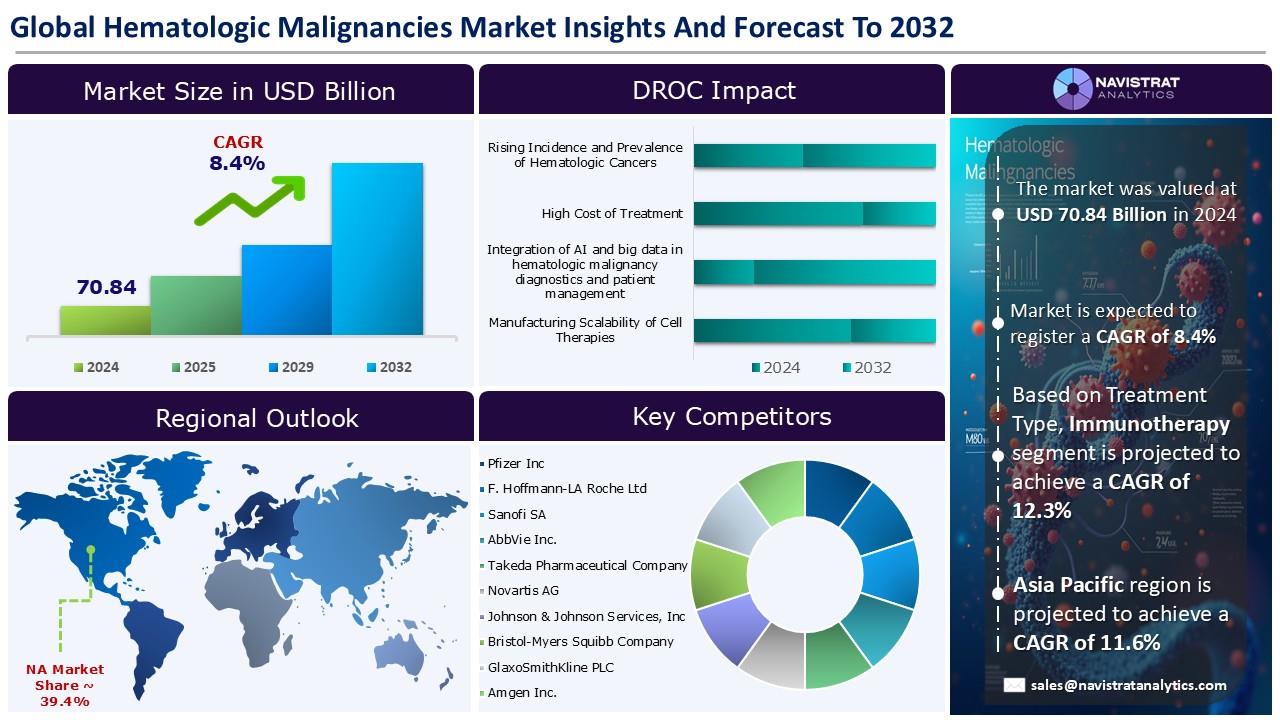

Hematologic Malignancies Market Size to Reach USD 135.72 billion in 2032

(MENAFN- Navistrat Analytics) August 29, 2025- The increasing incidence and prevalence of hematologic cancers remain a major driver of market growth. Data from the Lymphoma and Leukemia Society indicate that every three minutes, one person in the United States is diagnosed with leukemia, lymphoma, or myeloma. By 2024, an estimated 187,740 Americans will receive such a diagnosis, with these cancers projected to represent 9.4% of the total 2,001,140 new cancer cases in the country that year. Germline predisposition syndromes are also being more frequently identified in individuals with hematologic malignancies (HM), with genetic susceptibility estimated to account for 10%–20% of cases over a lifetime.

In June 2025, Incyte announced FDA approval of Monjuvi (tafasitamab-cxix), a humanized Fc-modified, cytolytic CD19-targeting monoclonal antibody, for use in combination with rituximab and lenalidomide in treating adult patients with relapsed or refractory follicular lymphoma. Tafasitamab incorporates an XmAb-engineered Fc domain designed to enhance B-cell destruction through apoptosis and immune effector functions such as Antibody-Dependent Cell-Mediated Cytotoxicity (ADCC) and Antibody-Dependent Cellular Phagocytosis (ADCP).

Despite its vast potential, immunotherapy also presents significant challenges and limitations. Stimulating the immune system to attack cancer cells can lead to a spectrum of side effects, from mild to severe. Complications such as cytokine release syndrome (CRS) and neurotoxicity are linked to certain immunotherapies, requiring vigilant monitoring and careful management to mitigate adverse reactions.

Segments market overview and growth Insights

Based on type, the hematologic malignancies market is segmented into leukemia, lymphoma, myeloma, and others. The leukemia segment accounted for the largest market share in 2024. The American Cancer Society projects that in 2025, approximately 66,890 new leukemia cases will be diagnosed in the United States, leading to an estimated 23,540 deaths. Acute myeloid leukemia (AML) accounts for nearly one-third of adult leukemia cases and about 1% of all cancers. In July 2025, Taiho Oncology, Inc. and Taiho Pharmaceutical Co., Ltd. announced that the U.S. Food and Drug Administration (FDA) had approved their supplemental new drug application (sNDA) for INQOVI (decitabine and cedazuridine) in combination with venetoclax for the treatment of adults with newly diagnosed AML who are not candidates for intensive induction chemotherapy.

Regional market overview and growth insights

North America held the largest market share in the Hematologic Malignancies market in 2024. The market is being driven by rising incidence and prevalence of hematologic cancers and advancements in targeted and immunotherapies. The American Cancer Society estimates that in 2025, multiple myeloma will account for about 36,110 new cases in the United States (20,030 in men and 16,080 in women), with roughly 12,030 projected deaths (6,540 in men and 5,490 in women). In April 2025, Amneal Pharmaceuticals, Inc., a global biopharmaceutical company, together with Shilpa Medicare Limited, announced the U.S. launch of BORUZU, an innovative bortezomib formulation designed for ready-to-use subcutaneous or intravenous (IV) administration.

Competitive Landscape and Key Competitors

The Hematologic Malignancies market is characterized by a fragmented structure, with many competitors holding a significant share of the market. list of major players included in the Hematologic Malignancies market report are:

o Pfizer Inc

o F. Hoffmann-LA Roche Ltd

o Sanofi SA

o AbbVie Inc.

o Takeda Pharmaceutical Company

o Novartis AG

o Johnson & Johnson Services, Inc

o Bristol-Myers Squibb Company

o GlaxoSmithKline PLC

o Amgen Inc.

o Regeneron Pharmaceuticals Inc.

o Gilead Sciences, Inc.

o Merck & Co., Inc.

o Astrazeneca

o Incyte

Major strategic developments by leading competitors

Glenmark Pharmaceuticals: In May 2025, Glenmark Pharmaceuticals launched Zanubrutinib, a cancer treatment, in India under the brand name 'Brukinsa' after gaining permission from the Drugs Controller General of India (DCGI). The medicine is expected to significantly improve the treatment of certain blood malignancies. These include CLL/SLL, WM, MCL, MZL, and FL.

Kura Oncology, Inc.: In November 2024, Kura Oncology, Inc. and Kyowa Kirin Co., Ltd. announced a global strategic collaboration to develop and commercialize ziftomenib, Kura's selective oral menin inhibitor, which is being studied for the treatment of acute myeloid leukemia (AML) and other hematologic malignancies. Kura will receive an upfront payment of USD 330 million and expects to receive up to USD 420 million in near-term milestone payments, including one upon the introduction of ziftomenib in the monotherapy relapsed/refractory (R/R) context.

Navistrat Analytics has segmented the Hematologic Malignancies market based on type, diagnosis, treatment type, route of administration, and end-use, and region:

• Type Outlook (Revenue, USD Billion; 2022-2032)

o Leukemia

o Lymphoma

o Myeloma

o Others

• Diagnosis Outlook (Revenue, USD Billion; 2022-2032)

o Blood Tests

o Biopsy

o Imaging Tests

• Treatment Type Outlook (Revenue, USD Billion; 2022-2032)

o Chemotherapy

o Radiotherapy

o Stem Cell Transplantation

o Immunotherapy

• Route of Administration Outlook (Revenue, USD Billion; 2022-2032)

o Oral

o Parenteral

o Others

• End-Use Outlook (Revenue, USD Billion; 2022-2032)

o Hospitals and Clinics

o Ambulatory Surgical Centers

o Cancer Centers

o Pharmaceutical and Biotech Companies

o Others

• Regional Outlook (Revenue, USD Billion; 2022-2032)

o North America

a. U.S.

b. Canada

c. Mexico

o Europe

a. Germany

b. France

c. U.K.

d. Italy

e. Spain

f. Benelux

g. Nordic Countries

h. Rest of Europe

o Asia Pacific

a. China

b. India

c. Japan

d. South Korea

e. Oceania

f. ASEAN Countries

g. Rest of APAC

o Latin America

a. Brazil

b. Rest of LATAM

o Middle East & Africa

a. GCC Countries

b. South Africa

c. Israel

d. Turkey

e. Rest of MEA

@Navistrat Analytics

In June 2025, Incyte announced FDA approval of Monjuvi (tafasitamab-cxix), a humanized Fc-modified, cytolytic CD19-targeting monoclonal antibody, for use in combination with rituximab and lenalidomide in treating adult patients with relapsed or refractory follicular lymphoma. Tafasitamab incorporates an XmAb-engineered Fc domain designed to enhance B-cell destruction through apoptosis and immune effector functions such as Antibody-Dependent Cell-Mediated Cytotoxicity (ADCC) and Antibody-Dependent Cellular Phagocytosis (ADCP).

Despite its vast potential, immunotherapy also presents significant challenges and limitations. Stimulating the immune system to attack cancer cells can lead to a spectrum of side effects, from mild to severe. Complications such as cytokine release syndrome (CRS) and neurotoxicity are linked to certain immunotherapies, requiring vigilant monitoring and careful management to mitigate adverse reactions.

Segments market overview and growth Insights

Based on type, the hematologic malignancies market is segmented into leukemia, lymphoma, myeloma, and others. The leukemia segment accounted for the largest market share in 2024. The American Cancer Society projects that in 2025, approximately 66,890 new leukemia cases will be diagnosed in the United States, leading to an estimated 23,540 deaths. Acute myeloid leukemia (AML) accounts for nearly one-third of adult leukemia cases and about 1% of all cancers. In July 2025, Taiho Oncology, Inc. and Taiho Pharmaceutical Co., Ltd. announced that the U.S. Food and Drug Administration (FDA) had approved their supplemental new drug application (sNDA) for INQOVI (decitabine and cedazuridine) in combination with venetoclax for the treatment of adults with newly diagnosed AML who are not candidates for intensive induction chemotherapy.

Regional market overview and growth insights

North America held the largest market share in the Hematologic Malignancies market in 2024. The market is being driven by rising incidence and prevalence of hematologic cancers and advancements in targeted and immunotherapies. The American Cancer Society estimates that in 2025, multiple myeloma will account for about 36,110 new cases in the United States (20,030 in men and 16,080 in women), with roughly 12,030 projected deaths (6,540 in men and 5,490 in women). In April 2025, Amneal Pharmaceuticals, Inc., a global biopharmaceutical company, together with Shilpa Medicare Limited, announced the U.S. launch of BORUZU, an innovative bortezomib formulation designed for ready-to-use subcutaneous or intravenous (IV) administration.

Competitive Landscape and Key Competitors

The Hematologic Malignancies market is characterized by a fragmented structure, with many competitors holding a significant share of the market. list of major players included in the Hematologic Malignancies market report are:

o Pfizer Inc

o F. Hoffmann-LA Roche Ltd

o Sanofi SA

o AbbVie Inc.

o Takeda Pharmaceutical Company

o Novartis AG

o Johnson & Johnson Services, Inc

o Bristol-Myers Squibb Company

o GlaxoSmithKline PLC

o Amgen Inc.

o Regeneron Pharmaceuticals Inc.

o Gilead Sciences, Inc.

o Merck & Co., Inc.

o Astrazeneca

o Incyte

Major strategic developments by leading competitors

Glenmark Pharmaceuticals: In May 2025, Glenmark Pharmaceuticals launched Zanubrutinib, a cancer treatment, in India under the brand name 'Brukinsa' after gaining permission from the Drugs Controller General of India (DCGI). The medicine is expected to significantly improve the treatment of certain blood malignancies. These include CLL/SLL, WM, MCL, MZL, and FL.

Kura Oncology, Inc.: In November 2024, Kura Oncology, Inc. and Kyowa Kirin Co., Ltd. announced a global strategic collaboration to develop and commercialize ziftomenib, Kura's selective oral menin inhibitor, which is being studied for the treatment of acute myeloid leukemia (AML) and other hematologic malignancies. Kura will receive an upfront payment of USD 330 million and expects to receive up to USD 420 million in near-term milestone payments, including one upon the introduction of ziftomenib in the monotherapy relapsed/refractory (R/R) context.

Navistrat Analytics has segmented the Hematologic Malignancies market based on type, diagnosis, treatment type, route of administration, and end-use, and region:

• Type Outlook (Revenue, USD Billion; 2022-2032)

o Leukemia

o Lymphoma

o Myeloma

o Others

• Diagnosis Outlook (Revenue, USD Billion; 2022-2032)

o Blood Tests

o Biopsy

o Imaging Tests

• Treatment Type Outlook (Revenue, USD Billion; 2022-2032)

o Chemotherapy

o Radiotherapy

o Stem Cell Transplantation

o Immunotherapy

• Route of Administration Outlook (Revenue, USD Billion; 2022-2032)

o Oral

o Parenteral

o Others

• End-Use Outlook (Revenue, USD Billion; 2022-2032)

o Hospitals and Clinics

o Ambulatory Surgical Centers

o Cancer Centers

o Pharmaceutical and Biotech Companies

o Others

• Regional Outlook (Revenue, USD Billion; 2022-2032)

o North America

a. U.S.

b. Canada

c. Mexico

o Europe

a. Germany

b. France

c. U.K.

d. Italy

e. Spain

f. Benelux

g. Nordic Countries

h. Rest of Europe

o Asia Pacific

a. China

b. India

c. Japan

d. South Korea

e. Oceania

f. ASEAN Countries

g. Rest of APAC

o Latin America

a. Brazil

b. Rest of LATAM

o Middle East & Africa

a. GCC Countries

b. South Africa

c. Israel

d. Turkey

e. Rest of MEA

@Navistrat Analytics

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- United States Lubricants Market Growth Opportunities & Share Dynamics 20252033

- UK Digital Health Market To Reach USD 37.6 Billion By 2033

- Immigration Consultancy Business Plan 2025: What You Need To Get Started

- United States Animal Health Market Size, Industry Trends, Share, Growth And Report 2025-2033

- Latin America Mobile Payment Market To Hit USD 1,688.0 Billion By 2033

- United States Jewelry Market Forecast On Growth & Demand Drivers 20252033

Comments

No comment