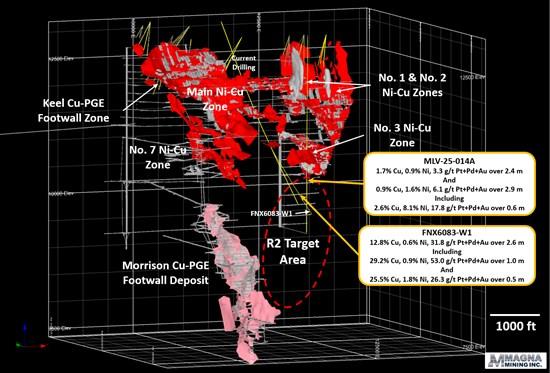

Magna Mining Intersects 29.2% Cu, 0.9% Ni, 53.0 G/T Pt + Pd + Au Over 1.0 Metre, 140 Metres Downdip Of Previous Intersection Below The No. 3 Zone At The Levack Mine In Sudbury, Ontario

| Drillhole | Property | Zone | | From (m) | To (m) | Length (m) | Cu % | Ni % | Co % | Pt g/t | Pd g/t | Au g/t | TPM g/t | NiEq | CuEq |

| FNX6083-W1 | Levack | R2 Target | | 991.85 | 992.22 | 0.37 | 16.68 | 0.07 | 0.00 | 1.33 | 2.44 | 0.09 | 3.86 | 9.57 | 17.03 |

| | | | and | 1005.48 | 1005.78 | 0.30 | 13.75 | 0.49 | 0.00 | 3.29 | 13.72 | 1.56 | 18.57 | 10.67 | 18.99 |

| | | | and | 1048.48 | 1048.84 | 0.36 | 2.87 | 0.05 | 0.00 | 7.98 | 5.64 | 0.81 | 14.43 | 3.73 | 6.65 |

| | | | and | 1050.70 | 1051.15 | 0.45 | 3.24 | 0.10 | 0.00 | 0.70 | 1.93 | 0.54 | 3.17 | 2.36 | 4.19 |

| | | | and | 1056.41 | 1056.71 | 0.30 | 6.58 | 0.68 | 0.01 | 7.03 | 8.18 | 1.31 | 16.52 | 6.65 | 11.83 |

| | | | and | 1152.23 | 1154.83 | 2.60 | 12.77 | 0.55 | 0.01 | 3.39 | 7.79 | 20.67 | 31.85 | 15.06 | 26.81 |

| | | | Including | 1153.16 | 1154.16 | 1.00 | 29.21 | 0.92 | 0.02 | 7.26 | 15.84 | 29.87 | 52.97 | 28.62 | 50.96 |

| | | | and | 1196.60 | 1197.14 | 0.54 | 25.53 | 1.80 | 0.03 | 10.40 | 12.08 | 3.80 | 26.28 | 19.54 | 34.79 |

Important Notes

All lengths are downhole length. True widths are uncertain at this time.

Ni Eq % = (Ni% x 85% Recovery 2204 x Ni Price $/lb) + (Cu% x 96% Recovery x 2204 x Cu Price $/lb) + (Co% x 56% Recovery x 2204 x Co Price $/lb) + (Pt gpt x 69% Recovery / 31.1035 x Pt $/oz) +(Pd gpt x 68% Recovery / 31.1035 x Pd $/oz) + (Au gpt x 68% Recovery / 31.1035 x Au $/oz))/2204 x Ni $/lb.

Cu Eq % = (Ni% x 85% Recovery 2204 x Ni Price $/lb) + (Cu% x 96% Recovery x 2204 x Cu Price $/lb) + (Co% x 56% Recovery x 2204 x Co Price $/lb) + (Pt gpt x 69% Recovery / 31.1035 x Pt $/oz) +(Pd gpt x 68% Recovery / 31.1035 x Pd $/oz) + (Au gpt x 68% Recovery / 31.1035 x Au $/oz))/2204 x Cui $/lb.

Metal prices in US$: $7.30/lb Ni, $4.10/lb Cu, $15.00/lb Co, $1,000/oz Pt, $1,050/oz Pd and $2,200/oz Au.

Table 2: Drillhole Collar Coordinates

| BHID | Easting | Northing | Elevation | Azimuth | Dip | Depth (m) |

| FNX6083-W1 | 471667 | 5167000 | 398 | 116 | 63 | 1263 |

*Drillhole Coordinates are in Coordinate System NAD 83 Zone 17

Qualified Person for Technical Information

The scientific and technical information in this press release has been reviewed and approved by David King, M.Sc., P.Geo. Mr. King is the Senior Vice President, Exploration and Geoscience for Magna Mining Inc. and is a qualified person under National Instrument 43-101.

Quality Assurance and Control

Sample QA/QC procedures for Magna have been designed to meet or exceed industry standards. Drill core is collected from the diamond drill and placed in sealed core trays for transport to Magna's core facilities. Levack drilling utilizes NQ sized core and McCreedy West utilizes BQTK sized core. The core is then logged, and samples marked in intervals of up to 1.5m. Levack drill core is split and sampled 1⁄2 core, and McCreedy West is whole core sampled. Samples are then put into plastic bags with 10 bagged samples being placed into rice bags for transport to SGS Laboratories in Garson, Ontario for preparation, which are then shipped to Lakefield, Ontario for analysis. Samples are submitted in batches of 50 with 4 QA/QC samples including, 2 certified reference material standards and 2 samples of blank material.

Cautionary Statement on Forward-Looking Statements

All statements, other than statements of historical fact, contained or incorporated by reference in this press release constitute "forward-looking statements" and "forward-looking information" (collectively, "forward-looking statements") within the meaning of applicable securities laws. Generally, these forward-looking statements can be identified by the use of forward-looking terminology, such as "may", "might", "potential", "expect", "anticipate", "estimate", "believe", "could", "should", "would", "will", "continue", "intend", "plan", "forecast", "prospective", "significant" or other similar words or phrases or variations thereof. Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management, are inherently subject to business, market, economic, technical and other risks, uncertainties and contingencies that may cause actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements, including risks and uncertainties relating to the failure of additional drilling to support assumptions, expectations or estimates of potential mineralization or grade, additional expansion or delineation of estimated resources, production planning, the lack of availability of drill rigs to implement exploration programs or otherwise the failure to proceed as quickly as planned with additional exploration or other drilling, continued delays for assay results, the failure to proceed as quickly as planned with a restart of mining at the Levack Mine, assuming there will be any restart, and other risks disclosed in the Company's annual management discussion and analysis, available on the SEDAR+ website (at: ). Although the Company has attempted to identify important risks, uncertainties, contingencies and factors that could cause actual results to differ materially from those expressed or implied in forward-looking statements, there can be no certainty or assurance that the Company has accurately or adequately captured, accounted for or disclosed all such risks, uncertainties, contingencies or factors. Readers should place no reliance on forward-looking statements as actual results, performance or achievements may be materially different from those expressed or implied by such statements. Resource exploration and development, and mining operations, are highly speculative, characterized by several significant risks, which even a combination of careful evaluation, experience and knowledge will not eliminate. Forward-looking statements speak only as of the date they are made. The Company does not undertake to update any forward-looking statements, whether as a result of new information or future events or otherwise, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this press release.

About Magna Mining Inc.

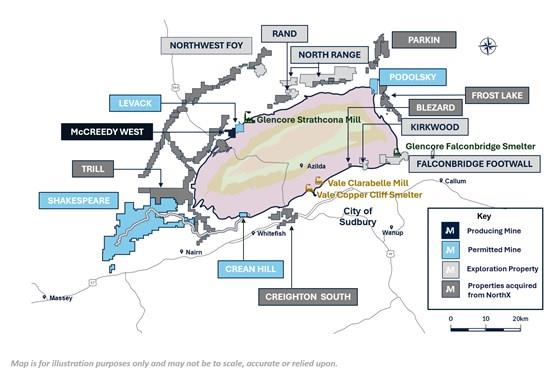

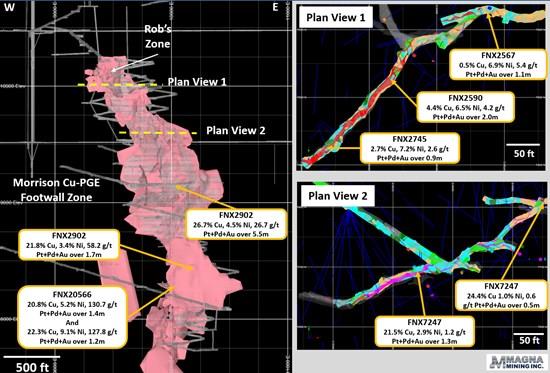

Magna Mining Inc. is a producing mining company with a strong portfolio of copper, nickel, and platinum group metals (PGM) assets located in the world-class Sudbury mining district of Ontario, Canada. The Company's primary asset is the McCreedy West Mine , currently in production, supported by a pipeline of highly prospective past-producing properties including Levack , Crean Hill , Podolsky , and Shakespeare .

Magna Mining is strategically positioned to unlock long-term shareholder value through continued production, exploration upside, and near-term development opportunities across its asset base.

Additional corporate and project information is available at and through the Company's public filings on the SEDAR+ website at .

For further information, please contact:

Jason Jessup

Chief Executive Officer

or

Paul Fowler, CFA

Executive Vice President

705-482-9667

Email: ...

To view the source version of this press release, please visit

SOURCE: Magna Mining Inc.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- United States Lubricants Market Growth Opportunities & Share Dynamics 20252033

- UK Digital Health Market To Reach USD 37.6 Billion By 2033

- Immigration Consultancy Business Plan 2025: What You Need To Get Started

- United States Animal Health Market Size, Industry Trends, Share, Growth And Report 2025-2033

- Latin America Mobile Payment Market To Hit USD 1,688.0 Billion By 2033

- United States Jewelry Market Forecast On Growth & Demand Drivers 20252033

Comments

No comment