Weekly Market Trends

Oil collapsed on Tuesday. WTI fell by more than 7% on that day, which was the 12th consecutive steady decline, making it the longest series in modern history. OPEC ministers failed to promise a reduction in production, while the Joint Technical Committee forecasted a production growth. The whole situation has caused major panic in the markets. Since Wednesday, oil has been steadily recovering, but it has not yet managed to fight back to even half of Tuesday's decline, not to mention the whole 28% collapse.

Bitcoin experienced a crash on Wednesday. Many months of sluggish dynamics turned into a sharp sell-off, when the key cryptocurrency fell under the $6000 mark. At the end of the week, BTCUSD was traded near $5500, which roughly corresponds to the cost of electricity required for its production.

On Thursday, nerves could not withstand the pound. The Brexit deal has caused several resignations, which in turn affected the British currency by more than 2% within the day.

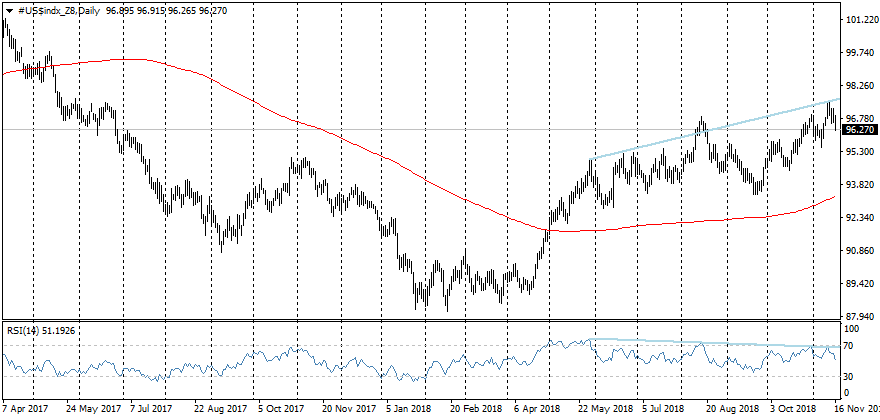

Meanwhile, the dollar has been decreasing during the entire week, rolling back from its 16-month highs on DXY. Technical analysis (divergence with RSI) suggests that the dollar has lost its momentum and is in a vulnerable position. This may already be the topic for next week.

Source: FxPro

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment