(MENAFN- ING) US: Recession fears remain elevated

We are rapidly heading towards the 14 December

FOMC meeting where a 50bp interest rate hike looks likely

after four consecutive 75bp moves. Nonetheless, the Federal Reserve will not be pleased with the recent sharp falls in Treasury yields and the dollar, which are loosening financial conditions and undermining the Fed's efforts to beat inflation down. Consequently, we are likely to see strong messaging in the press conference and the accompanying forecast update that the rate rises are not finished and that the policy rate is set to stay high for a prolonged period of time. Markets are likely to remain sceptical given that recession fears remain elevated. Softening consumer confidence, weaker ISM services and a relatively subdued PPI report are unlikely to do the Fed many favours next week in this regard.

Canada: Favour 50bp however a very close call

In Canada, the highlight will be the central bank policy meeting for which both markets and economists are split down the

middle on whether it will be a 25bp or 50bp hike. We favour the latter given a robust 3Q GDP outcome, the tight jobs market and the ongoing elevated inflation readings. But we acknowledge there are signs of softening in the economy. The housing market is

looking vulnerable and Canadian households are more exposed to higher rates than elsewhere due to high borrowing levels so we recognise this is a very close call. We are getting very close to the peak though, which we think will be 4.5% in 1Q 2023.

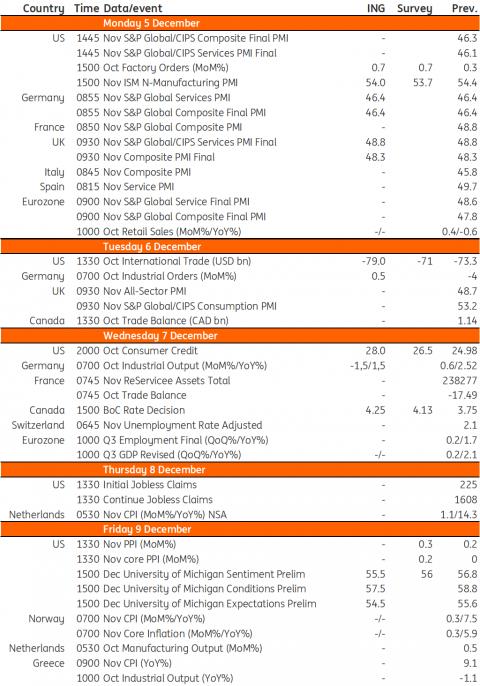

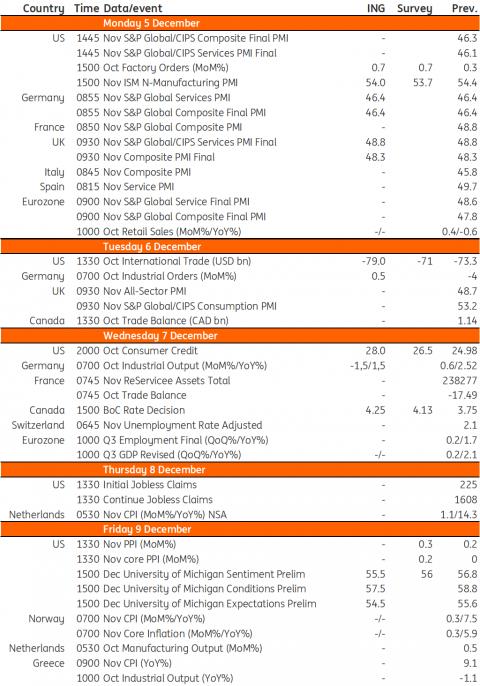

Key events in developed markets next week

Refinitiv, ING

MENAFN02122022000222011065ID1105261267

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment