Taiwan's September Export Numbers Hold Up Well

| $12.4bn |

Taiwan's trade balance

September |

| Lower than expected |

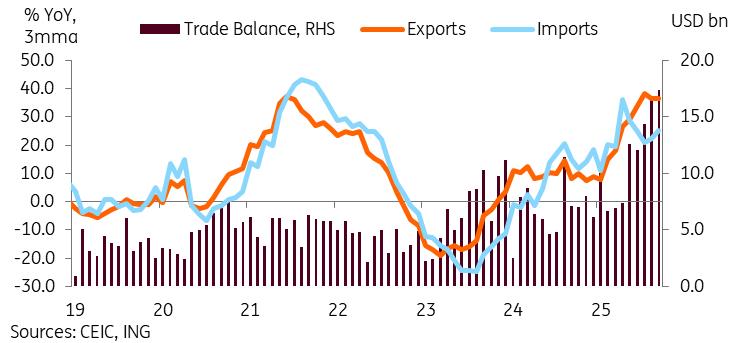

Taiwan's exports grew by 33.8% YoY in September to reach USD 54.2bn. This growth was a little softer than both our and market forecasts, but nonetheless, it's still quite a respectable growth rate.

By export destination, the main focus was on those to the US, which have been the primary driver of export growth so far this year. Despite Taiwan getting hit with a 20% tariff in August, exports to the US have generally held up quite well in the last two months. In September, they grew 51.6% YoY, only a little lower than the year-to-date export growth of 54.9%. We also saw a significant pickup of exports to Mexico in the month, which rose a whopping 374.7% YoY. Intra-Asia trade growth was also solid, with exports to ASEAN up 34.0% YoY, while exports to Mainland China and Hong Kong were a little more muted by comparison with a 12.8% YoY uptick.

By product, semiconductor exports slowed to 27.1% YoY in September, which represented a six-month low but was still largely in line with the year-to-date growth. Computers and computer accessories exports, on the other hand, accelerated to 125.7% YoY, the fourth time in the last five months that we've seen triple-digit YoY growth for this category. As has been the case for most of the year, other export categories generally saw notably slower growth.

Trade surplus disappointed amid export miss and import beat

Import growth beat forecasts

Imports, on the other hand, slowed to 25.1% YoY or USD 41.9bn in September, a smaller drop off than forecasted.

The import strength was mostly concentrated in three categories: electronics & components (42.7%), machinery (52.7%), and information and audiovisual products (70.0%).

Combined with the slightly softer export data, this translates to a smaller trade balance of USD 12.4bn, representing a three-month low and also presenting a bit of downside risk for the third-quarter GDP outlook.

That said, the trade report remains relatively encouraging, as we do not yet see obvious signs of a significant tariff-induced slowdown. However, this could still emerge in the coming months if no deal is reached to bring tariffs more in line with those of potential competitor economies.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment