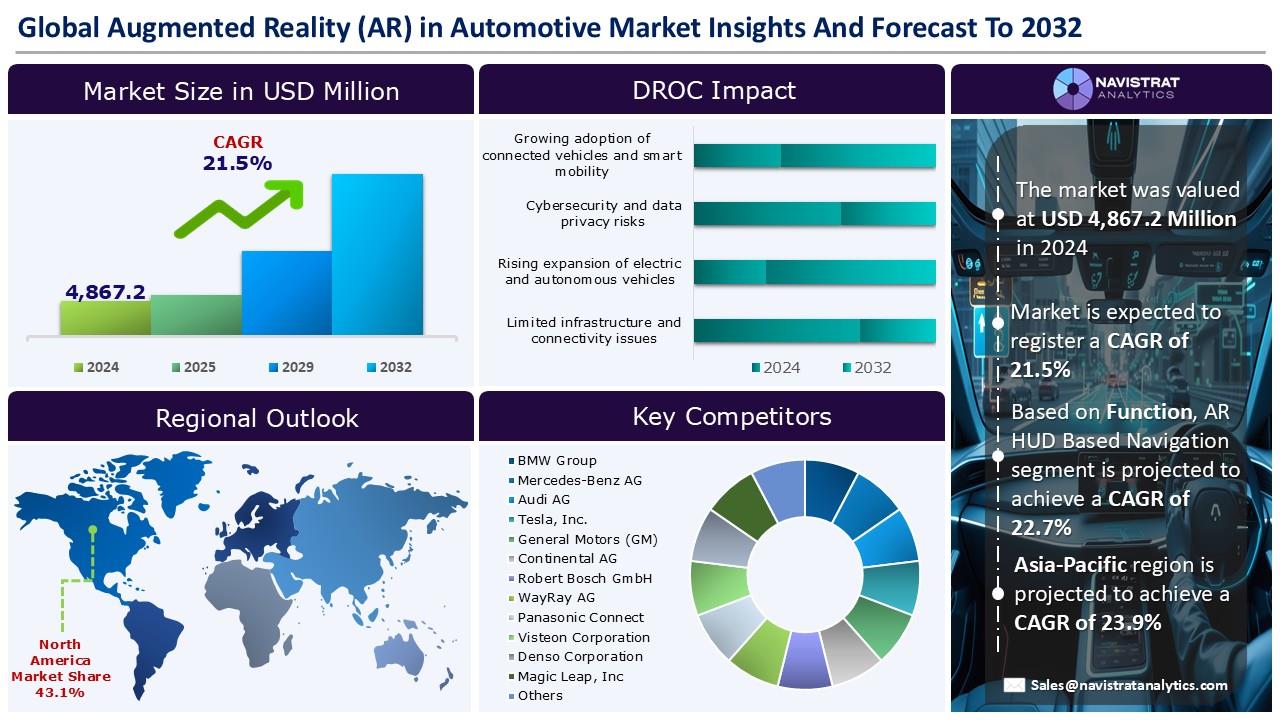

Augmented Reality (AR) in Automotive Market Size to Reach USD 22,171.3 Million in 2032

(MENAFN- Navistrat Analytics) April 22, 2025 - The growing consumer demand for advanced in-vehicle experience is a primary driver for the revenue growth of Augmented Reality (AR) in automotive market. Today’s tech-savvy consumers seek seamless, immersive, and interactive driving environments, compelling automakers to adopt AR-enabled technologies such as Head-Up Displays (HUDs), next-generation infotainment systems, and AI-powered navigation tools. AR solutions enhance situational awareness by projecting real-time information in the windshield, including speed, navigation, and hazard alerts. It reduces driver distraction and improves overall road safety.

The rising demand for AR in automotive prompted manufacturers to introduce advanced products in the market. In September 2024, for instance, Mojo Vision, known for its ‘Mojo Lens’ AR smart contact lens, announced a strategic partnership with CY Vision, a leading provider of advanced HUD technology, underscoring the industry's momentum toward integrated AR solutions. The two companies aim to develop Head-Up Displays (HUDs) leveraging micro-LED technology to seamlessly incorporate augmented reality into automotive systems.

However, cybersecurity and data privacy concerns are significant factors limiting the revenue growth of the automotive AR market. AR-integrated technologies such as Head-Up Displays (HUDs), infotainment platforms, and Advanced Driver Assistance Systems (ADAS) depend heavily on real-time data, including vehicle diagnostics, GPS tracking, and driver behavior insights. This extensive data usage increases the risk of cyberattacks, data breaches, and unauthorized access, potentially compromising driver safety and personal information. Furthermore, rising consumer apprehension around data privacy and digital surveillance is dampening demand for AR-enabled vehicles, thereby impeding overall market expansion.

Segments Market Overview and Growth Insights:

Based on the function, the Augmented Reality (AR) in automotive market is segmented into standard AR HUD, AR HUD based navigation, AR HUD based adaptive cruise control, and AR HUD based lane departure warning.

The standard AR HUD segment accounted for the largest market share in 2024, driven by rising consumer demand for improved driving experiences, increased adoption of advanced driver assistance systems (ADAS), and the expanding incorporation of AR technology in mid-range and premium vehicle models. Moreover, collaborations between automotive OEMs and technology providers are accelerating the development and adoption of Standard AR HUDs, making them increasingly accessible across various vehicle segments. For example, in January 2025, Appotronics, a leading player in the laser display industry, entered into a strategic partnership with Ceres Holographics, a key innovator in holographic-enabled transparent display technologies.

Regional Market Overview And Growth Insights:

North America dominated the market in terms of revenue share in 2024, driven by a robust automotive sector, strong consumer demand for Advanced Driver Assistance Systems (ADAS), and the rapid uptake of connected and autonomous vehicles, particularly in the U.S. and Canada.

In July 2024, Alphabet, the parent company of Waymo, announced plans to invest up to USD 5 billion in the startup, which also unveiled the sixth generation of its Waymo Driver autonomous system. Waymo currently operates a fleet of nearly 800 autonomous vehicles in California, in addition to its presence in Phoenix, U.S. Such investments in autonomous vehicle technologies are substantially contributing to market revenue growth in the region, as self-driving vehicles depend extensively on advanced sensor fusion, real-time data processing, and AI-powered navigation systems.

Competitive Landscape and Key Competitors:

The Augmented Reality (AR) in Automotive market is characterized by a fragmented structure, with many competitors holding a significant share of the market. List of major players included in the market report are:

o BMW Group

o Mercedes-Benz AG

o Audi AG

o Tesla, Inc.

o General Motors (GM)

o Continental AG

o Robert Bosch GmbH

o WayRay AG

o Panasonic Connect

o Visteon Corporation

o Denso Corporation

o Magic Leap, Inc

Major Strategic Developments By Leading Competitors:

Magic Leap: On July 31, 2023, Magic Leap integrated its next-generation device, the Magic Leap 2, into the Mercedes-Benz Vision One-Eleven Concept Car (C111). This state-of-the-art electric vehicle (EV) incorporates Augmented Reality (AR) digital overlays delivered through the Magic Leap 2 to elevate the driving experience. Departing from conventional augmented dashboards, Magic Leap’s approach utilizes immersive AR goggles. With a wide Field of View (FoV), the head-mounted display (HMD) offers drivers an array of advanced features and enhanced functionality.

BMW Group: On May 17, 2023, Meta and BMW announced a major milestone in their collaborative vehicle-based Virtual Reality (VR) initiative. Building on a partnership that began in 2021, the two companies shared progress on integrating Augmented Reality (AR) and VR technologies into smart vehicles. As part of this effort, Meta worked with BMW to incorporate real-time Inertial Measurement Unit (IMU) data from the vehicle’s sensor suite into Meta’s Project Aria research glasses. This integration allows the system to precisely track the glasses’ position relative to the car, significantly enhancing the potential for immersive AR/VR applications within the automotive environment.

Navistrat Analytics has segmented global Augmented Reality (AR) in automotive market on the basis of function, technology, level of driving, vehicle type, propulsion, application, end-use and region:

• Function (Revenue, USD Million; 2022-2032)

o Standard AR HUD

o AR HUD Based Navigation

o AR HUD Based Adaptive Cruise Control

o AR HUD Based Lane Departure Warning

• Technology Outlook (Revenue, USD Million; 2022-2032)

o Sensor Technology

a. Radar

b. LiDAR

c. Image Sensor

d. Sensor Fusion

e. Others

o Display Technology

a. TFT-LCD

b. OLED

c. MicroLED

d. Others

• Level of Driving Outlook (Revenue, USD Million; 2022-2032)

o Non-Autonomous

o Autonomous

• Vehicle Type (Revenue, USD Million; 2022-2032)

o Passenger Vehicles

o Commercial Vehicles

• Propulsion Outlook (Revenue, USD Million; 2022-2032)

o Battery Electric Vehicle

o Hybrid

• Application Outlook (Revenue, USD Million; 2022-2032)

o In-Vehicle AR Systems

a. AR Projection

b. AR Navigation

c. AR-Based Digital Cockpit

d. Others

o External AR Applications

a. AR Car Repair Assistance

b. New Product Design & Prototyping

c. Vehicle Assembly Optimization

d. AR for Virtual Car Showroom

o Others

• Regional Outlook (Revenue, USD Million; 2022-2032)

o North America

a. U.S.

b. Canada

c. Mexico

o Europe

a. Germany

b. France

c. U.K.

d. Italy

e. Spain

f. Benelux

g. Nordic Countries

h. Rest of Europe

o Asia Pacific

a. China

b. India

c. Japan

d. South Korea

e. Oceania

f. ASEAN Countries

g. Rest of APAC

o Latin America

a. Brazil

b. Rest of LATAM

o Middle East & Africa

a. GCC Countries

b. South Africa

c. Israel

d. Turkey

e. Rest of MEA

Get a preview of the complete research study on our website.

© 2025 Navistrat Analytics.

The rising demand for AR in automotive prompted manufacturers to introduce advanced products in the market. In September 2024, for instance, Mojo Vision, known for its ‘Mojo Lens’ AR smart contact lens, announced a strategic partnership with CY Vision, a leading provider of advanced HUD technology, underscoring the industry's momentum toward integrated AR solutions. The two companies aim to develop Head-Up Displays (HUDs) leveraging micro-LED technology to seamlessly incorporate augmented reality into automotive systems.

However, cybersecurity and data privacy concerns are significant factors limiting the revenue growth of the automotive AR market. AR-integrated technologies such as Head-Up Displays (HUDs), infotainment platforms, and Advanced Driver Assistance Systems (ADAS) depend heavily on real-time data, including vehicle diagnostics, GPS tracking, and driver behavior insights. This extensive data usage increases the risk of cyberattacks, data breaches, and unauthorized access, potentially compromising driver safety and personal information. Furthermore, rising consumer apprehension around data privacy and digital surveillance is dampening demand for AR-enabled vehicles, thereby impeding overall market expansion.

Segments Market Overview and Growth Insights:

Based on the function, the Augmented Reality (AR) in automotive market is segmented into standard AR HUD, AR HUD based navigation, AR HUD based adaptive cruise control, and AR HUD based lane departure warning.

The standard AR HUD segment accounted for the largest market share in 2024, driven by rising consumer demand for improved driving experiences, increased adoption of advanced driver assistance systems (ADAS), and the expanding incorporation of AR technology in mid-range and premium vehicle models. Moreover, collaborations between automotive OEMs and technology providers are accelerating the development and adoption of Standard AR HUDs, making them increasingly accessible across various vehicle segments. For example, in January 2025, Appotronics, a leading player in the laser display industry, entered into a strategic partnership with Ceres Holographics, a key innovator in holographic-enabled transparent display technologies.

Regional Market Overview And Growth Insights:

North America dominated the market in terms of revenue share in 2024, driven by a robust automotive sector, strong consumer demand for Advanced Driver Assistance Systems (ADAS), and the rapid uptake of connected and autonomous vehicles, particularly in the U.S. and Canada.

In July 2024, Alphabet, the parent company of Waymo, announced plans to invest up to USD 5 billion in the startup, which also unveiled the sixth generation of its Waymo Driver autonomous system. Waymo currently operates a fleet of nearly 800 autonomous vehicles in California, in addition to its presence in Phoenix, U.S. Such investments in autonomous vehicle technologies are substantially contributing to market revenue growth in the region, as self-driving vehicles depend extensively on advanced sensor fusion, real-time data processing, and AI-powered navigation systems.

Competitive Landscape and Key Competitors:

The Augmented Reality (AR) in Automotive market is characterized by a fragmented structure, with many competitors holding a significant share of the market. List of major players included in the market report are:

o BMW Group

o Mercedes-Benz AG

o Audi AG

o Tesla, Inc.

o General Motors (GM)

o Continental AG

o Robert Bosch GmbH

o WayRay AG

o Panasonic Connect

o Visteon Corporation

o Denso Corporation

o Magic Leap, Inc

Major Strategic Developments By Leading Competitors:

Magic Leap: On July 31, 2023, Magic Leap integrated its next-generation device, the Magic Leap 2, into the Mercedes-Benz Vision One-Eleven Concept Car (C111). This state-of-the-art electric vehicle (EV) incorporates Augmented Reality (AR) digital overlays delivered through the Magic Leap 2 to elevate the driving experience. Departing from conventional augmented dashboards, Magic Leap’s approach utilizes immersive AR goggles. With a wide Field of View (FoV), the head-mounted display (HMD) offers drivers an array of advanced features and enhanced functionality.

BMW Group: On May 17, 2023, Meta and BMW announced a major milestone in their collaborative vehicle-based Virtual Reality (VR) initiative. Building on a partnership that began in 2021, the two companies shared progress on integrating Augmented Reality (AR) and VR technologies into smart vehicles. As part of this effort, Meta worked with BMW to incorporate real-time Inertial Measurement Unit (IMU) data from the vehicle’s sensor suite into Meta’s Project Aria research glasses. This integration allows the system to precisely track the glasses’ position relative to the car, significantly enhancing the potential for immersive AR/VR applications within the automotive environment.

Navistrat Analytics has segmented global Augmented Reality (AR) in automotive market on the basis of function, technology, level of driving, vehicle type, propulsion, application, end-use and region:

• Function (Revenue, USD Million; 2022-2032)

o Standard AR HUD

o AR HUD Based Navigation

o AR HUD Based Adaptive Cruise Control

o AR HUD Based Lane Departure Warning

• Technology Outlook (Revenue, USD Million; 2022-2032)

o Sensor Technology

a. Radar

b. LiDAR

c. Image Sensor

d. Sensor Fusion

e. Others

o Display Technology

a. TFT-LCD

b. OLED

c. MicroLED

d. Others

• Level of Driving Outlook (Revenue, USD Million; 2022-2032)

o Non-Autonomous

o Autonomous

• Vehicle Type (Revenue, USD Million; 2022-2032)

o Passenger Vehicles

o Commercial Vehicles

• Propulsion Outlook (Revenue, USD Million; 2022-2032)

o Battery Electric Vehicle

o Hybrid

• Application Outlook (Revenue, USD Million; 2022-2032)

o In-Vehicle AR Systems

a. AR Projection

b. AR Navigation

c. AR-Based Digital Cockpit

d. Others

o External AR Applications

a. AR Car Repair Assistance

b. New Product Design & Prototyping

c. Vehicle Assembly Optimization

d. AR for Virtual Car Showroom

o Others

• Regional Outlook (Revenue, USD Million; 2022-2032)

o North America

a. U.S.

b. Canada

c. Mexico

o Europe

a. Germany

b. France

c. U.K.

d. Italy

e. Spain

f. Benelux

g. Nordic Countries

h. Rest of Europe

o Asia Pacific

a. China

b. India

c. Japan

d. South Korea

e. Oceania

f. ASEAN Countries

g. Rest of APAC

o Latin America

a. Brazil

b. Rest of LATAM

o Middle East & Africa

a. GCC Countries

b. South Africa

c. Israel

d. Turkey

e. Rest of MEA

Get a preview of the complete research study on our website.

© 2025 Navistrat Analytics.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- United States Lubricants Market Growth Opportunities & Share Dynamics 20252033

- UK Digital Health Market To Reach USD 37.6 Billion By 2033

- Immigration Consultancy Business Plan 2025: What You Need To Get Started

- United States Animal Health Market Size, Industry Trends, Share, Growth And Report 2025-2033

- Latin America Mobile Payment Market To Hit USD 1,688.0 Billion By 2033

- United States Jewelry Market Forecast On Growth & Demand Drivers 20252033

Comments

No comment