3 Cathie Wood Stocks To Trade For Bulls As Well As Bears

(MENAFN- ValueWalk) These Ark Invest fund stocks have a little something for everyone

Get The Full Series in PDF

Get the entire 10-part series on Charlie Munger in PDF. Save it to your desktop, read it on your tablet, or email to your colleagues.

Q2 2021 hedge fund letters, conferences and more

Giano Capital Adds Cyclical Stocks A“Barometer” Shows Rising InflationGiano Capital returned 1.9% in August, taking the fund's year-to-date performance to 2.2%. Since its inception, Giano's flagship fund has returned 8.6% annualized, that's according to a copy of the firm's August update, which ValueWalk has been able to review. Q2 2021 hedge fund letters, conferences and more Giano presents its returns going back to Read More

Most investors would gladly welcome the opportunity to own the next big thing inside their portfolios. It's human and certainly ape-like nature, right? And right now no single investment fund exudes that swashbuckling growth-centric approach than Cathie Wood's Ark Invest. Think of these growth names as Cathie Wood stocks.

Zoom Video (NASDAQ: ZM ). Teladoc (NYSE: TDOC ). Shopify (NYSE: SHOP ). Grayscale Bitcoin Trust (OTCMKTS: GBTC ). Ark's Cathie Woods has been in some of the market's biggest winners inside the past two years during the coronavirus pandemic.

Led by the flagship Ark Innovation ETF (NYSEARCA: ARKK ) the concentrated, active management approach and aggressive pursuit of emerging market trends led to ARKK soaring more than 150% and more than three-fold over the growth-heavy Nasdaq's own gain of around 43% in 2020.

But growth has a cost or rather a price that is always paid without fail. And Cathie Wood stocks aren't immune as Ark's various funds have come to terms with in 2021. And this year and as the Nasdaq has continued its ascent by almost 19%, ARKK is off 2% year-to-date.

Today, and given it's September and notoriously a time for bears to suit up, let's look at three Cathie Wood stocks to trade—and which both 'da bulls and 'da bears can rally behind based on their long-term price charts.

- DraftKings (NASDAQ: DKNG )

- CRISPR Therapeutics (NASDAQ: CRSP )

- Tesla (NASDAQ: TSLA )

More important, don't make the mistake of counting Ark out. The story might change, but corrections happen to the best of them. And today let's look at the price charts of two Cathie Wood stocks to buy following the inevitable, and one which may still be facing a bit more bearish payback.

Table of Contents show- 1. Cathie Wood Stocks To Trade: DraftKings (DKNG)

- 2. CRISPR Therapeutics (CRSP)

- 3. Cathie Wood Stocks: Tesla (TSLA)

Source: Charts by TradingView

The first of our Cathie Wood stocks to trade are shares of DraftKings. The online gaming operator is one name Ark Invest is continuing to bet on with ARKK and Ark's Next Generation Internet ETF (NYSEARCA: ARKW ) owning about 13.5 million shares combined.

Ark's position in DraftKings has ballooned by more than 200% since 2020. And today, September is shaping up as a solid-looking spot to place a wager on this Cathie Wood stock's improving bullish trend.

Technically, DKNG has just cleared the 62% retracement level of a cup-shaped monthly base embedded in the stock's up-channel pattern.

With resistance still well above current prices and bullish stochastics set up for support, it's time to gamble smartly on this Cathie Wood stock using an actively managed November $65/$75 collar or bull call spread.

CRISPR Therapeutics (CRSP)

Source: Charts by TradingView

The next of our Cathie Wood stocks to trade is CRISPR Therapeutics. This one is the odd man out as the lone short among today's three profiled names.

As investors desiring to buy the next big thing, it's inevitable that some of those selections will be challenged along the way. Others simply won't live up to the initial billing. Worse, some stocks poised for greatness today may ultimately fail.

When it comes to CRSP stock, the gene-editing upstart's business still looks well-poised to thrive. That's good news. As is the fact this Cathie Wood stock remains a part of the Ark Genomics Revolution ETF (NYSEARCA: ARKG ) with a portfolio weight of 2.59%.

Right now though, the price chart hints at a larger corrective cycle for CRSP stock which can be capitalized on as a bear.

Technically, this Cathie Wood stock put together a failed monthly cup-shaped base back in July. Following that, an inside candlestick hangman pattern and increasingly weak-looking stochastics in August has solidified the bearish action.

Given CRSP's weaker options liquidity, I'd go with a limit order, long October $110/$100 bear put spread today rather than miss this short Cathie Wood stock opportunity.

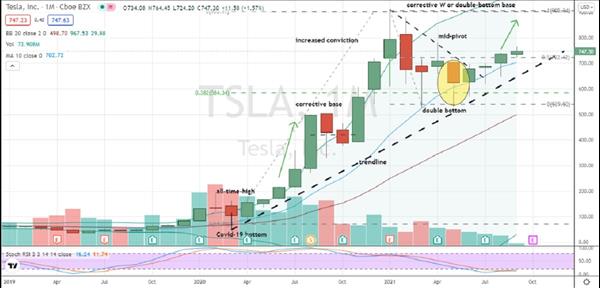

Cathie Wood Stocks: Tesla (TSLA)

Source: Charts by TradingView

The last of our Cathie Wood stocks to trade are shares of Tesla, and this one is meant to be bought!

The fact is investors don't always need to be searching for the next big thing. At least not when a tried-and-true intact growth story like TSLA stock is ready to be purchased.

Technically, this one is similar to our other Cathie Wood buy. As with DKNG, shares of TSLA are trading inside the upper half of a corrective cup-shaped base. Here though, investors can pick up Ark's most-heavily weighted company just above the 50% resistance level which it cleared this month.

Today and with a classic“cup-half-full” pattern in play, trading this Cathie Wood stock's trend looks better built, off and on the price, chart using a December $775/$850 bull call spread.

On the date of publication, Chris Tyler holds long positions (either directly or indirectly) in DraftKings (DKNG), Grayscale Bitcoin Trust (GBTC), Ark Innovation ETF (ARKK) and Ark Genomics Revolution ETF (ARKG). The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines .

Chris Tyler is a former floor-based, derivatives market maker on the American and Pacific exchanges. For additional market insights and related musings, follow Chris on Twitter @Options_CAT and StockTwits .

Article By Chris Tyler, InvestorPlace

Updated on Sep 9, 2021, 1:09 pm

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment