403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Best 7 Semiconductor Stocks For Market Movers (Chart)

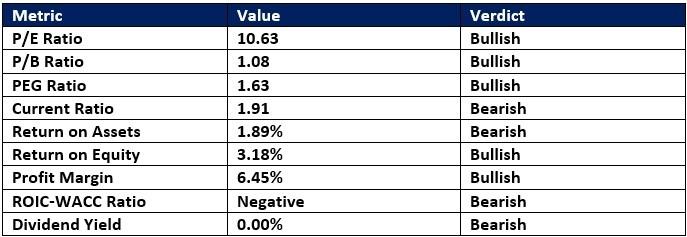

(MENAFN- Daily Forex) After the PHLX Semiconductor Index (SOX) dropped by 16% year-to-date at the end of April, it soared over 100% by mid-October. Savvy investors made tremendous profits by understanding the underlying currents driving price action are Semiconductor Stocks?Semiconductor stocks refer to publicly listed companies that design and manufacture computer chips, also known as semiconductors. They are an essential component in today's world, powering everything from cars to consumer electronics, from telecommunications to energy, and from defense to artificial intelligence.A semiconductor is a material with electrical conductivity to regulate electrical currents, embedded with tiny circuits. Without semiconductors, we would have computer chips with the most basic functions. The sophistication of semiconductors ranges from simple ones that power kitchen appliances to cutting-edge graphics processing units (GPUs) required by artificial intelligence (AI) and defense solutions Should You Consider Buying Semiconductor Stocks?Semiconductor stocks drive the global economy, and the integration of AI, combined with the recent boost in defense spending, will continue to fuel growth. Some investors compare semiconductor companies to the internet companies during the Dot-Com boom and bust, which have created today's Magnificent Seven.Here are a few things worth considering when evaluating Semiconductor stocks:

- Semiconductors are at the forefront of technological innovation, including AI and quantum computing. Investors must brace for volatility. Cyclical cycles will impact the share price of semiconductor stocks. The regulatory landscape is bound to change and adapt. Most semiconductor stocks have excessive valuations.

- Texas Instruments (TXN) NXP Semiconductors (NXPI) Baidu (BIDU) Qnity Electronics (Q) Micron Technology (MU) Advanced Micro Devices (AMD) CEVA (CEVA)

- The BIDU D1 chart shows price action below its ascending Fibonacci Retracement Fan with fading downside momentum. It also shows Baidu inside a horizontal support zone with rising breakout pressures. The Bull Bear Power Indicator is bearish with an ascending trendline, nearing a bullish crossover.

- BIDU Entry Level: Between $108.01 and $118.40 BIDU Take Profit: Between $149.51 and $156.97 BIDU Stop Loss: Between $88.66 and $93.25 Risk/Reward Ratio: 2.15

- The Q D1 chart shows price action breaking out above its ascending 38.2% Fibonacci Retracement Fan level. It also shows Qnity Electronics breaking out above a horizontal support zone with rising bullish momentum. The Bull Bear Power Indicator is bearish with a positive divergence.

- Q Entry Level: Between $77.94 and $83.50 Q Take Profit: Between $102.15 and $107.25 Q Stop Loss: Between $67.09 and $70.63 Risk/Reward Ratio: 2.23

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment