US chip-making revival off to a slow start

(MENAFN- Asia Times) TOKYO – From the third quarter of 2019 to the first quarter of 2021, Huawei's share of the global smartphone market dropped from 18% to 4%. American politicians who have demonized and sanctioned Huawei must be pleased.

However, in the second quarter of 2021, the world's top five smartphone vendors were Samsung (19%), Xiaomi (17%), Apple (14%), Oppo (10%) and Vivo (10%). The three Chinese companies had a combined market share of 37%. Xiaomi overtook Apple for the first time.

America is playing leveraged Whack Mole with China. Hammer one down, three pop up.

But Xiaomi, Oppo and Vivo all use Qualcomm processors, which are designed in America and manufactured by TSMC in Taiwan or Samsung in South Korea. America and its allies are making more money.

In its July 28 earnings call, Qualcomm CFO Akash Palkhiwala said “ … we did see some weakness within the quarter [three months to June] relative to our expectations in China and in India. A lot of the weakness we saw was at the low tier.

“So the phenomena we saw is really kind of weaker low tier, but then mix shift towards the high end in these markets. And so that's a key trend that we're monitoring, which, obviously, net-net, the mix shift is a very positive thing for us.”

In other words, Qualcomm is doing very well in China thanks to other customers picking up the opportunity taken away from Huawei.

But hey, wasn't the idea to deny China access to these advanced chips? Aren't Chinese 5G smartphones an existential threat to our national security and very way of life?

Maybe not.

A Qualcomm China executive delivers a speech about Qualcomm Snapdragon enabling a further development of Internet of Things at a meeting during the 2020 World Internet Conference held in Wuzhen town, Jiaxing city, east Chinaís Zhejiang province, 23 November 2020. Photo: AFP via Imaginechina

Separately, an analysis conducted by Nikkei Asia found that 51 of Apple's top 200 suppliers in 2020 were based in China, 48 in Taiwan, 34 in Japan and 32 in the US. A total of 21 Apple suppliers were located in Vietnam, but seven of those were Chinese-owned.

The number of Apple suppliers based in China, Vietnam, Thailand and India is growing, while the number based in Taiwan, Japan and the US is in decline.

This is not the trend hoped for by America's China-bashers, but given the relative wage and other cost structures, it can hardly be a surprise.

One Apple supply chain manager told Nikkei Asia on June 2 this year:“Most Chinese suppliers have very similar approaches. They are willing to take low-margin businesses that other suppliers are reluctant to pick up. This way, they could gradually level up by working with Apple and can later bid for more business the next time.”

Meanwhile, in the three months to June, Tokyo Electron – Japan's largest manufacturer of semiconductor production equipment – made 35% of its sales in China versus 10% in America.

In the same period, LAM Research – one of Tokyo Electron's major American competitors – made 37% of its sales in China against 5% in America.

Even the Netherlands' ASML, which produces the advanced EUV lithography equipment that the US government is so anxious to keep out of Chinese hands, made 17% of its sales in China versus 6% in America.

As usual, South Korea and Taiwan were ASML's best markets, accounting for 39% and 36% of its June quarter revenues, respectively.

American politicians, commentators and industry executives have been talking excitedly about reversing the decline of semiconductor production in the US for more than a year now. But what is needed is less talk and more action.

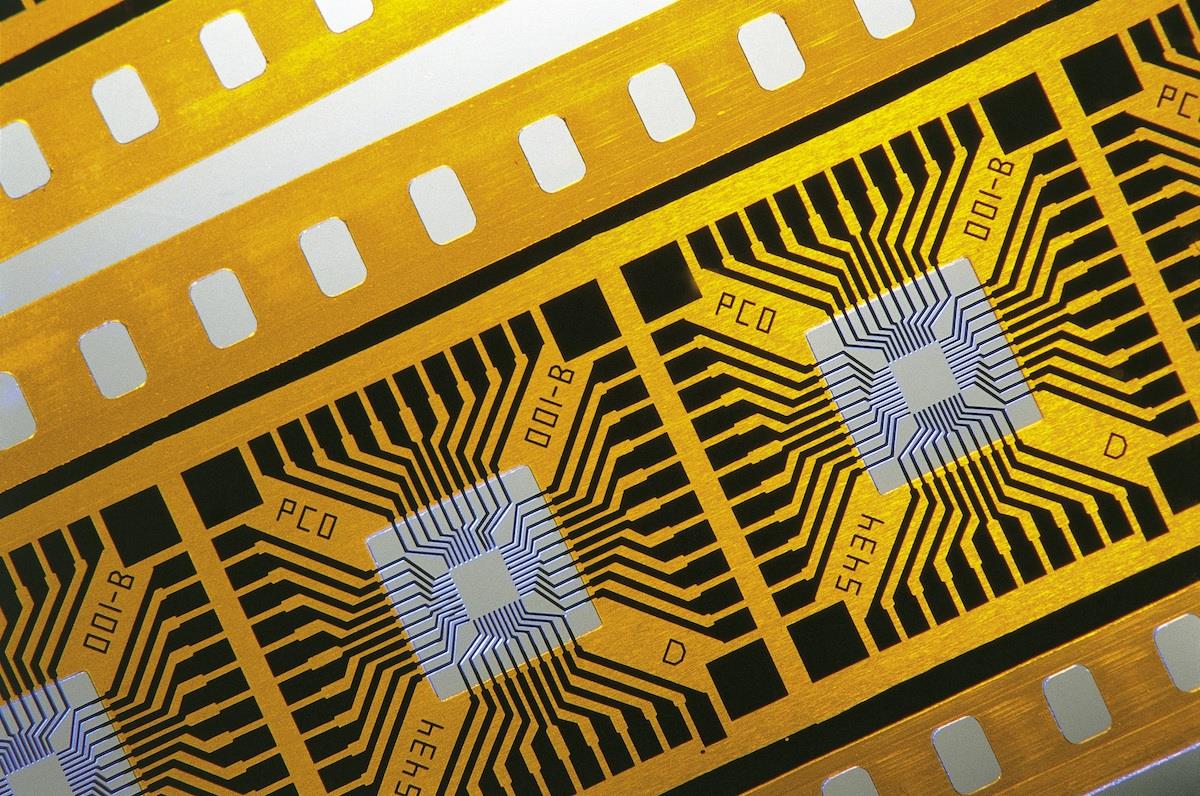

In September 2020, the US Semiconductor Industry Association published a report stating that:

- A strong domestic semiconductor manufacturing presence is critical to America's economic competitiveness, national security and supply chain resilience.

- The share of global semiconductor manufacturing located in the US has plummeted in recent decades, mostly because competing governments offer large incentives and the US does not.

- Robust federal incentives for semiconductor manufacturing are needed to strengthen national security, attract substantial chip manufacturing to the US and create tens of thousands of American jobs.

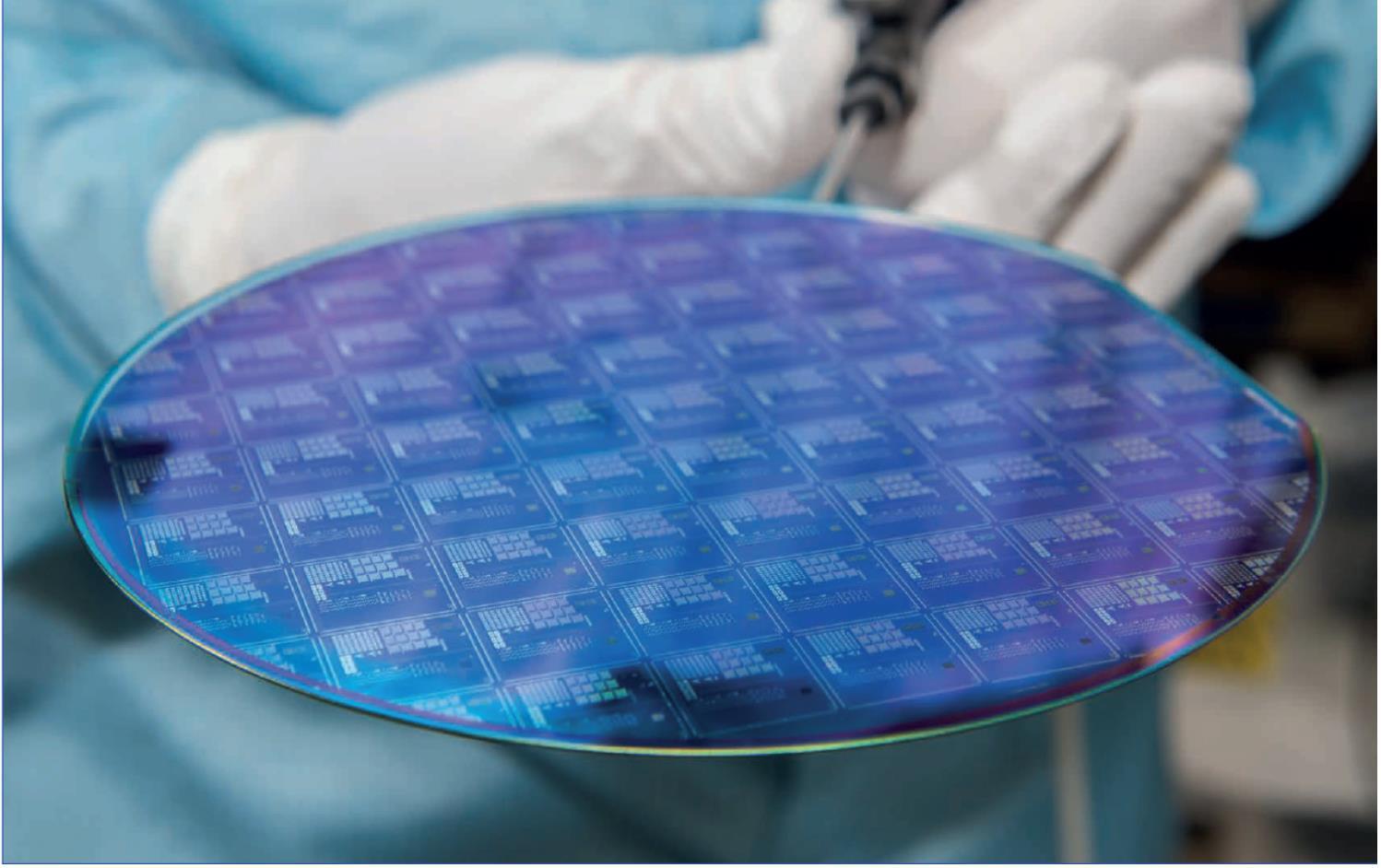

Semiconductors are at the heart of the US-China tech war. Photo: Facebook

It concluded that:

With a US$50 billion federal investment, the US is projected to capture nearly a quarter of new global capacity that is not yet in development, compared with only 6% with no government action.

However, in a blog published on August 24 this year, SEMI, the global semiconductor equipment and materials industry association, pointed out that:“One of the first orders of business for Congress when it returns in September should be to fund the CHIPS for America Act programs, which were authorized earlier this year in the fiscal year 2021 National Defense Authorization Act (NDAA).

“In April, the White House Supply Chain Report called for $52 billion in semiconductor incentives and research funding. In June, the Senate passed the United States Innovation and Competition Act (USICA), which included emergency appropriations of $39 billion to fund the incentive grant program at the Commerce Department, $12 billion for semiconductor research programs and $2 billion for the CHIPS for America Defense Fund.

“The House has yet to act, and the programs remain unfunded …

“Additionally, SEMI strongly supports and encourages Congress to pass the Facilitating American-Built Semiconductors (FABS) Act. The legislation would create a permanent and effectively refundable 25% tax credit for equipment and facilities to produce semiconductors and semiconductor tools …

“A globally competitive corporate tax code is a key driver of innovation and economic growth.”

A man walks past a company logo at the headquarters of the world's largest semiconductor maker TSMC in Hsinchu, Taiwan, January 29, 2021. Photo: AFP / Sam Yeh

Foreign subsidies and tax breaks are major whining points for American politicians anxious to“level the playing field,” so why the delay?

Now that US troops have departed Afghanistan, perhaps they will get back to work. But it is not clear whether or not politicians can override American corporate and financial interests.

One of former president Donald Trump's last initiatives was to pressure Taiwanese semiconductor foundry (contract manufacturer) TSMC into fabricating semiconductors for military use in the US instead of Taiwan.

President Joe Biden and many other politicians carried this policy forward and in June TSMC announced that the proposed subsidies had convinced it to start construction of a new factory in Arizona.

Speaking to Bloomberg, TSMC Chairman Mark Liu said:“Subsidies will be a key factor in TSMC's decision to set up a fab in the US … Our request is that the state and federal governments together make up for the cost gap between the US and Taiwan.”

Intel, the largest American semiconductor maker, doesn't like this at all. In an article entitled“More than manufacturing: Investments in chip production must support U.S. priorities” in Politico on June 24, 2021, CEO Pat Gelsinger wrote:

“The federal government should invest in American intellectual property and capabilities. It should invest US tax dollars in companies that are based here and house their most critical assets ― including patents and people ― domestically …

“… foreign chipmakers vying for US subsidies will keep their valuable intellectual property on their own shores, ensuring that the most lucrative and cutting-edge manufacturing stays there and requiring the US to make the difficult choice between forgoing the advanced chips necessary for critical national security applications or relying on insecure, foreign supply chains for them …

“We must look beyond short-term capacity issues and think seriously about what US chip leadership really looks like.”

Gelsinger has a point. TSMC plans to begin volume production using 5-nanometer process technology in Arizona in 2024, but will move from 5-nanometer to 3-nanometer technology in Taiwan by the end of 2022.

On top of that, in late July, the Taiwanese government granted TSMC approval to build a new factory in Taiwan that will use 2-nanometer technology. It is expected to be equipped starting in 2023.

In the meantime, Intel and Apple have signed up to be the first users of TSMC's 3-nanometer process technology. Intel is still working on a 7-nanometer.

The Intel logo is displayed outside the Intel headquarters in Santa Clara, California. Photo: AFP / Justin Sullivan / Getty Images

So, in terms of miniaturization, TSMC is about two generations ahead of Intel and rapidly moving ahead.

Under the banner“Intel Accelerated,” Gelsinger is leading an effort to catch up with, overtake and compete with TSMC.

On March 23, Intel announced an increase in its 2021 capital spending budget from about $14 billion to $20 billion to upgrade and expand its production capacity.

How did financial markets react?

On April 9, Intel's share price peaked at $68.49. Since then, it had dropped by 21% to $54.09 as of August 31.

The American government wants American semiconductor companies to expand their production capacity and Intel's top management wants to do so. But Wall Street does not like the idea because outsourcing to Taiwan is more immediately profitable.

And Intel itself is of two minds. In June, The Wall Street Journal reported that Intel was“exploring a deal” to buy GlobalFoundries, one of TSMC's competitors, for about $30 billion.

M & A is a CEO thing. This deal, if it gets done, would cost Intel one and a half times its current record-high capital spending budget, but would not add one silicon wafer to US semiconductor production.

Scott Foster is an analyst with Lightstream Research, Tokyo.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment