403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Crude Oil Weekly Forecast 16/11: Best Opportunities? (Chart)

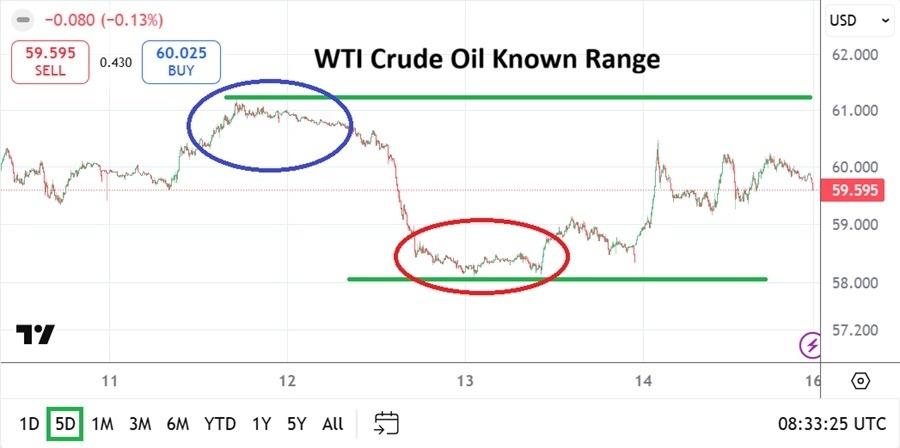

(MENAFN- Daily Forex) Speculators who are looking to take advantage of WTI Crude Oil via its technical range may feel as if they are being presented with a solid opportunity. Past results certainly do not guarantee future outcomes, but technically WTI Crude Oil demonstrated a known range last week that can be claimed to have been polite. The commodity went into this weekend around the 59.595 mark which was in the same vicinity as the previous week's results.

- After a move higher from Monday's low around 59.250, WTI Crude Oil hit the 61.200 level on Tuesday which turned out to be the apex for the week.

- The trend in WTI Crude Oil via a one month chart continues to demonstrate a rather magnetic posture towards the 60.000 level. Traders who have the ability to be patient and look for the 60.000 USD value to emerge again may be following a solid tactic, that is if the known range remains static. However, the 59.000 level below also has received plenty of price action and last week was no different. Technical traders may be comfortable with current levels, but they also need a bit of luck while trying to ride the existing short and near-term fluctuations which are driven by large players.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment