth due to the adoption of technologically advanced meters that offer accuracy and dependability. These meters are becoming increasingly important as businesses reopen and the economy's strength returns, leading to an increase in energy consumption costs. The implementation of smart grids and the ongoing pipeline monitoring are key developments in the market. The accuracy and real-time data provided by smart meters enable energy efficiency initiatives and the elimination of conventional meters. The high connectivity of these meters allows for communication between electrical utilities and gas utility providers, facilitating drill-down data analysis and prioritized alarms. The market is witnessing the emergence of new standards, such as NB-IoT, and the use of fuel like natural gas in residential buildings and gas heating systems is driving the shipment volume. The manufacturing plants are also focusing on the cost-benefit analysis of smart meters, considering their high initial investment but long-term savings. Safety and operational security are functional benefits of smart meters, with companies like Picarro and Sensirion offering methane emission detection and ultra-low current consumption solutions. The market is also seeing the entry of start-ups and the SMS PLC company's SGM6200 series. The market size is expected to reach Million units, with the growth driven by the climate target and the need for energy efficiency initiatives. The market is also being influenced by population density, drilling activities, and the implementation of smart leak detection systems. Despite the slow economic recovery, the market is expected to continue growing due to the functional benefits and cost savings offered by smart meters.

Table of Contents:

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation

-

Technology

-

AMR

AMI

-

Hardware

Software

-

Europe

North America

APAC

South America

Middle East And Africa

7

Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contacts

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email:

[email protected]

Website:

SOURCE Technavio

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment