US Household Spending Holds Firm

US retail sales rose a very robust 0.7% month-on-month in March versus 0.4% expected with only one forecaster predicting this outcome out of 64 analysts. February's growth rate was revised up to +0.9% from +0.6% MoM with March strength led by non-store retailers (+2.7% MoM), general merchandise (+1.1%) and gasoline stations sales (up 2.1%). There was some weakness though with sporting goods (-1.8%), clothing (-1.6%) electronics (-1.2% and motor vehicles (-0.7%) all falling. The means that the control group, which excludes volatile items and better matches with broader spending trends, rose 1.1% versus the 0.4% consensus while February was again revised higher to +0.3% from 0.0%.

The fastest rate of growth that anyone forecast for this metric was +0.8% MoM, so as with the jobs data and the core inflation number this outcome is higher than absolutely everyone was forecasting. Official data suggests the US is booming, but the business surveys tell a more subdued story, much like the credit card spending data. This wide divergence is difficult to explain.

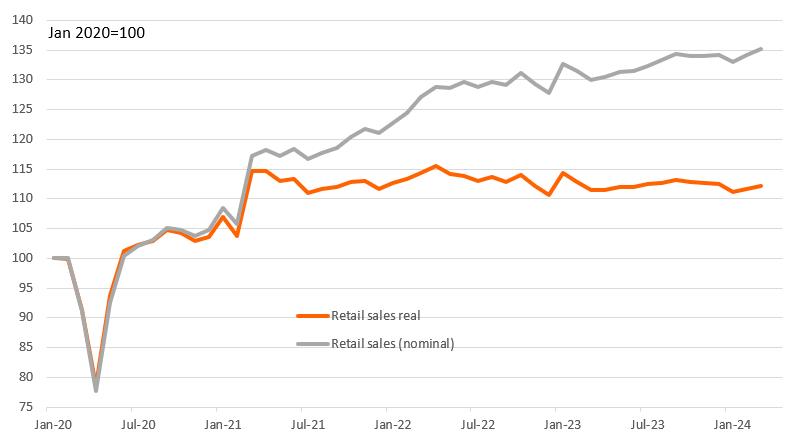

Retail sales levels – nominal & real

Source: Macrobond, ING Fed needs to see a clear slowdown before being comfortable with rate cuts

In mitigation, we have to acknowledge that the retail sales number is a nominal dollar growth rate and with inflation running so hot this is accounting for much of the growth. Real retail sales, i.e. retail sales adjusted for inflation, are much weaker and essentially have been flat for the past three years as the chart above shows. Income growth is slowing, savings are being exhausted and the cost of borrowing on credit cards is at multi-decade highs. We expect spending and inflation to slow, but until it does the Fed won't be contemplating rate cuts.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment