US-South Korea Trade Deal Reached, Stabilising USDKRW

The US and South Korea reached a trade agreement during the Asia-Pacific Economic Cooperation summit. Markets had anticipated a longer negotiation process due to differences over US investment terms. The agreement specifies a 15% sectoral tariff on autos, as well as Korean investment in the US totalling $350 billion-$150 billion allocated to shipbuilding and $200 billion provided in cash over the next 10 years.

The big gap in US investment was a major factor holding up the deal. The fund will be financed via a combination of direct investment, loans and guarantees. Of the total, $150 billion will be allocated to Korean shipbuilders working in the US. And $200 billion will be paid in cash, capped at $20 billion per year. Korea added a condition that it may adjust payment timing and amounts based on market conditions.

The $20 billion figure had already been cited several times, including by Governor Rhee in parliament, who stated that annual FX market impacts would be minimal, up to $15–20 billion. So, markets welcomed the details of the deal.

USDKRW to gain, some volatility expected surrounding Fed decisionSealing the 15% tariff and greater certainty about the funding structure helped relieve pressure on the KRW. We believe that better terms for Korean bio/pharma and semiconductors also lifted market sentiment.

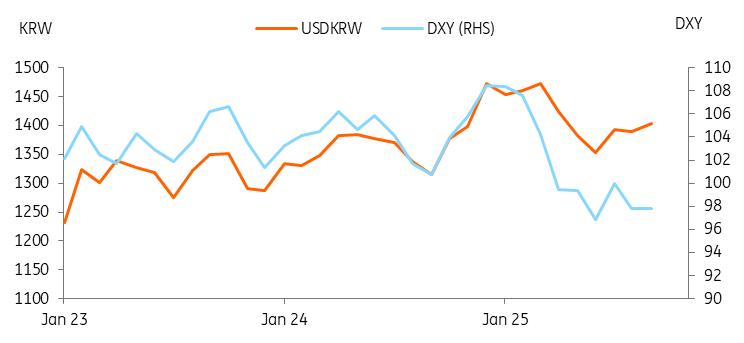

After the news, USDKRW gained almost 0.9%, falling from 1,435 to 1,420 late yesterday. Hawkish Federal Reserve comments limited KRW's further gains this morning, hovering around 1,420-1,425.

But we expect the USDKRW to trend down to 1,400 by the year-end. Although market expectations on the Fed's December cut have fallen, ING continues to remain in favour of the December cut. If we are right, the downward move may persist. A more stable KRW could give the Bank of Korea greater flexibility in its monetary policy. We still believe that housing market trends should be closely watched, but a stronger KRW could support the BoK's easing stance.

Also, even if the funding can be digested with interest income and FX reserves, as the BoK argued, we expect to see an increase in dollar-denominated bond issuances. Also, structurally strong demand for the dollar should limit the downside of the USDKRW in the longer term despite the narrowing rate gap between the US and Korea. We expect the USDKRW to reach 1,350 by the end of 2026.

USDKRW is likely to gain as won specific risk factors reduce

Source: CEIC

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment