Bitcoin Hits $100K: A Higher Low Could Be Ahead

- Bitcoin faces ongoing liquidity contests as it tests support at $100,000, with traders watching for signs of reversal. Price action indicates a possible formation of a higher low, supported by strengthening RSI signals, hinting at underlying buying interest. Recent data shows significant liquidations and liquidity shearing that highlight the fragility and strategic maneuvers of large traders. On-chain analytics suggest Bitcoin may be approaching a bottom, increasing the prospects for a new rally in the near term. A key indicator, the cumulative volume delta on Bitcoin futures, points toward fading speculative selling pressure, bolstering a potential recovery narrative.

Bitcoin (BTC ) once again challenged the key $100,000 support zone Friday, as bullish traders continue to hope for a trend reversal. Market sentiment remains cautious amid increased volatility and liquidity push-and-pull, with many looking for further signals of strength amidst the uncertain environment.

BTC price falls victim to“liquidity herding game”Data from Cointelegraph Markets Pro and TradingView revealed Bitcoin's retreat to nearly $99,000 during the Wall Street open, underscoring persistent selling pressure.

After failing to sustain a significant relief rally from multi-month lows, BTC /USD faced continued downward pressure, prompting traders to reassess their long positions. Liquidation data from CoinGlass indicated over $700 million in crypto long liquidations over the past 24 hours, further illustrating the risk-off sentiment prevailing in the markets.

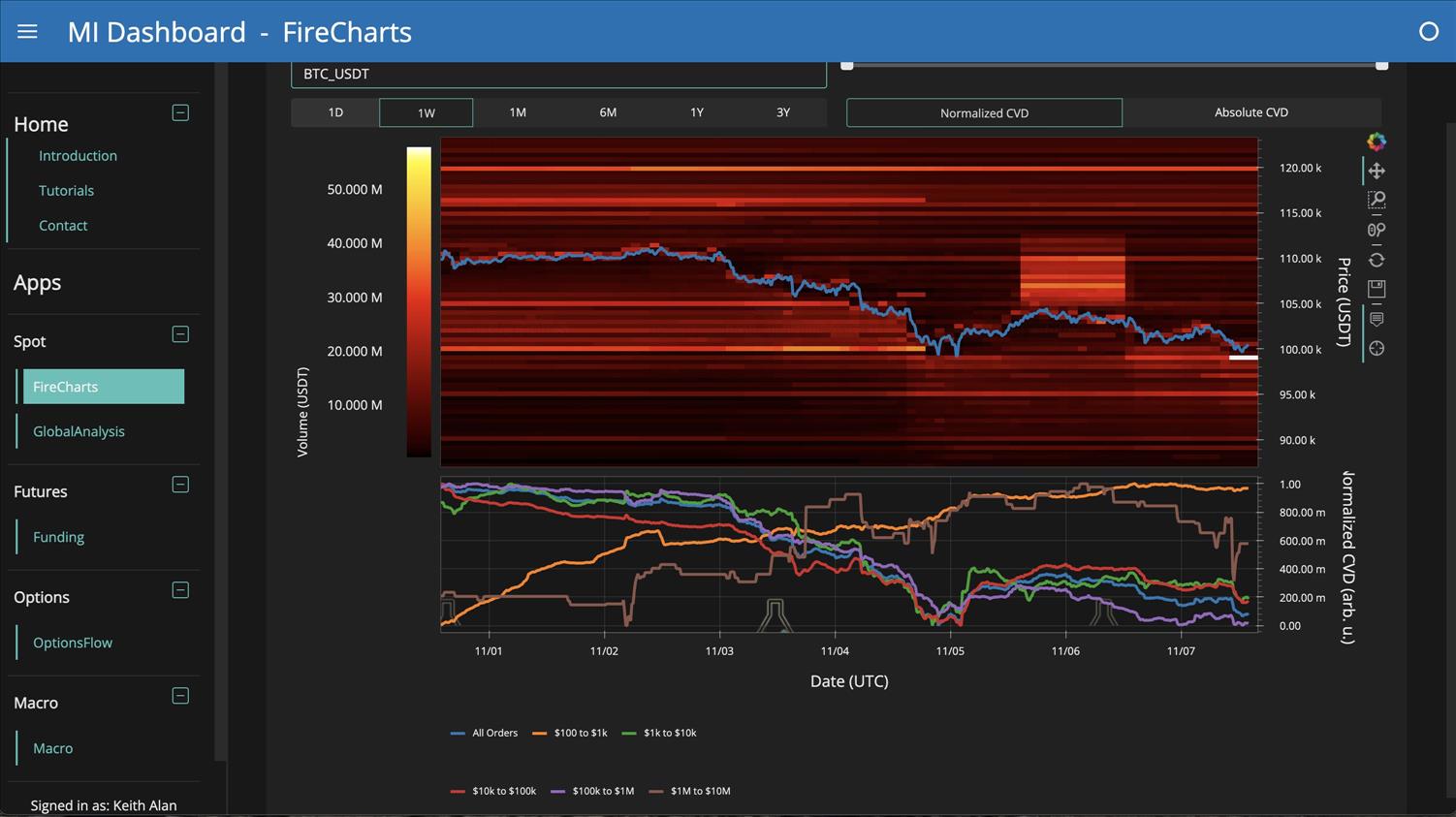

Total crypto liquidations (screenshot). Source: CoinGlassMarket participants continued to see large-volume traders influencing short-term trends, with liquidity pools fluctuating both above and below current price levels. The visual heatmap from Material Indicators revealed that $57 million in bid liquidity near $99,000 could act as a“plunge protection,” yet traders remain wary, with the perception that large players may be hesitant to get filled, hinting at potential manipulation of short-term price moves.

BTC/USDT order-book data. Source: Material Indicators/X

Analyst Exitpump highlighted rising open interest in Bitcoin options, suggesting that the recent buy pressure could lead to a short squeeze if bulls maintain momentum. According to a recent Tweet, despite a control of the short positions, the bounce from large bids signals possible strength in the near term.

On the hourly charts, price attempted to establish a higher low, while the RSI indicators showed a rebound from oversold levels, hinting at cautious optimism.

However, traders like CRG note that Bitcoin's early recovery signs are tentative until confirmed by more robust strength, warning that we could see further downside before a sustainable move upward.

Little needed to start“next rally” on BitcoinCryptoQuant's on-chain analytics suggest that Bitcoin appears to be in a bottoming phase, with the possibility of a springboard to new gains if current conditions hold. The platform's analysis of volume delta on Bitcoin futures indicates a decline in speculative selling pressure, a precondition for a potential rally.

According to Sunny Mom,“speculative selling is fading,” and while spot market data remains slightly bearish, the absence of forced sales by major holders signals that a recovery could be near. The landscape is ripe for a bullish breakthrough should positive Catalysts emerge.

This outlook is reinforced by the idea that, with minimal additional buying, Bitcoin could ignite a new upward trend, attracting traders and investors optimistic about the long-term outlook for cryptocurrency markets and digital assets.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment