Chronic Inflammatory Demyelinating Polyneuropathy Market Outlook 2034 Clinical Trials, Market Size, Medication, Prevalence, Companies By Delveinsight

"Chronic Inflammatory Demyelinating Polyneuropathy Market"CIDP Companies are Takeda, Argenx, Sanofi, Janssen Research and Development, Immunovant Sciences GmbH, HanAll Pharma, Roivant Sciences, Shire, Argenx, Sanofi, Nihon Pharmaceutical, Immunovant Sciences, Octapharma, CSL Behring, Janssen Research, Novartis, Biogen, UCB Biopharma, Takeda, MedDay Pharmaceuticals, Teijin Pharma, Pfizer, Octapharma, Momenta Pharmaceuticals, Mitsubishi Tanabe Pharma Corporation, Kedrion, Grifols, Bio Products Laboratory, Baxter, GeNeuro Pharmaceuticals, and others

Chronic Inflammatory Demyelinating Polyneuropathy Market Summary

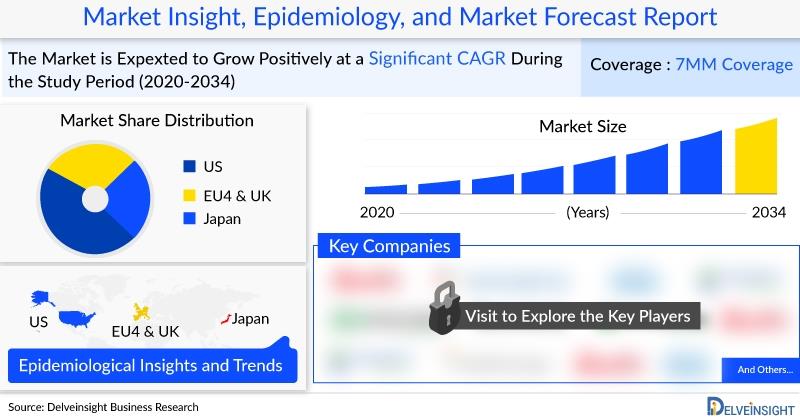

The Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) market is set to grow steadily from 2024–2034 at a CAGR of 7.2%, driven by innovative therapies like riliprubart, nipocalimab, and batoclimab . Valued at USD 1,780 million in 2023 across the 7MM, the market is led by Octapharma, Pfizer, CSL Behring, and Takeda, with products such as HYQVIA and PRIVIGEN. In 2023, there were around 45,587 diagnosed cases , with the US accounting for 66.3%. However, challenges persist, including limited approved relapse therapies, reliance on off-label immunoglobulins, and long-term treatment risks like infections, osteoporosis, and diabetes. Unmet needs highlight opportunities for novel treatments.

DelveInsight's "Chronic Inflammatory Demyelinating Polyneuropathy Market Insights, Epidemiology, and Market Forecast-2034′′ report offers an in-depth understanding of the Chronic Inflammatory Demyelinating Polyneuropathy, historical and forecasted epidemiology as well as the Chronic Inflammatory Demyelinating Polyneuropathy market trends in the United States, EU4 (Germany, Spain, Italy, France) the United Kingdom and Japan.

To Know in detail about the Chronic Inflammatory Demyelinating Polyneuropathy market outlook, drug uptake, treatment scenario and epidemiology trends, Click here; Chronic Inflammatory Demyelinating Polyneuropathy Market Forecast

Some of the key facts of the Chronic Inflammatory Demyelinating Polyneuropathy Market Report:

-

The Chronic Inflammatory Demyelinating Polyneuropathy market size was valued ~USD 1.3 billion in 2023 and is anticipated to grow with a significant CAGR during the study period (2020-2034).

In June 2025, Japan's Ministry of Health, Labour and Welfare (MHLW) has awarded orphan drug designation to riliprubart, a monoclonal antibody that specifically inhibits activated C1s in the classical complement pathway for patients with chronic inflammatory demyelinating polyneuropathy (CIDP). Despite existing treatments, many CIDP patients continue to experience residual symptoms such as weakness, numbness, and fatigue, which can result in long-term complications and reduced quality of life. Around 30% of CIDP patients do not respond to standard therapies. The MHLW grants orphan drug status to medicines targeting rare diseases or conditions with unmet medical needs. Currently, approximately 4,000 individuals in Japan are diagnosed with CIDP.

In June 2025, Amsterdam, the Netherlands - argenx SE (Euronext & Nasdaq: ARGX), a global immunology company focused on improving outcomes for individuals with severe autoimmune disorders, announced that the European Commission (EC) has approved VYVGART® (efgartigimod alfa) 1000 mg for subcutaneous (SC) injection as a standalone therapy for adult patients with progressive or relapsing active chronic inflammatory demyelinating polyneuropathy (CIDP) following prior corticosteroid or immunoglobulin treatment. VYVGART SC is available in vials or prefilled syringes and can be administered by patients, caregivers, or healthcare professionals. The treatment begins with a weekly dosing schedule, which can be adjusted to every other week based on clinical assessment.

In May 2025, Nuvig Therapeutics, Inc. ("Nuvig"), a private biotechnology firm focused on developing innovative immunomodulatory therapies for inflammatory autoimmune diseases, announced that the first patient has been treated in its Phase 2 clinical trial assessing NVG-2089 in individuals with chronic inflammatory demyelinating polyneuropathy (CIDP). The company also revealed plans to present Phase 1 study results of NVG-2089 in healthy volunteers at the 2025 Peripheral Nerve Society (PNS) Annual Meeting.

In January 2025, A recent study published in Annals of Clinical and Translational Neurology reported that, based on a retrospective cohort analysis in China, a simplified regimen using low-dose rituximab (Rituxan; Genentech/Biogen) demonstrated better efficacy and safety compared to standard therapy in treating patients with chronic inflammatory demyelinating polyradiculoneuropathy (CIDP).

In September 2024, Kine Sciences administered the first dose in its Phase Ib/IIa clinical trial of KINE-101, a novel nano peptide developed for the treatment of chronic inflammatory demyelinating polyneuropathy (CIDP). KINE-101 functions by activating Treg cells to regulate both humoral and cell-mediated immune responses. This milestone follows the successful completion of a Phase I study in October last year, which confirmed KINE-101's strong safety profile.

In September 2024, argenx SE (Euronext & Nasdaq: ARGX), a global immunology company dedicated to enhancing the lives of individuals with severe autoimmune diseases, has announced the publication of the pivotal ADHERE Study in The Lancet Neurology. This study represents the largest clinical trial conducted to date on chronic inflammatory demyelinating polyneuropathy (CIDP), a rare, debilitating, and often progressive immune-mediated neuromuscular disorder affecting the peripheral nervous system.

In March 2024, HYQVIA® (immune globulin infusion 10%) is a liquid medication that combines a 10% concentration of immune globulin with recombinant human hyaluronidase PH20 (rHuPH20) enzyme, designed for the treatment of primary immunodeficiency (PI) and chronic inflammatory demyelinating polyneuropathy (CIDP).

In 2023, the CIDP market size in the U.S. was around USD 1,382 million, with expected growth driven by the introduction of emerging therapies.

In 2023, the total market size of the EU4 and the UK was estimated at approximately USD 363 million, accounting for nearly 20% of the total market revenue across the 7MM.

In 2023, the UK had the largest market size among the EU4 and the UK, reaching approximately USD 88 million, followed closely by Germany at around USD 87 million. In contrast, Spain had the smallest market, valued at nearly USD 46 million.

In 2023, Japan's CIDP market size was around USD 35 million, with projections indicating growth throughout the forecast period (2024-2034).

In 2023, the U.S. had the highest number of diagnosed prevalent cases of CIDP, totaling around 30,230, with projections indicating an increase by 2034.

In 2023, the UK recorded the highest number of diagnosed prevalent cases of CIDP among the EU4 and the UK, with approximately 3,250 cases, followed by Germany with around 3,174 cases. Conversely, Spain had the lowest prevalence, with nearly 1,691 cases.

In 2023, Japan had around 2,045 diagnosed prevalent cases of CIDP, with projections indicating growth by 2034.

In 2023, the U.S. recorded around 15,417 cases of typical CIDP and approximately 14,813 cases of atypical CIDP among the subtype-specific cases.

In 2023, Japan's diagnosed prevalent cases of CIDP were distributed across different age groups as follows: approximately 41 cases in ages 0-19, 82 cases in ages 20-39, 798 cases in ages 40-59, 900 cases in ages 60-79, and 225 cases in those aged 80 and older.

Key CIDP Companies: Takeda, Argenx, Sanofi, Janssen Research and Development, Immunovant Sciences GmbH, HanAll Pharma, Roivant Sciences, Shire, Argenx, Sanofi, Nihon Pharmaceutical, Immunovant Sciences, Octapharma, CSL Behring, Janssen Research, Novartis, Biogen, UCB Biopharma, Takeda, MedDay Pharmaceuticals, Teijin Pharma, Pfizer, Octapharma, Momenta Pharmaceuticals, Mitsubishi Tanabe Pharma Corporation, Kedrion, Grifols, Bio Products Laboratory, Baxter, GeNeuro Pharmaceuticals, and others

Key CIDP Therapies: HYQVIA (Immune Globulin Infusion 10% [Human] with Recombinant Human Hyaluronidase), VYVGART HYTRULO (Efgartigimod Alfa and Hyaluronidase-Qvfc), GAMMAGARD LIQUID/KIOVIG (Immune Globulin Infusion [Human] 10% Solution), Riliprubart (SAR445088), Nipocalimab, Batoclimab (HL161), Efgartigimod, SAR445088, NPB-01, Batoclimab, Panzyga, IgPro20, Nipocalimab, Fingolimod, Interferon Beta-1a, Rozanolixizumab, TAK-771, MD1003, and others

The Chronic Inflammatory Demyelinating Polyneuropathy epidemiology based on gender analyzed that CIDP are more prominent in males in comparison to females.

The CIDP market is expected to surge due to the disease's increasing prevalence and awareness during the forecast period. Furthermore, launching various multiple-stage Chronic Inflammatory Demyelinating Polyneuropathy pipeline products will significantly revolutionize the Chronic Inflammatory Demyelinating Polyneuropathy market dynamics.

To know in detail about the Chronic Inflammatory Demyelinating Polyneuropathy market outlook, drug uptake, treatment scenario, and epidemiology trends, click here: Chronic Inflammatory Demyelinating Polyneuropathy Treatment Market

Chronic Inflammatory Demyelinating Polyneuropathy Overview

Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) is a rare neurological disorder in which the immune system attacks the myelin sheath-the protective covering of the peripheral nerves-leading to nerve damage. This causes progressive weakness, numbness, and tingling in the arms and legs. CIDP develops gradually over at least eight weeks and can result in difficulty walking, loss of reflexes, and fatigue. While the exact cause is unknown, it is considered an autoimmune condition. Treatments focus on reducing immune system activity and managing symptoms, commonly using corticosteroids, intravenous immunoglobulin (IVIg), or plasma exchange, often improving strength and mobility over time.

Chronic Inflammatory Demyelinating Polyneuropathy Epidemiology

In 2023, the US reported the highest diagnosed prevalent cases of CIDP with about 30,230, expected to rise by 2034. Within EU4 and the UK, the UK led with nearly 3,250 cases, followed closely by Germany (3,174), while Spain had the lowest (1,691). Japan recorded around 2,045 cases in 2023, also projected to increase. Subtype-specific cases in the US included approximately 15,417 typical and 14,813 atypical CIDP cases. In Germany, 2,380 males and 793 females were diagnosed. In Japan, CIDP prevalence by age included 41 (0–19), 82 (20–39), 798 (40–59), 900 (60–79), and 225 (80+ years).

Chronic Inflammatory Demyelinating Polyneuropathy Epidemiology Segmentation:

The Chronic Inflammatory Demyelinating Polyneuropathy market report proffers epidemiological analysis for the study period 2020-2034 in the 7MM segmented into:

-

Total Prevalence of Chronic Inflammatory Demyelinating Polyneuropathy

Prevalent Cases of Chronic Inflammatory Demyelinating Polyneuropathy by severity

Gender-specific Prevalence of Chronic Inflammatory Demyelinating Polyneuropathy

Diagnosed Cases of Episodic and Chronic Chronic Inflammatory Demyelinating Polyneuropathy

Download the report to understand which factors are driving Chronic Inflammatory Demyelinating Polyneuropathy epidemiology trends @ Chronic Inflammatory Demyelinating Polyneuropathy Epidemiology Forecast

Chronic Inflammatory Demyelinating Polyneuropathy Drugs Uptake and Pipeline Development Activities

Riliprubart (SAR445088) – Sanofi

Riliprubart is a Phase III investigational IgG4 humanized monoclonal antibody targeting C1s in the classical complement pathway. It aims to reduce inflammation and nerve damage in CIDP patients resistant to IVIg or standard treatments. The FDA granted Orphan Drug Designation (ODD) in July 2021, with submission timelines expected by 2026.

Nipocalimab – Janssen R&D

Nipocalimab is an FcRn inhibitor monoclonal antibody administered intravenously, designed to lower harmful IgG antibodies without broadly suppressing immunity. It is in Phase II/III trials for CIDP and received FDA ODD in October 2021. Ongoing studies may be pivotal in shaping its future role in CIDP treatment.

Batoclimab (HL161) – Immunovant/HanAll Pharma/Roivant

Batoclimab is a fully human monoclonal antibody targeting FcRn, delivered via subcutaneous injection, to reduce IgG antibody levels in autoimmune diseases, including CIDP. It is in Phase II trials, with top-line results expected in March 2025. Findings will inform future trials and regulatory strategies for CIDP therapies.

CIDP Therapies and Key Companies

-

HYQVIA (Immune Globulin Infusion 10% [Human] with Recombinant Human Hyaluronidase): Takeda

VYVGART HYTRULO (Efgartigimod Alfa and Hyaluronidase-Qvfc): Argenx

GAMMAGARD LIQUID/KIOVIG (Immune Globulin Infusion [Human] 10% Solution): Takeda

Riliprubart (SAR445088): Sanofi

Nipocalimab: Janssen Research and Development

Batoclimab (HL161): Immunovant Sciences GmbH/HanAll Pharma/Roivant Sciences

HyQvia: Shire

Efgartigimod: Argenx

SAR445088: Sanofi

NPB-01: Nihon Pharmaceutical

Batoclimab: Immunovant Sciences

Panzyga: Octapharma

IgPro20: CSL Behring

Nipocalimab: Janssen Research

Fingolimod: Novartis

Interferon Beta-1a: Biogen

Rozanolixizumab: UCB Biopharma SRL

TAK-771: Takeda

MD1003: MedDay Pharmaceuticals

What's driving growth and what's holding back the Chronic Inflammatory Demyelinating Polyneuropathy market? Discover DelveInsight's latest report for 360° insights @ Chronic Inflammatory Demyelinating Polyneuropathy Market Dynamics

Chronic Inflammatory Demyelinating Polyneuropathy Market Drivers

-

Rising Disease Awareness : Increasing recognition of CIDP among clinicians and patients supports early diagnosis and treatment adoption.

Advancements in Diagnostics : Improved imaging, electrophysiological testing, and biomarker research enhance accurate and timely detection.

Pipeline Expansion : Novel therapies (riliprubart, nipocalimab, batoclimab, etc.) are expected to boost treatment options beyond current standards.

Strong Market Size Growth : Projected CAGR of ~7.2% (2024–2034) signals robust opportunities for pharmaceutical companies.

Established Therapies : Availability of effective immunoglobulin products (HYQVIA, PRIVIGEN, HIZENTRA) drives consistent adoption.

Regulatory Support : Orphan Drug Designations (ODDs) for investigational therapies encourage innovation and faster market entry.

Chronic Inflammatory Demyelinating Polyneuropathy Market Barriers

-

High Treatment Costs : Long-term use of IVIg, SCIg, and immunotherapies significantly increases healthcare expenditure.

Off-label Use : Widespread reliance on immunoglobulins and corticosteroids delays the adoption of newly approved treatments.

Adverse Effects : Prolonged use of corticosteroids and immunosuppressants carries risks such as diabetes, infections, and osteoporosis.

Relapse and Resistance : Many patients experience relapses or show inadequate response to existing therapies, leaving unmet needs.

Limited Approved Options : Few therapies are specifically approved for CIDP, restricting personalized treatment approaches.

Diagnosis Challenges : Misdiagnosis and underreporting in early stages limit timely treatment initiation.

Scope of the Chronic Inflammatory Demyelinating Polyneuropathy Market Report

-

Study Period: 2020-2034

Coverage: 7MM [The United States, EU5 (Germany, France, Italy, Spain, and the United Kingdom), and Japan]

Key Chronic Inflammatory Demyelinating Polyneuropathy Companies: Takeda, Argenx, Sanofi, Janssen Research and Development, Immunovant Sciences GmbH, HanAll Pharma, Roivant Sciences, Shire, Argenx, Sanofi, Nihon Pharmaceutical, Immunovant Sciences, Octapharma, CSL Behring, Janssen Research, Novartis, Biogen, UCB Biopharma, Takeda, MedDay Pharmaceuticals, Teijin Pharma, Pfizer, Octapharma, Momenta Pharmaceuticals, Mitsubishi Tanabe Pharma Corporation, Kedrion, Grifols, Bio Products Laboratory, Baxter, GeNeuro Pharmaceuticals, and others

Key Chronic Inflammatory Demyelinating Polyneuropathy Therapies: HYQVIA (Immune Globulin Infusion 10% [Human] with Recombinant Human Hyaluronidase), VYVGART HYTRULO (Efgartigimod Alfa and Hyaluronidase-Qvfc), GAMMAGARD LIQUID/KIOVIG (Immune Globulin Infusion [Human] 10% Solution), Riliprubart (SAR445088), Nipocalimab, Batoclimab (HL161), Efgartigimod, SAR445088, NPB-01, Batoclimab, Panzyga, IgPro20, Nipocalimab, Fingolimod, Interferon Beta-1a, Rozanolixizumab, TAK-771, MD1003, and others

Chronic Inflammatory Demyelinating Polyneuropathy Therapeutic Assessment: Chronic Inflammatory Demyelinating Polyneuropathy current marketed and Chronic Inflammatory Demyelinating Polyneuropathy emerging therapies

Chronic Inflammatory Demyelinating Polyneuropathy Market Dynamics: Chronic Inflammatory Demyelinating Polyneuropathy market drivers and Chronic Inflammatory Demyelinating Polyneuropathy market barriers

Competitive Intelligence Analysis: SWOT analysis, PESTLE analysis, Porter's five forces, BCG Matrix, Market entry strategies

Chronic Inflammatory Demyelinating Polyneuropathy Unmet Needs, KOL's views, Analyst's views, Chronic Inflammatory Demyelinating Polyneuropathy Market Access and Reimbursement

To learn more about the key players and advancements in the Chronic Inflammatory Demyelinating Polyneuropathy Treatment Landscape, visit the Chronic Inflammatory Demyelinating Polyneuropathy Market Analysis Report

Table of Contents

1. Chronic Inflammatory Demyelinating Polyneuropathy Market Report Introduction

2. Executive Summary for Chronic Inflammatory Demyelinating Polyneuropathy

3. SWOT analysis of Chronic Inflammatory Demyelinating Polyneuropathy

4. Chronic Inflammatory Demyelinating Polyneuropathy Patient Share (%) Overview at a Glance

5. Chronic Inflammatory Demyelinating Polyneuropathy Market Overview at a Glance

6. Chronic Inflammatory Demyelinating Polyneuropathy Disease Background and Overview

7. Chronic Inflammatory Demyelinating Polyneuropathy Epidemiology and Patient Population

8. Country-Specific Patient Population of Chronic Inflammatory Demyelinating Polyneuropathy

9. Chronic Inflammatory Demyelinating Polyneuropathy Current Treatment and Medical Practices

10. Chronic Inflammatory Demyelinating Polyneuropathy Unmet Needs

11. Chronic Inflammatory Demyelinating Polyneuropathy Emerging Therapies

12. Chronic Inflammatory Demyelinating Polyneuropathy Market Outlook

13. Country-Wise Chronic Inflammatory Demyelinating Polyneuropathy Market Analysis (2020–2034)

14. Chronic Inflammatory Demyelinating Polyneuropathy Market Access and Reimbursement of Therapies

15. Chronic Inflammatory Demyelinating Polyneuropathy Market Drivers

16. Chronic Inflammatory Demyelinating Polyneuropathy Market Barriers

17. Chronic Inflammatory Demyelinating Polyneuropathy Appendix

18. Chronic Inflammatory Demyelinating Polyneuropathy Report Methodology

19. DelveInsight Capabilities

20. Disclaimer

21. About DelveInsight

About DelveInsight

DelveInsight is a leading Healthcare Business Consultant and Market Research firm focused exclusively on life sciences. It supports Pharma companies by providing comprehensive end-to-end solutions to improve their performance.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment