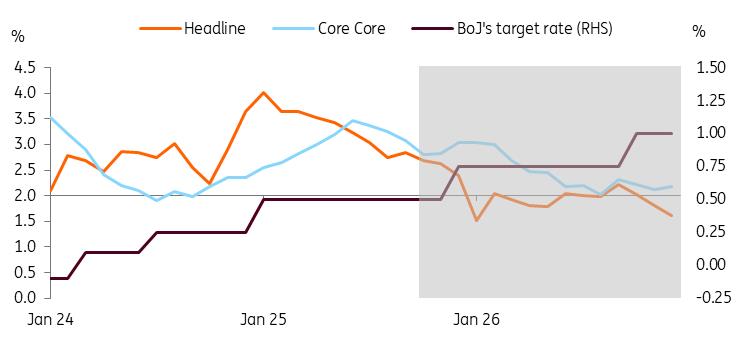

Rising Japanese Inflation Keeps Door Open For A December Rate Hike

| 2.9% |

Consumer price inflation

Core excluding food and energy rose 3.0% YoY |

| As expected |

Japan's consumer price inflation rose to 2.9% year-on-year in September from the previous month's 2.7% rate, in line with market consensus. The largest gain was in utilities, which rose 1.9% from the previous -4.0%, related to the government energy subsidy program. Underlying inflationary pressure is still firm. Other data indicate that firm wage growth is boosting private spending. In addition, the weak JPY is likely to add more pressure in the near term. Thus, this will support the BoJ's rate hike in the coming months.

Inflation to stay above 2% for an extended period, supporting gradual BoJ rate hikes

Source: CEIC BoJ watch

The timing of the next rate hike remains uncertain. There are differing opinions, as indicated by two dissenting votes in the previous meeting. This situation is expected to continue at the 29-30 October meeting. It is anticipated that there will be two dissenting votes without significantly affecting the overall outcome. Most board members are cautious about the recent re-escalation of trade tensions between the US and China and current US economic conditions. Therefore, the BoJ is likely to continue its rate-hike pause in October. Thus, we now see a December hike as our base case scenario.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment