403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

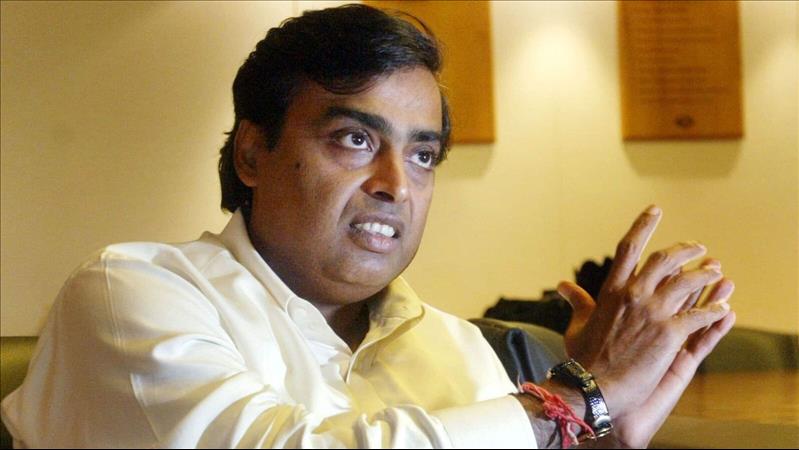

SAT Quashes Sebi Order Against Mukesh Ambani, Navi Mumbai SEZ

(MENAFN- Live Mint) "The Securities Appellate Tribunal has quashed the market regulator's 2021 order against Reliance Industries Ltd managing director Mukesh Ambani, Navi Mumbai SEZ, and Mumbai SEZ in a case related to alleged manipulative trades in Reliance Petroleum Ltd shares January 2021, the Securities and Exchange Board of India imposed a penalty of Rs25 crore on Reliance Industries and Rs15 crore on Ambani. It had also asked Navi Mumbai SEZ to pay a penalty of Rs20 crore. Ambani along with RIL and other entities challenged the order before SAT Monday, a bench led by Justice Tarun Agarwala held that“Sebi's 2021 order is quashed. In case the penalty has been deposited with respondents (Sebi) it must be returned to the appellants”.A detailed order is awaited case pertains to the sale and purchase of RPL shares in the cash and futures segments in November 2007. Subsequently, Reliance decided to sell nearly 5% stake in RPL, a listed subsidiary that was later merged with RIL in 2009 adjudicating officer BJ Dilip had held that any manipulation in the volume or price of securities always eroded investor confidence in the market.“In the instant case, the general investors were not aware that the entity behind the above F&O segment transactions was RIL. The execution of the... fraudulent trades affected the price of the RPL securities in both cash and F&O segments and harmed the interests of other investors,” he said in his order, in its order, had also stated that RIL had engaged in a scheme of manipulative trading in respect of the sale of RIL's 5% stake in RPL. It had said that RIL, before undertaking sale transactions in the cash segment, had booked large short positions in RPL November futures through 12 agents with whom it had entered into an agreement to circumvent position limits for a commission payment, RIL fraudulently cornered nearly 93% of open interest in RPL November Futures, when the agents took short positions in the F&O segment on its behalf, Sebi had said in its order. The funding for the margin payments by the agents was provided by Navi Mumbai SEZ and Mumbai SEZ, it had said, Sebi added that a common person connected with RIL had placed orders in the cash segment on behalf of RIL and in the F&O segment on behalf of the agents the date of the settlement of RPL November Futures-November 29, 2007-RIL sold 19.5 million RPL shares on the NSE cash segment in the last 10 minutes of trading, resulting in a fall in the prices on the cash segment and artificially depressing the settlement price of RPL November Futures, Sebi had said in its order resulted in profits on the huge short positions held by the agents in the RPL November Futures, and the profits were transferred back to RIL by the agents, the regulator had said in its order.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment