403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

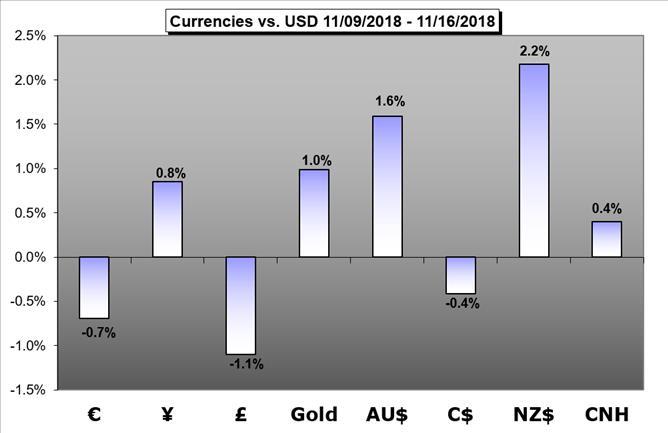

Weekly Fundamental Forecast: Trade Wars, Brexit and Italy Risks Advance as Bulls Hope for Holiday Respite

(MENAFN- DailyFX) The week ahead will test the mettle of holiday trading conditions. The US Thanksgiving holiday is a well-known curb on turnover in global markets which naturally breaks up speculative momentum. However, the abundance of systemic thematic threats (trade wars, Brexit, Italy's budget) and 2018's predilection for volatility could make this an unnerving holiday.

Crude oil prices confirmed longest losing streak since at least 1984. Renewed OPEC supply cut bets may be undermined as Russia seems off the table while the US continues pumping oil.

The Australian Dollar remains in unfamiliar territory just above the long downtrend that marked much of this year. What's more it may well stay there this week.

Trading Sterling (GBP) is becoming increasingly difficult and dangerous as constant Brexit headlines and UK political upheaval combine to create a toxic cocktail.

The US Dollar may find fresh strength next week as political tumult in Europe buoys haven demand while markets rethink a dovish shift in Fed rate hike bets.

The fundamental outlook for gold has remained mixed in recent weeks but that could change given a slew of dovish comments from Federal Reserve officials.

The Chinese economy had uneven developments, bringing mixed impact to the Yuan; at the same time, the US-China trade war and PBOC's guidance will continue to weigh on the Yuan.

The ECB's account of the October meeting may undermine the recent advance in EUR/USD as the Governing Council remains in no rush to normalize monetary policy.

The political backdrop looks bleak for the UK as PM May struggles to bring her party together to support her Brexit plans. Italy yet again defy the European Commission and stick to its big spending budget plan

See what live coverage is scheduled to cover key event risk for the FX and capital markets on the .

See how retail traders are positioning in the majors using the

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment