More On The Draft Of Poland's 2026 Budget High Deficit But Lower Net Borrowing Needs

The Ministry of Finance is providing more clarity when it comes to the 2026 budget draft (see our first comment from Thursday ).

We know from Thursday's press conference that the general government deficit in 2026 should amount to 6.5% of GDP, mainly as a result of a higher-than-initially expected fiscal gap in 2025 that is currently seen at 6.9% of GDP vs 6.3% of GDP expected earlier.

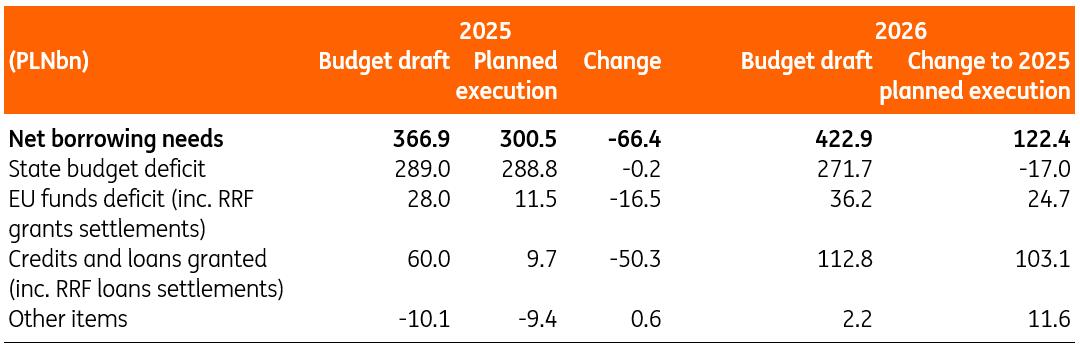

The state budget deficit for 2026 (in cash terms) should shrink to PLN272 billion vs a very high PLN289bn in 2025.

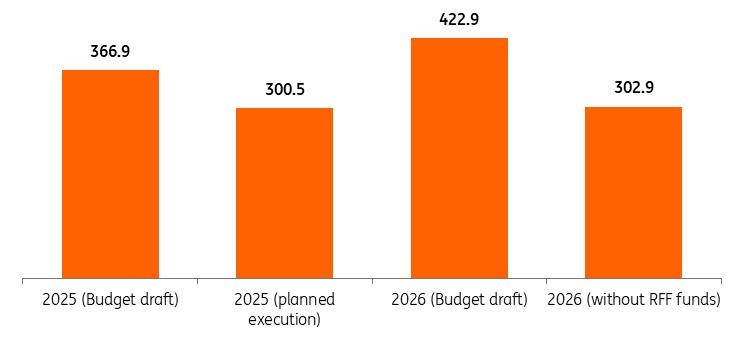

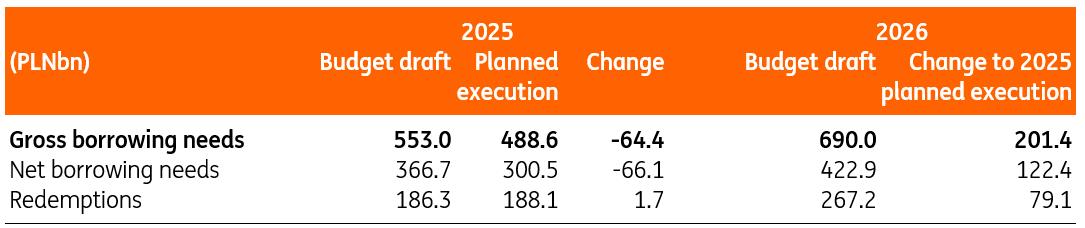

Headline net borrowing needs in 2026 surprised on the high side, but...In yesterday's communication, the Ministry of Finance surprised with high estimates of 2026 net borrowing needs at PLN423bn, up significantly from PLN301bn expected for 2025, though less than the PLN367bn projected in the 2025 budget bill. However, in an interview with Bloomberg, Minister Domanski clarified that the net borrowing needs, excluding the EU's recovery fund component, are to remain at a very similar level in 2026 as in 2025, i.e., around PLN300bn.

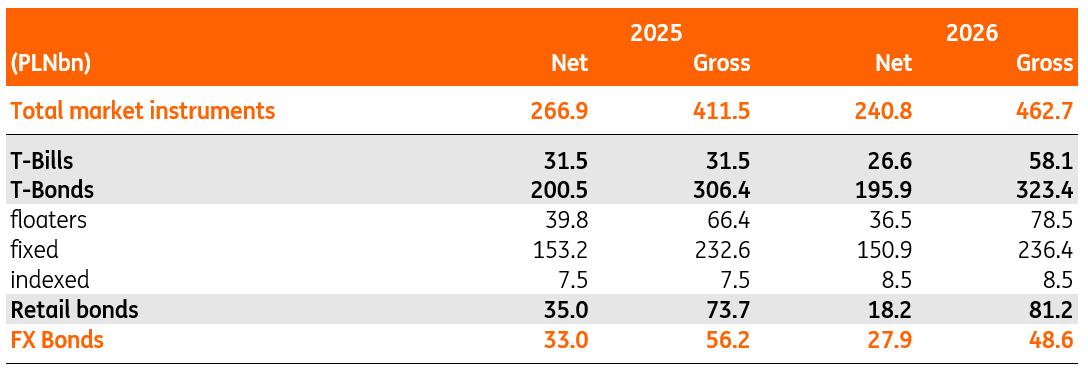

Also, the funding plan for the 2026 budget posted later on Friday confirms that net supply of T-Bonds and T-Bills in 2026 should reach PLN240.8bn vs PLN265bn in 2025 (planned execution) and PLN246bn in 2025 (original plan posted in August 2024). The net supply of FX Bonds in 2026 should be lower, ie, PLN28bn vs PLN33bn in 2025 (planned execution) and PLN42.9bn in 2025 (original plan posted in August 2024).

This message is supportive for Polish government bonds, as the amounts to be financed on the market are to be similar in 2026 as in 2025, while the current year's borrowing needs were also revised lower.

The net borrowing needs adjusted for RFF funds stays flat between 2025 and 2026The net borrowing needs (PLNbn)

Source: Ministry of Finance The gross and net borrowing needs

Source: Ministry of Finance The backdrop of net borrowing needs

Source: Ministry of Finance The supply of T-Bills, T-Bonds and FX Bonds in 2025 and 2026

Source: Ministry of Finance Headline net borrowing needs reflects the backloading of RFF funds

By definition, the net borrowing needs' - as key components - include: the central budget deficit, the budget of EU-related funds (EU cohesion funds and Recovery and Resilience Facility (RRF) grants), and the balance of credits and loans granted. The latter includes RRF loans from the EU, from which the Ministry of Finance is lending to local government or various public funds.

Compared to mid-2024 projections, Poland is currently heading for EU RRF's funds accumulation in 2026, after the recent RRF revision. According to our projections, in 2025 Poland should receive PLN29bn from the EU in grants and loans, compared to PLN64bn projected in mid-2024. The amount of around PLN35bn was moved from 2025 to 2026. Now Poland is to absorb nearly 60% of the total RRF funds in 2026. This shift lowers the projected net borrowing needs for 2025, but inflates them in 2026.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- United States Lubricants Market Growth Opportunities & Share Dynamics 20252033

- UK Digital Health Market To Reach USD 37.6 Billion By 2033

- Immigration Consultancy Business Plan 2025: What You Need To Get Started

- United States Animal Health Market Size, Industry Trends, Share, Growth And Report 2025-2033

- Latin America Mobile Payment Market To Hit USD 1,688.0 Billion By 2033

- United States Jewelry Market Forecast On Growth & Demand Drivers 20252033

Comments

No comment