Bank Of England Is Set To Start Monetary Easing Cycle

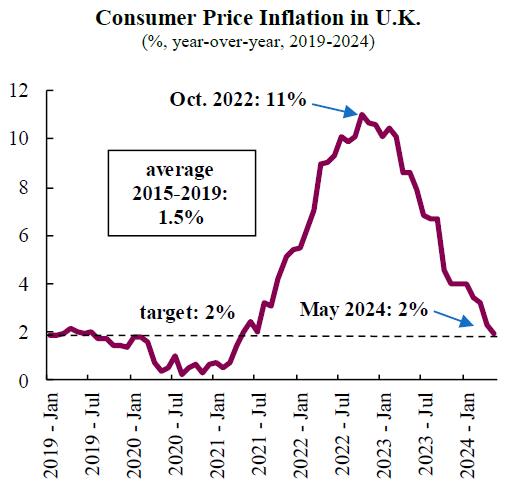

DOHA: Amongst the advanced economies, the UK has experienced one of the worst post-Covid inflation outbursts. In response, the Bank of England (BoE) reacted firmly by initiating an interest rate tightening cycle at the end of 2021 that increased its benchmark interest rate 14 times. This sequence of decisions raised the interest rate from 0.10% to a 16 year high of 5.25%, a level that has been maintained since August 2023, QNB said in its economic commentary.

In addition to this significant interest rate tightening, in early 2022 the BoE began a“quantitative tightening” phase, which implies reducing its stock of U.K. gilts and corporate bonds. This course of action gradually reverts the balance sheet expansion that was implemented to support financial markets and economic activity during the Covid-pandemic.

Now, after three years of inflation levels above target, and even reaching double-digit highs in H2-2022, the BoE finds itself in a context that is favourable to a new direction in its monetary policy trajectory. We expect the BoE's August policy meeting to mark the beginning of a gradual monetary easing cycle. In this article, we discuss the three main factors that support our outlook.

First, after 3 years of above-target inflation, the BoE has managed to bring prices under control, providing a strong argument in favour of a pivot in interest rates. Headline inflation reached the 2% target of monetary policy in May, delivering a highly anticipated condition for a shift in the direction of monetary policy.

Since headline measures of prices can display some volatility in the short term, central banks closely monitor additional measures that reveal underlying and more persistent trends. In this regard, a key measure is core inflation. By excluding the more volatile components, such as energy and food products, core inflation provides a more stable and informative view of the underlying price trends. The last data prints show monthly core inflation rates close to 0.3%, significantly down from the peak of 0.9% at the beginning of last year.

Second, economic growth is expected to remain lacklustre, even as the UK is headed for a recovery after a mild recession in 2023. In H2-2023, economic activity contracted for two consecutive quarters by 0.4%, in part due to the impact of tighter monetary policy.

Third, financial conditions have reached highly restrictive levels on the back of a cycle of significant monetary tightening. The Financial Conditions Index for the UK provides a useful summary of financial market conditions. This indicator combines information of short- and long-term interest rates, and credit spreads. The index spiked in the second half of 2023, and is currently at heights that have not been registered since the Global Financial Crisis, amid significant turmoil and instability in financial markets that led to a credit freeze and a banking crisis. High policy rates and quantitative tightening will continue to keep credit costs elevated and withdraw liquidity from the financial system in the near future, even after the beginning of an easing cycle. In fact, credit volumes have steadily contracted in real terms for over a year. The longer it takes for the BoE to ease policy, the higher are the chances of financial instability. In other words, monetary easing is also becoming necessary to reduce the country's financial vulnerability.

All in all, in our view, the BoE is set to begin an interest rate easing phase in its upcoming meeting, a decision that should be supported by below-target headline inflation, economic stagnation, and restrictive financial conditions. We expect the easing cycle to be gradual, absent significant unexpected economic developments, with two additional 25 bps cuts this year.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment