Poland's Economic Growth Outshines CEE Peers In Second Quarter

The Polish Statistical Office confirmed its flash estimate of 2Q25 GDP growth at 3.4% YoY following a 3.2% YoY expansion in 1Q25. Seasonally adjusted data indicates that economic growth accelerated slightly to 0.8% quarter-on-quarter from 0.7% QoQ in the previous quarter. The composition of 2Q25 GDP growth was also unveiled.

Supply side underpinned by services expansion as opposed to almost stagnant manufacturingLooking from the supply side, GDP was mainly driven by the services sector. Total value added went up by 3.0% YoY, including a 5.9% YoY increase in trade and repairs, 4.4% YoY in transport and storage and 6.1% YoY in professional, academic and technical activities. Expansion in services was accompanied by a decline in value added in construction (-0.2% YoY vs. +0.8% YoY in 1Q25) and still sluggish growth in industry (1.6% YoY vs. 1.0% YoY in the previous quarter).

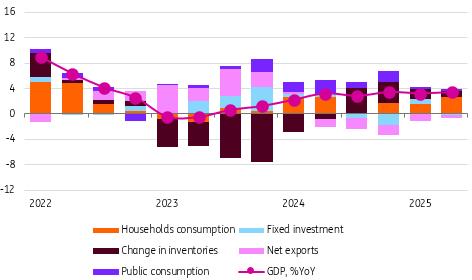

Household expenditure propelled 2Q25 GDP growthGDP and its composition, %YoY, percentage points.

Source: GUS, ING. Consumption dominated expenditure growth

The expenditure side of GDP was dominated by household consumption, which rose by 4.4% YoY following an increase of 2.5% YoY in 1Q25. The strength of consumer spending had already been signalled by quarterly retail sales data, and consumer demand was supported by calendar effects, among other factors. In 2025, the majority of the Easter spending took place in April, compared with March in 2024, which boosted the annual growth rate of consumption. Fixed investment disappointed, posting a 1.0% YoY decline after rising by 6.3% YoY in the previous quarter, even though we saw some encouraging signs in investment outlays of large enterprises in 2Q25. In 1Q25, investment growth was mostly propelled by the public sector as a result of rising defence investment. The change in inventories contributed 1.0 percentage point to annual GDP growth (1.5 percentage points in 1Q25) and domestic demand expanded by 4.0% YoY vs. 4.6% YoY in the previous quarter.

The deterioration in the foreign trade balance translated into a negative contribution from net exports, which knocked 0.4 percentage points off annual GDP growth in 2Q25 i.e. less than 1.1 percentage points in 1Q25. Exports of goods and services advanced by 1.5% YoY and imports by 2.6% YoY compared to 1.1% YoY and 3.5% YoY, respectively, in 1Q25. The slower growth of imports in an environment of buoyant consumption indicated less robust defence investment via imported military equipment.

Poland sustains solid growth while CEE underperformsPoland's economy remains on a path of solid growth, and in 2H25, we expect GDP growth to accelerate to nearly 4% YoY, which should allow for full-year growth of 3.5%.

Central and Eastern Europe's economic performance has disappointed for a second straight year, yet Poland stands out as a solid performer. Both Hungary and Romania are heading for much slower growth than expected and a rather poor performance historically. In Hungary, we expect GDP growth to be just 0.7% this year vs the 2.1% consensus estimate at the beginning of the year, while the forecast for Romania points to 0.3% growth compared to forecasts of 2.1% at the beginning of the year. Czechia has escaped stagnation this year.

Polish industry is nearly stagnant, similar to other countries in the region, but the domestic economy is expanding on the back of rising services, including trade (as confirmed by buoyant consumption), as well as other important sectors like transport and professional activities.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment