Democrats Launch Counter-Measure To Limit Defi Protocols-What You Need To Know

- Several Democratic U.S. senators have proposed a bill to restrict DeFi protocols deemed risky, including creating a“restricted list.” The proposal aims to impose Know Your Customer (KYC) rules on crypto app frontends and limit protections for developers, sparking fears of industry stifling. Crypto legal experts warn that the move could effectively ban certain activities and undermine bipartisan efforts to establish clear crypto regulation frameworks. Critics argue that the measures could catalyze industry offshoring, slowing U.S. competitiveness in crypto innovation. Advocates emphasize the importance of risk-based regulation that balances consumer protection with preserving decentralization and innovation.

Despite previous backing for a comprehensive crypto market structure bill, some Democratic senators have introduced a contentious alternative aimed at restricting decentralized finance (DeFi). The proposal proposes placing certain DeFi protocols on a“restricted list” if they are considered too risky-potentially banning usage by U.S. citizens engaging in recurring revenues from these protocols. Critics argue that such measures could effectively eliminate the innovation-driven sector, possibly forcing it to operate outside the U.S. regulatory environment.

The Senate Banking Committee Democrats recently forwarded their draft to Republicans, outlining plans to enforce Know Your Customer (KYC) protocols on crypto app frontends-including non-custodial wallets-and weaken protections for crypto developers. Industry insiders like crypto lawyer Jake Chervinsky have expressed alarm, suggesting that the proposal doesn't regulate crypto; it aims to ban it. He pointed out that allowing the Treasury Department to create a“restricted list” could be both unprecedented and unconstitutional.

Gabriel Shapiro, founder of MetaLeX Labs, warned that anyone using these protocols or earning recurring revenues could face penalties, which threatens to significantly chill DeFi innovation within the U.S.

Source: Jake Chervinsky

The sponsors of the counter-proposal include Senators such as Mark Warner, Ruben Gallego, Andy Kim, Reverend Raphael Warnock, Angela Alsobrooks, and Lisa Blunt Rochester, according to industry commentary.

This legislative effort coincides with a potential reversal of momentum toward crypto-friendly regulation initiated during the Trump era, which aimed to establish the U.S. as a global crypto hub.

Bipartisan efforts clash with heavy-handed regulationThe new proposal conflicts with bipartisan proposals like the Responsible Financial Innovation Act (RFIA), which, as of September 9, seeks to clarify oversight responsibilities-assigning the Commodity Futures Trading Commission (CFTC) to regulate spot markets and aiming to limit Securities and Exchange Commission's overreach. RFIA also emphasizes protections for crypto developers amid recent clashes with enforcement actions targeting innovation-focused projects like Tornado Cash and Samourai Wallet.

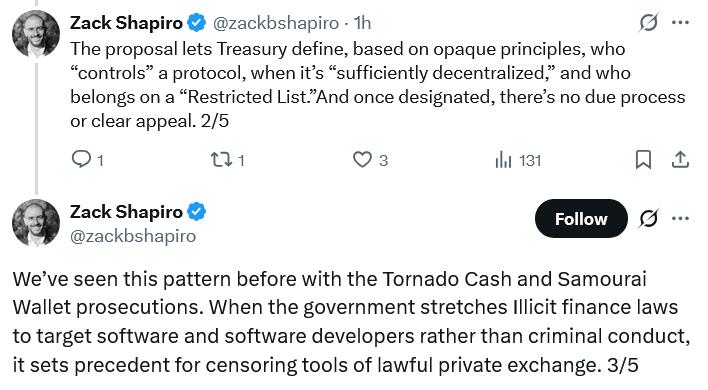

Source: Zack Shapiro Industry voices warn against overreach

Zunera Mazhar, vice president of government and policy affairs at the Digital Chamber, criticized the proposed restrictions, arguing they would do little to address actual risks and could push crypto innovation offshore. Instead, she advocates focusing on tangible chokepoints where illicit finance occurs, employing a risk-based approach that fosters responsible growth without hampering innovation.

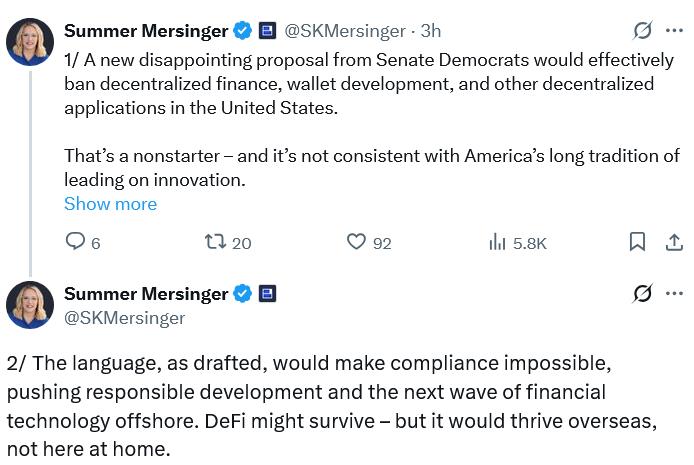

Summer Mersinger, CEO of the Blockchain Association, echoed these sentiments, cautioning that such heavy-handed regulation could make compliance impossible for industry players operating within the U.S.

Source: Summer Mersinger Crypto Investing Risk Warning

Crypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Pepeto Presale Exceeds $6.93 Million Staking And Exchange Demo Released

- Citadel Launches Suiball, The First Sui-Native Hardware Wallet

- Luminadata Unveils GAAP & SOX-Trained AI Agents Achieving 99.8% Reconciliation Accuracy

- Tradesta Becomes The First Perpetuals Exchange To Launch Equities On Avalanche

- Thinkmarkets Adds Synthetic Indices To Its Product Offering

- Edgen Launches Multi‐Agent Intelligence Upgrade To Unify Crypto And Equity Analysis

Comments

No comment