(MENAFN- Asia Times) In recent times, the global economy has endured far-reaching macroeconomic shocks ranging from pandemic-induced disruptions, severe climatic events, and geopolitical tensions to an active war with a crippling trickle-down effect in countries the world over.

While the impact of these events has been debilitating enough to destabilize the most robust of economies, these have been testing times, particularly for the Global South nations, which have historically been deprived of resources and economic insulation.

Classified as a“high-growth rate” economy, although Bangladesh managed to ride the pandemic wave and improve its societal parameters at an astonishing rate despite finding the global economic circumstances stacked against its growth, its structural flaws have become quite evident.

Even though Bangladesh cannot be claimed to be in the midst of an economic crisis, the economy would thrive by drawing caution from its challenges in different sectors to prevent stagnation or any impending economic catastrophe.

First, the ready-made garments (RMG) industry plays a pivotal role – a whopping 84% – in driving up export earnings and paving the way to industrial innovations. Yet the dangers of an RMG-concentrated manufacturing sector sorely outweigh the many benefits that it presents, vis-à-vis homogeneity hazards in the export basket.

In recent times, this industry has been impacted by the current instability in the global market as well as the production side's dependence on human labor and inadequate infrastructure. To augment long-term growth, the country's service sector offers a strong alternative to the export mix that is dominated by RMG, along with complementing it in the near future.

Second, the country's tax agency is rife with corruption and lacks adequate methods for raising income. With taxes being the primary source of income for the government, tax evasion in Bangladesh has become a serious impediment to its advancement.

The fact that tax receipts have consistently been below 80% of total government revenue over the last 18 years only demonstrates the degree of corruption that has ripped through the system. Additionally, the poor condition of the transportation system, limited access to electricity, and recent increases in input costs have all played a part in widening the fiscal deficits of the country.

To clamp down on the loss of income receipts, the Bangladeshi government must start taking stronger anti-corruption strides as soon as possible, along with planned steps to increase revenue and reduce spending.

Third, dwindling RMG exports, rising import costs for necessities like food and energy, and fiscal deficits have worsened the current account balance. It could be ameliorated by refining effective strategies for export promotion and reducing Bangladesh's reliance on imported inputs.

An unfavorable business climate has further leveraged its way into the capital account, which is reflected by falling foreign direct investment (FDI), thus bringing Bangladesh's balance-of-payments precarities to center stage.

Fourth, recent global events have had a significant impact on several interconnected macroeconomic parameters, including the decline in remittances, the depletion of foreign exchange, and the weakening of the Bangladeshi currency, the taka.

These developments have caused the government to take immediate action to stabilize the domestic economy. To safeguard the weaker segments of society, this would need to be supported with proper social-security measures.

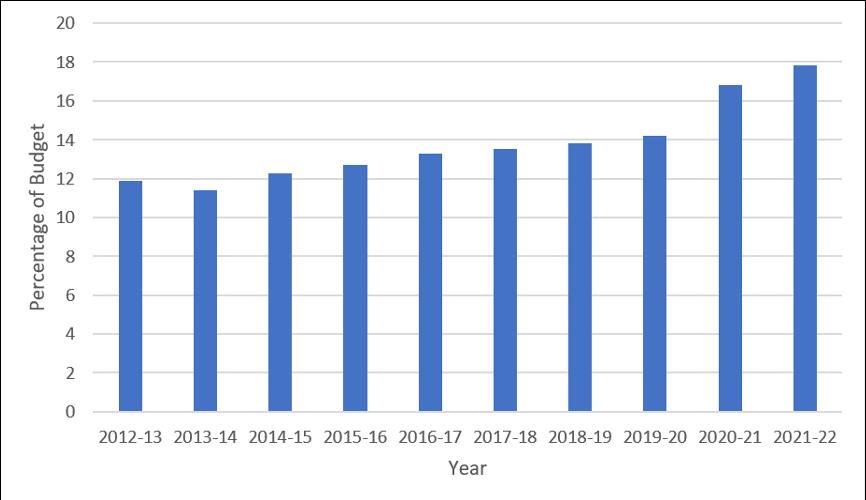

Social security programs in Bangladesh (percentage of budget, 2013–2022). Sources: Author's own, data from the ministry of finance, bangladesh

Fifth, to meet the extra demand without jeopardizing the economy's growth prospects, the Bangladeshi energy sector needs to upgrade its technology and move more quickly toward renewable energy sources.

The recent inflationary pressures, primarily brought on by rising food and fuel prices and made worse by the conflict between Russia and Ukraine, pose short-to-medium-term threats to the economy. This is yet another reason to improve domestic capabilities and forge diverse international partnerships to increase resilience in these areas.

Sixth, even though Bangladesh has improved on several socioeconomic metrics thanks to its distinctive grassroots development model, the nation still needs to address its inequality problems in order to achieve sustainable growth over the longer term. Most significant, the economy must be encouraged to save and invest more in infrastructure to fuel strong economic growth in the coming years.

Finally, another significant risk also exists for the Bangladesh economy. According to a report from the United States Institute of Peace, the country's growth trajectory will soon be in jeopardy because of rapid climate change.

Bangladesh is the seventh most adversely affected nation in the world by extreme weather occurrences, according to the Global Climate Risk Index. Because of Bangladesh's low-lying topography, 15 million to 30 million Bangladeshis could be forced to leave their coastal homes as a result of rising sea levels.

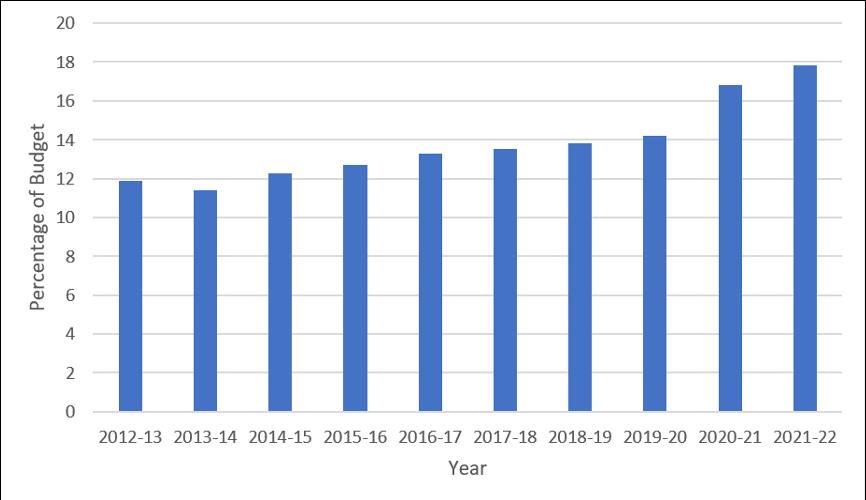

Internal displacement due to climatic disasters in Bangladesh (in millions) Source: internal displacement monitoring center

Migration into urban areas without adequate planning and bad governance could make the problem worse by fostering the growth of slums and unsustainable forms of living. As a result, there is an increased risk that urban resources will be depleted, sluggish development projects, rising urban poverty, and air and water pollution are some areas that require rapid attention.

When compared with Sri Lanka or Pakistan, Bangladesh's economic condition does not appear to be dire at this time. Those two nations, in contrast to Bangladesh, have not only failed to achieve their domestic economic goals but also had to shoulder the load of foreign commercial loans and debt servicing obligations.

The ratio of Bangladesh's external debt to GDP was 11.87% as of last August, significantly less than the ceiling of 40% mandated by the International Monetary Fund (IMF). In reality, even after including the nation's 19.55% domestic debt-to-GDP ratio, the total debt-to-GDP ratio as of March 2022 was 31.42% , generating no worries about its domestic and international debt position.

The early warning signals of a GDP slowdown in Bangladesh are starting to show, and the IMF approved a support package of us$4.7 billion in January. The severe exogenous macroeconomic shocks brought on by the pandemic and the Russia-Ukraine war have exacerbated some issues, but a thorough understanding of and attention to the structural weaknesses in Bangladesh's economy could guarantee long-term economic growth and sustainable development.

Comments

No comment