Capitan Drills 2,636 G/T Silver Over 1.5 Metres Within Wider Interval Of 370.2 G/T Silver Over 19.8 Metres

| Hole ID | From (m) | To (m) | Interval (m) | Ag Eq Rec (g/t) | Ag (ppm) | Au (ppm) | Pb (%) | Zn (%) |

| 25-ERRC-01 | | | | | | | | |

| Interval | 0 | 10.7 | 10.7 | 32.8 | 29.8 | 0.043 | 0.01 | 0.05 |

| Interval | 29 | 44.2 | 15.2 | 52.8 | 51.7 | 0.04 | 0.01 | 0.03 |

| Including | 41.2 | 42.7 | 1.5 | 181.3 | 181.1 | 0.12 | 0.04 | 0.05 |

| Interval | 54.9 | 67.1 | 12.2 | 43.3 | 34.8 | 0.11 | 0.02 | 0.07 |

| Interval | 77.7 | 79.2 | 1.5 | 129.6 | 124.6 | 0.133 | 0.04 | 0.06 |

| 25-ERRC-02 | | | | | | | | |

| Interval | 1.5 | 3.0 | 1.5 | 37.2 | 13 | 0.35 | 0.01 | 0.01 |

| Interval | 38.1 | 39.6 | 1.5 | 26.6 | 20.7 | 0.07 | 0.02 | 0.06 |

| Interval | 47.2 | 48.8 | 1.5 | 32.2 | 18.7 | 0.10 | 0.09 | 0.16 |

| Interval | 82.3 | 83.8 | 1.5 | 41.9 | 38.5 | 0.04 | 0.03 | 0.07 |

| 25-ERRC-03 | | | | | | | | |

| Interval | 41.1 | 47.2 | 6.1 | 44.3 | 37.15 | 0.13 | 0.00 | 0.01 |

| Interval | 80.8 | 103.6 | 22.9 | 49.8 | 31.65 | 0.05 | 0.14 | 0.38 |

| Including | 100.6 | 102.1 | 1.5 | 127.8 | 115.5 | 0.032 | 0.15 | 0.37 |

| 25-ERRC-04 | | | | | | | | |

| Interval | 64.0 | 76.2 | 12.2 | 30.7 | 24.38 | 0.03 | 0.06 | 0.12 |

| 25-ERRC-05 | | | | | | | | |

| Interval | 79.2 | 83.8 | 4.6 | 26.6 | 12.3 | 0.026 | 0.09 | 0.31 |

| Interval | 100.6 | 102.1 | 1.5 | 83.1 | 59 | 0.114 | 0.22 | 0.4 |

| 25-ERRC-06 | | | | | | | | |

| Interval | 24.4 | 25.9 | 1.5 | 88.3 | 16.3 | 0.76 | 0.07 | 0.55 |

| Interval | 30.5 | 32 | 1.5 | 40.7 | 18.8 | 0.31 | 0.00 | 0.06 |

| 25-ERRC-07 | | | | | | | | |

| Interval | 0 | 4.6 | 4.6 | 118.5 | 115.9 | 0.084 | 0.05 | 0.07 |

| Interval | 47.2 | 57.9 | 10.7 | 35.9 | 25.7 | 0.073 | 0.05 | 0.16 |

| 25-ERRC-08 | | | | | | | | |

| Interval | 53.3 | 59.4 | 6.1 | 59 | 46.9 | 0.064 | 0.08 | 0.24 |

| Interval | 102.1 | 118.9 | 16.8 | 119.1 | 109.4 | 0.046 | 0.13 | 0.28 |

| Including | 103.6 | 105.2 | 1.5 | 466.9 | 456 | 0.088 | 0.35 | 0.66 |

| Including | 115.8 | 117.3 | 1.5 | 396 | 382 | 0.02 | 0.48 | 0.65 |

| Interval | 138.7 | 140.2 | 1.5 | 67.8 | 68.5 | 0.008 | 0.03 | 0.06 |

| 25-ERRC-09 | | | | | | | | |

| Interval | 70.1 | 83.8 | 13.7 | 106.4 | 79 | 0.1 | 0.21 | 0.57 |

| Including | 74.7 | 76.2 | 1.5 | 465.9 | 427 | 0.203 | 0.42 | 1.14 |

| 25-ERRC-10 | | | | | | | | |

| Interval | 48.8 | 51.8 | 3 | 314.1 | 316.3 | 0.187 | 0.06 | 0.06 |

| Including | 50.3 | 51.8 | 1.5 | 492.4 | 502 | 0.226 | 0.09 | 0.07 |

| Interval | 62.5 | 67.1 | 4.6 | 62.2 | 53.4 | 0.072 | 0.06 | 0.16 |

| Including | 65.5 | 67.1 | 1.5 | 110.2 | 106.5 | 0.057 | 0.06 | 0.13 |

| Interval | 129.5 | 132.6 | 3 | 130.4 | 116.3 | 0.003 | 0.25 | 0.41 |

| Including | 129.5 | 131.1 | 1.5 | 183.9 | 166.5 | 0.003 | 0.31 | 0.55 |

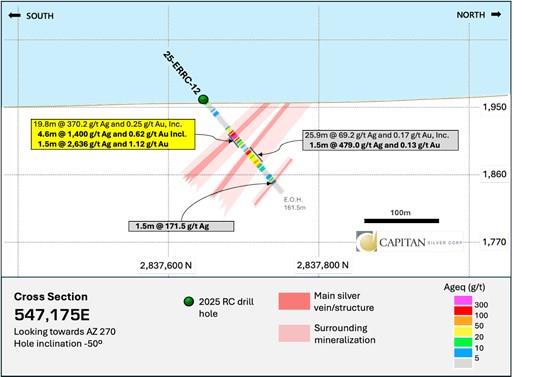

| 25-ERRC-12 | | | | | | | | |

| Interval | 48.8 | 68.6 | 19.8 | 368.1 | 370.2 | 0.25 | 0.04 | 0.06 |

| including | 61.0 | 65.5 | 4.6 | 1,369.3 | 1,400.0 | 0.62 | 0.15 | 0.18 |

| and | 61.0 | 62.5 | 1.5 | 2,571.0 | 2,636.0 | 1.12 | 0.27 | 0.25 |

| Interval | 76.2 | 77.7 | 1.5 | 37.4 | 36.6 | 0.04 | 0.00 | 0.01 |

| Interval | 86.9 | 112.8 | 25.9 | 79.0 | 69.2 | 0.17 | 0.03 | 0.05 |

| including | 88.4 | 89.9 | 1.5 | 467.1 | 479.0 | 0.13 | 0.15 | 0.11 |

| Interval | 141.7 | 143.3 | 1.5 | 168.0 | 171.5 | 0.03 | 0.09 | 0.07 |

- Reported intervals are not true width (T.W). Drilling has been optimized to intersect mineralization between 70-90% T.W.

- AgEq grades are reported using the following assumption:

Metal Recovery: Ag 94%, Au 86%, Pb 93.5%, Zn 92%.

All summarized intervals reported in this press release were calculated using a 25 ppm Ag equivalent (AgEq) cut-off grade with AgEq considering Ag, Au, Pb and Zn and calculated as follows: AgEq = Ag g/t + (80x Au g/t) + (0.003 x Pb g/t) + (0.0037 x Zn g/t). Intervals contain no more than 3 metres of internal dilution. High grades have not been capped. Sampling: RC samples are collected, split, logged and weighed at the drill site. Duplicate samples and pulp rejects are returned and stored at the Capitan Silver CDP exploration camp. Samples are sent to the Bureau Veritas Lab in Durango, Mexico for prep and then analyzed using code MA300, 4-acid digestion, multi-element analysis. Au is analyzed using Fire Assay (FA430). Overlimit (>200 ppm Ag) assays utilize method MA370, with gravimetric utilized for any overlimit thereafter.

QAQC: Capitan Silver maintains a rigorous QAQC program and inserts multiple standards, blanks and duplicates into the sample stream at regular intervals. Check Assays are performed at SGS laboratories in Durango, Mexico.

Qualified Person

The scientific and technical data contained in this news release pertaining to the Cruz de Plata project was reviewed and approved by Marc Idziszek, P.Geo, a non-independent qualified person to Capitan Silver, who is responsible for ensuring that the technical information provided in this news release is accurate and who acts as a "qualified person" under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

About Capitan Silver Corp.

Capitan Silver is defining a new high-grade silver system at its Cruz de Plata project, located in the heart of Mexico's primary silver belt. The Company is led by a proven and accomplished management team that has previously advanced three projects into production, on time and on budget. The Company has been diligent in maintaining a tight share structure and has one of the tightest share structures among its peer group, with the top three shareholders owning over 38% of the Company's share capital. Capitan Silver is fully funded and actively drilling at its Cruz de Plata Silver project.

Overview: Cruz de Plata Silver Project

Capitan Silver Corp.'s 2,551-hectare Cruz de Plata Silver-Gold project is located within the Altiplano region of the State of Durango, one of the safest States in Mexico in recent years. Access to the project site is excellent from either Durango or Torreon, with exploration permitted year-round.

The project area is the birthplace of the Peñoles Mining Company with historic mining dating back to 1887. These historical mines are contained within a well-defined, outcropping, high-grade silver trend and include the Jesús María (2.5 km strike length), Santa Teresa (1.8 km length), San Rafael North (1.3 km) vein trend. These veins are believed to be part of a much larger intermediate sulfidation system that stretches across the Cruz de Plata property. Grades from historic mining along with these veins ranged from 300 to 2,000 g/t Ag, 3-12% Pb, and 4-10% Zn. The style of mineralization at the Cruz de Plata Silver belt is mostly intermediate sulfidation.

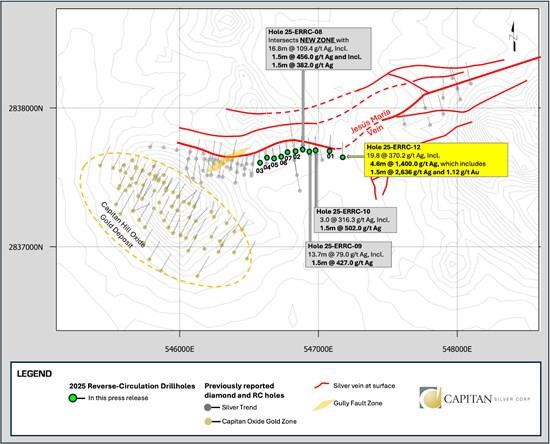

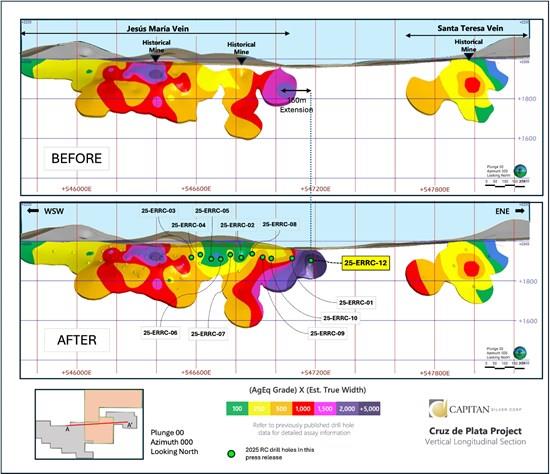

Drilling by the Company and previous operators has focused mostly on the Jesús María vein system as well as along cross-cutting Gully Fault Ag-Au zone.

Previously Announced Drill Results Include:

- JM_DDH_13_06: 0.9 m of 3,567 g/t AgEq within a wider interval of 13.7 m of 381.06 g/t AgEq

21-JMRC-10: 1.5 m @ 2,250.1 g/t AgE q within a wider interval of 16.8 m @ 309.82 g/t AgEq 21-JMRC-01: 1.5 m @ 1,099.3 g/t AgEq and 1.5 m @ 1,267.2 g/t AgEq within a wider interval of 42.7 m @ 207.82 g/t AgEq

22-JMRC-22: 1.5 m of 1,431.68 g/t AgEq within a wider interval of 10.7 m of 314.54 g/t AgEq JM_DDH_14_24: 7.15 m of 1,024.4 g/t AgEq within a wider interval of 42.0 m of 244.72 g/t AgEq

JM_DDH_13_07: 2.0 m of 970.77 g/t AgEq within a wider interval of 6.0 m of 368.3 g/t AgEq including 21-JMRC-03: 1.5 m of 739.6 g/t AgEq , and 1.5 m of 800.0 g/t AgEq and 1.5 m @ 595.5 g/t AgEq within a wider interval of 10.7 m @ 403.43 g/t AgEq

JM_DDH_14_10: 4.3 m of 786.5 g/t AgEq within a wider interval of 40.6 m of 160.05 g/t AgEq

(1) Silver equivalent calculated using the following equation: AgEq = (Ag x 0.94) + (Au x 0.86 x 80) + (Zn x 0.037 x 0.935) + (Pb x 0.03 x 0.92).

(2) For further detail see appendix 1 and 2 and press releases dated February 16, 2022, March 8, 2022, May 2, 2022, June 29, 2022, January17, 2023.

(3) AgEq grades are now calculated using metal recoveries. Intervals from historic press releases may not match current release.

The Jesús María vein has been drill tested over a strike length of approximately 1.45 km and remains open on its eastern side as well down-dip to the south. All historic drilling by the Company and previous operators have returned Jesús María-style mineralization, with no holes missing their intended target. Other targets outside of the Jesús María area have seen limited to no drill testing. To date, several multi-kilometre silver trends have been identified at Cruz de Plata with a cumulative strike length of +7 km.

In addition, the project contains the Capitan Hill disseminated oxide gold deposit which is located in the hanging wall to the Jesús María vein, approximately 150-300 m to its south. This zone represents the top of the mineralized system and has similarities to the nearby El Castillo and San Agustin oxide gold mines that were advanced, built and operated by members of Capitan's management team.

ON BEHALF OF CAPITAN SILVER CORP.

"Alberto Orozco"

Alberto Orozco, CEO

For additional information contact:

Alberto Orozco

CEO

Capitan Silver Corp.

...

Phone: (788) 327-6671

IR Team

Capitan Silver Corp.

...

Phone: (778) 327-6671

DISCLAIMER FOR FORWARD-LOOKING INFORMATION

Certain statements in this press release may be considered forward-looking information. These statements can be identified by the use of forward-looking terminology (e.g., "expect", "estimates", "intends", "anticipates", "believes", "plans"). Such information involves known and unknown risks -- including the availability of funds, the results of financing and exploration activities, the interpretation of exploration results and other geological data, or unanticipated costs and expenses and other risks identified by Capitan in its public securities filings that may cause actual events to differ materially from current expectations. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

To view the source version of this press release, please visit

SOURCE: Capitan Silver Corp.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- United States Lubricants Market Growth Opportunities & Share Dynamics 20252033

- UK Digital Health Market To Reach USD 37.6 Billion By 2033

- Immigration Consultancy Business Plan 2025: What You Need To Get Started

- United States Animal Health Market Size, Industry Trends, Share, Growth And Report 2025-2033

- Latin America Mobile Payment Market To Hit USD 1,688.0 Billion By 2033

- United States Jewelry Market Forecast On Growth & Demand Drivers 20252033

Comments

No comment