France's Fiscal Crisis Puts Europe On The Brink Of Eurobonds

France, the eurozone's second-largest economy, is heading into stormy waters. Public debt has swollen to 114% of GDP and last year's budget deficit reached 5.8% , nearly double the EU's ceiling.

Prime Minister François Bayrou faces a high-stakes budget confidence vote in early September. Failure could trigger snap elections or rule by decree - scenarios that unsettle investors.

Why This Time Is Different France is too big to fail. A loss of confidence in Paris would not be contained: it would reverberate across Italy, Spain and the wider euro area, raising existential questions for the currency union. Unlike the UK, whose challenges play out in sterling markets, France's fate is inseparable from the euro system. If Paris falters, the European Central Bank (ECB) , the European Commission and member states will be drawn in. Germany's Dilemma Germany - the bloc's traditional paymaster - is less dominant than a decade ago. Public debt now exceeds 66% of GDP and Berlin has relaxed the debt brake to fund a sweeping modernization drive. What began as a €100 billion special defense fund in 2022 has expanded into a €500 billion+ rearmament and infrastructure trajectory, with total commitments widely estimated at ~€1 trillion over the next decade . That transformation strains Germany's finances even as it strengthens its security posture. The Eurobond Option One long-taboo solution is back on the table: Eurobonds . By issuing joint EU debt, member states could mutualize borrowing costs and create a common safe asset. Brussels and high-debt capitals argue this would stabilize markets and strengthen the euro; northern states worry about moral hazard. During the pandemic, the EU trialed common borrowing via the €800 billion NextGenerationEU fund. A French crisis could force a reprise at larger scale.

Integration by Crisis - Promise and Peril Supporters say Eurobonds could deepen markets and enhance the euro's international role. Critics warn of moral hazard and loss of sovereignty as budget oversight shifts toward Brussels. The political risk is real: creditor states fear open-ended liabilities; debtor states bridle at externally imposed rules. Managing that trade-off will determine whether a rescue consolidates the Union or fuels backlash.

A Defining Choice Ahead Europe faces a binary decision. The question is not whether to stabilize France, but how. If Eurobonds are launched to prevent contagion, the eurozone would cross a historic threshold toward fiscal union. Whether that cements unity or ignites new divisions will shape the European project for years to come. Europe's Fiscal Flashpoints - At a Glance

-

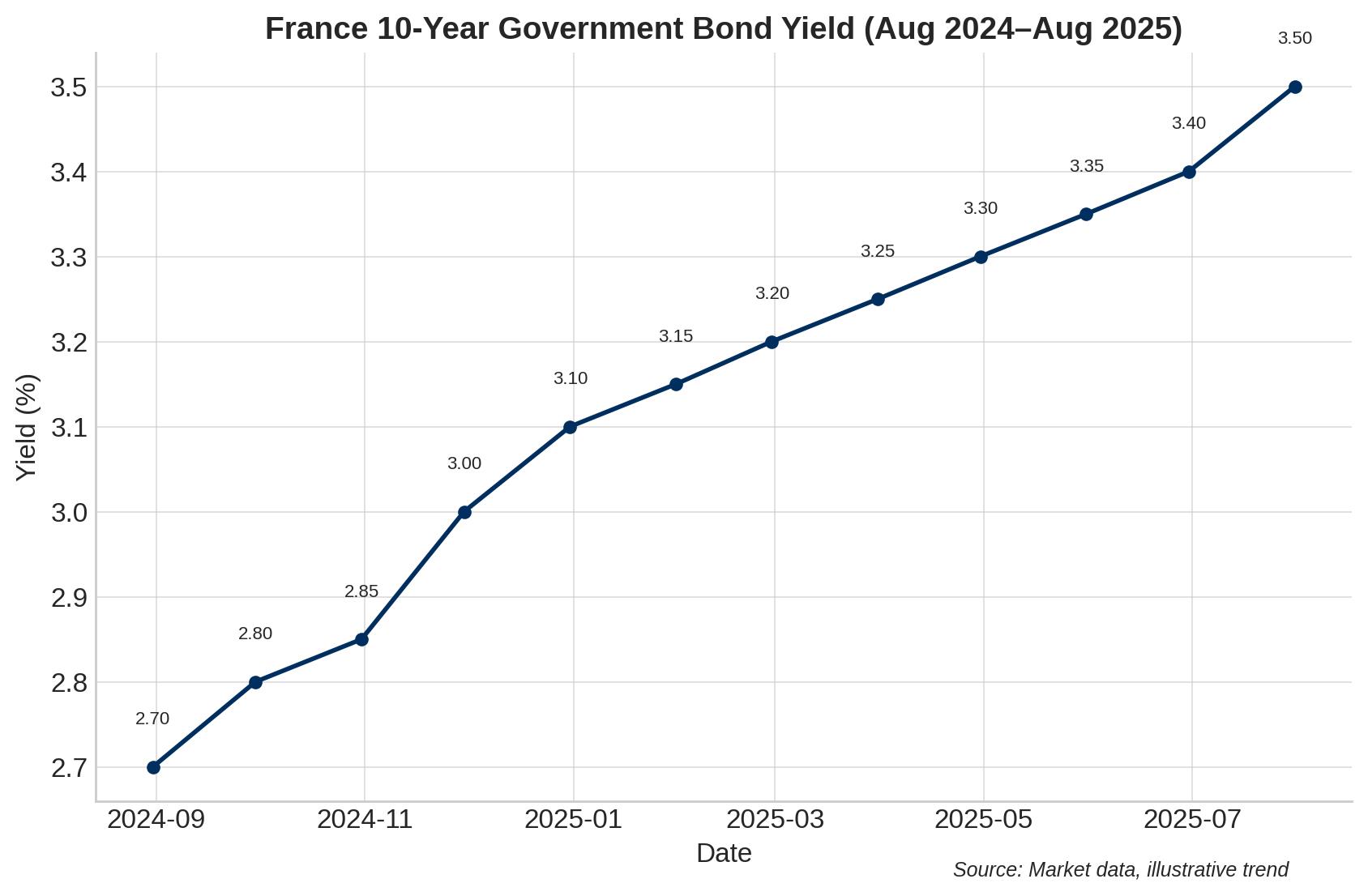

France: Debt 114% of GDP; deficit 5.8%; 10-year yield ≈ 3.5%; budget confidence vote due early September.

Germany: Debt 66% of GDP; debt brake relaxed; €500bn+ package approved; total decade commitments ≈ €1tn.

Italy: Debt 137% of GDP; growth weak; vulnerable to contagion.

United Kingdom (non-euro): Debt ≈ 100% of GDP; fiscal pressures rising.

-

Joint EU debt long resisted by“frugal” states.

Precedent: €800bn NextGenerationEU (2020).

Deployed at scale, they imply deeper fiscal union.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- United States Lubricants Market Growth Opportunities & Share Dynamics 20252033

- UK Digital Health Market To Reach USD 37.6 Billion By 2033

- Immigration Consultancy Business Plan 2025: What You Need To Get Started

- United States Animal Health Market Size, Industry Trends, Share, Growth And Report 2025-2033

- Latin America Mobile Payment Market To Hit USD 1,688.0 Billion By 2033

- United States Jewelry Market Forecast On Growth & Demand Drivers 20252033

Comments

No comment