Unemployment Remains A Bright Spot For Hungary

| 4.3% |

Unemployment rate (May-July)

Previous 4.5% |

The latest labour market statistics from the Hungarian Central Statistical Office (HCSO) painted a more favourable picture than the market consensus in July 2025. The model estimate indicates that the unemployment rate has stagnated at 4.3% for three consecutive months. Meanwhile, the official three-month moving average survey shows a 0.2ppt decline to 4.3% for the May-July period. This is consistent with the stagnant trend observed since the fourth quarter of 2024. Based on these statistics, the number of those unemployed sits slightly above 210,000.

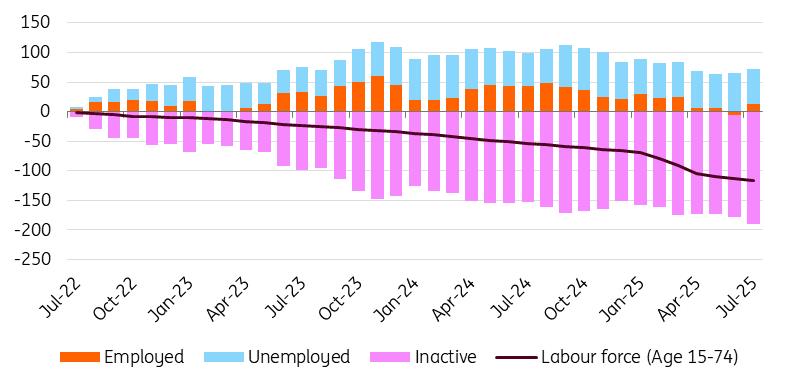

Examining the details, the monthly data shows that the decline in the working-age population persisted. However, the number of inactive people fell significantly (by nearly 36,000 on a monthly basis), which was reflected in an increase in the number of labour market participants. The 32,500 increase in employment from June to July suggests that inactive participants entered the labour market primarily for seasonal work. The unemployment number decreased minimally, and the main question now is whether the slow decline in employment seen previously will return with the end of seasonal jobs or if we'll see a plateau.

Changes in the labour market since mid-2022 ('000, 3-m moving avg)

Source: HCSO, ING

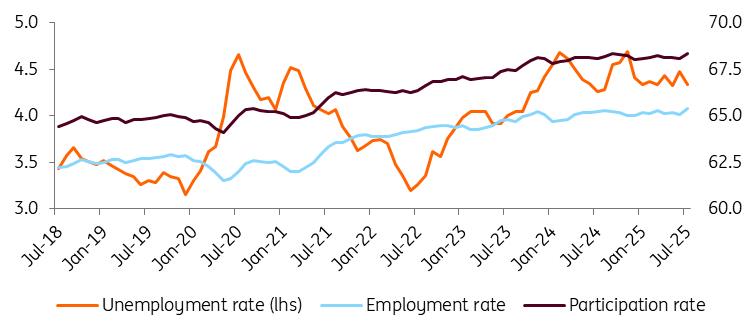

In July, both demand and supply expanded hand in hand, and in turn, the unemployment rate remained stable despite the rise in participation and employment rates. In recent months, these rates have remained essentially unchanged; it seems that this pattern is now also shifting.

Based on three-month averages, both the participation rate and the employment rate have peaked. The former is at its highest level since summer 2024, and the latter is at an all-time high. Of course, seasonal effects continue to significantly impact these indicators.

In any case, after a long time, we can finally report some meaningful, positive developments. The labour market therefore remains tight, which puts companies in an extremely difficult position as they try to manage increasing wage costs in an economy that has been stagnating for three years. Strong wage growth is expected to stay with us into next year as well.

Historical trends in the Hungarian labour market (%)

Source: HCSO, ING

We do not anticipate any significant changes to the supply side of the labour market moving forward. No demographic shifts are expected; rising labour costs and the lack of economic performance could further reduce labour market demand.

In our view, the planned 13% increase in the minimum wage next year will strengthen employees' bargaining position, although the generally weak economy will soften it. These factors could generate significant tensions in the labour market. If the economic situation does not improve, it is increasingly likely that companies will try to maintain total wage levels by raising wages as expected, reducing the number of employees to cut costs, and raising consumer prices. We are not revising our labour market forecast considering the latest data. The forecast suggests that the unemployment rate will remain around 4.5% for the rest of the year, though risks point to further labour market weakening.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- United States Lubricants Market Growth Opportunities & Share Dynamics 20252033

- UK Digital Health Market To Reach USD 37.6 Billion By 2033

- Immigration Consultancy Business Plan 2025: What You Need To Get Started

- United States Animal Health Market Size, Industry Trends, Share, Growth And Report 2025-2033

- Latin America Mobile Payment Market To Hit USD 1,688.0 Billion By 2033

- United States Jewelry Market Forecast On Growth & Demand Drivers 20252033

Comments

No comment