Massive Fraud Case Exposes Vietnam's Corrupt Bank System

But this approach hasn't worked everywhere. On April 11, 2024, a businesswoman in Vietnam was sentenced to death for taking out US$44 billion in fraudulent loans from one of the country's biggest banks.

Truong My Lan took the money – most of which is unlikely to be recovered – out of Saigon Commercial Bank (SCB) by bypassing a Vietnamese law that prevents anyone from owning more than 5% of a bank's shares. By using hundreds of shell companies (among other methods) she ended up owning more than 90% of the bank.

Meanwhile, the loans that she took out (worth just under 10% of Vietnam's GDP for 2024) made up 93% of the bank's entire lending portfolio. On several occasions she withdrew huge amounts in cash, which she stored in her basement.

Lan is expected to appeal the court's verdict. But on a basic level, this extraordinary case of fraud exposes the inherent vulnerabilities of banks, which use deposits to fund loans. Put simply, for every £10 ($12.45) deposited, a bank could lend up to £9 ($11.22) to fund mortgages or corporate loans, keeping just £1 ($1.25) as a reserve to allow for withdrawals.

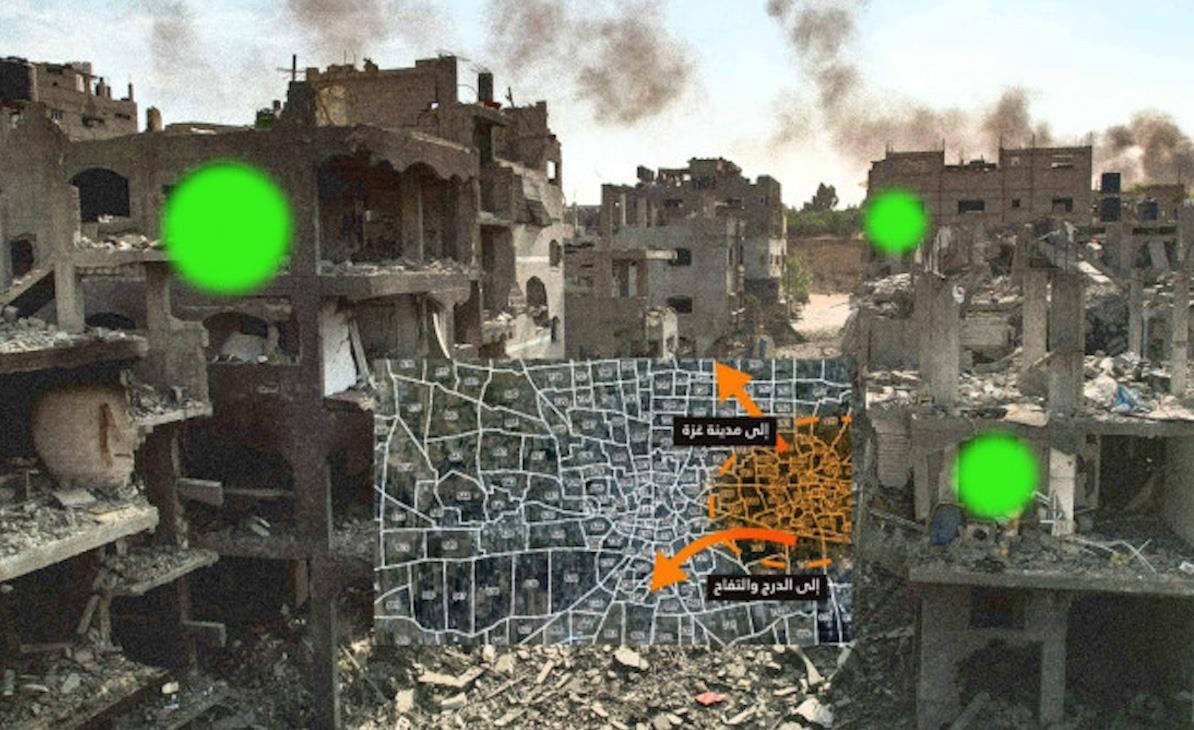

Gaza: AI changing speed, scale and harm of modern war

Einstein-Tagore dialogue shines a path for modern leaders

US is no longer the arsenal of democracy

But while depositors can theoretically withdraw their money whenever they want, if they demand a particularly large amount of cash, the bank may not have enough in reserve to cover it. After Lan's arrest in 2022, SCB faced a bank run (when large numbers of customers try to withdraw their money) and the bank has been under state control ever since.

To avoid this kind of situation, banks in most countries are carefully regulated. And since the global financial crisis, many are required to hold higher levels of capital and liquidity to absorb losses in times of stress.

The scale of fraud and corruption that took place at SCB highlights the devastating impact that a corrupt environment can have on the financial sector. Different studies show that corruption can adversely affect the stability of banking, reduce lending and increase the probability of banking crises .

Vietnam has been facing the challenges of corruption for a long time, and the SCB trial was an important part of the so-called “Blazing Furnace” campaign that targeted politicians and business leaders as part of an attempt to eradicate corruption from the Vietnamese government and economy.

But it may not be that simple.

There is an argument that in some cases, corruption can actually have social benefits – that it can“grease the wheels” of an otherwise stagnant economy. Some have argued that what happened with SCB is fairly widespread (on a smaller scale) in the Vietnamese economy, and that the significant economic growth the country has experienced in recent years (the economy has tripled in size since 2010) is largely thanks to high levels of corruption .

This idea is backed up by research which suggests that corruption is not always economically destructive, but can in fact play a supportive role .

The theory is that in places of slow-moving administration and endless red tape, corruption can occasionally speed things along, bypassing the inefficient limitations of bureaucracy.

Corrupting influencesIn some cases then, corruption can lead to businesses and institutions functioning more efficiently. Projects get started, jobs are created, contracts are awarded. Things get done.

Restrictive red tape. Image: Lightspring / Shutterstock via The Conversation

That's not to argue for more corruption of course – just to illustrate that its effects can be more nuanced than we might think. And we should remember that the regulatory world itself can be corrupted too.

While financial regulation which targets corruption may be effective , when authorities have too much regulatory power, this can breed corrupting practises. Research suggests that it brings about opportunities to receive payment for regulatory favours, subsidies and government contracts.

Sign up for one of our free newsletters

- The Daily ReportStart your day right with Asia Times' top stories AT Weekly ReportA weekly roundup of Asia Times' most-read stories

It has even been argued that regulations put in place after the global financial crisis in the US, specifically aimed at preventing another crisis, created new risks of increased corruption.

But international cooperation can help. Advanced economies such as the UK, US and EU are all members of the Basel Committee on Banking Supervision where regulatory guidelines for the banking sector are adopted collectively. This protects the member states – and their citizens – against corruption by establishing shared standards, monitoring each other's procedures and exchanging information.

As a result, an extreme case such as the one observed in Vietnam is unlikely to unfold in the west. But continuous vigilance is required, as even the procedures and regulations put in place to maintain high standards are themselves susceptible to the kind of corruption they are designed to prevent.

George Kladakis is Lecturer in Finance, University of St Andrews

This article is republished from The Conversation under a Creative Commons license. Read the original article .

Thank you for registering!

An account was already registered with this email. Please check your inbox for an authentication link.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment