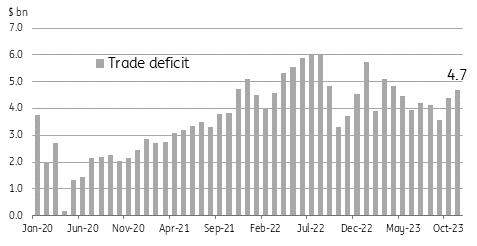

Philippines: Trade Deficit Widens Again In November

Philippine trade data showed exports falling more than expected, down 13.7% YoY (12.9% expected) with the important electronics sub-sector dropping 24.7% YoY on soft global demand for basic semiconductor components. Exports of other major products were also down with other manufactured goods (-1.8%YoY) and other mineral products (-6.2%YoY) falling although we did see growth for exports of chemicals and bananas.

Imports of capital goods which had been in negative territory for 7 months posted a marginal gain of 0.1% driven by a batch of aircraft orders and heavy transport equipment. Imports of consumer goods remained robust, up 15.4% YoY due to strong imports of passenger cars and basic food items like fish and rice.

The import trends reflect recent developments with the national government importing important food items such as rice and fish to help combat inflation. Meanwhile, the delivery of aircraft moves in line with ongoing re-fleeting operations by airlines to approach pre-Covid flight capacity.

Overall, the trade balance remained in substantial deficit, widening to $4 from $4 in the previous month. This development suggests that the current account is likewise in shortfall and points to sustained pressure on PHP in the coming months.

Wider trade deficit could spell pressure on PHPSource: Philippine Statistics Authority

Wider deficit points to softer 4Q GDP

A bigger-than-expected drop in exports and the surprise rise in capital imports have resulted in a deeper trade deficit for November. The sustained widening of the trade gap suggests that net exports for 4Q 2023 could slip back into negative territory and weigh on overall GDP after delivering 1.6 percentage points to growth in 3Q.

This trend should persist going into 2024 with exports expected to struggle amidst still weak global demand for basic electronics components while imports could continue to grow.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment