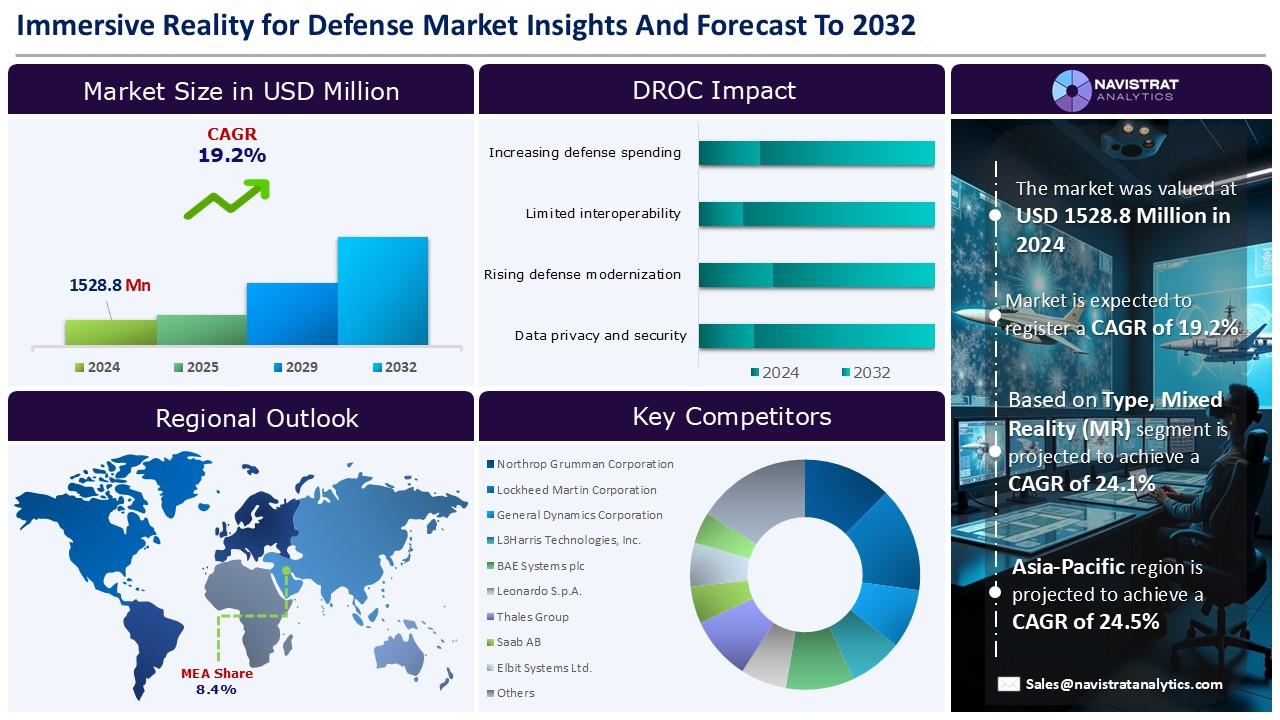

Immersive Reality for Defense Market is 1.53 billion in 2024 and is projected to register a CAGR of 19.2%

(MENAFN- Navistrat Analytics) 28th August 2025 – Rising geopolitical tensions and an increase in armed conflicts globally are projected to drive up demand for immersive reality solutions in military training. According to the Peace Research Institute, 2024 saw the largest number of state-based armed conflicts, with 61 reported across 36 nations.

These significant instances strengthen army training through establishing combat resilience targets, which encourages defense companies to use more modern and realistic training techniques. Immersive reality technologies including Virtual Reality (VR), Mixed Reality (MR), and Augmented Reality (AR), provide real-time, scenario-based warfare training.

Immersive reality simulates vehicles, battle settings, and operational scenarios to develop critical abilities in a controlled, realistic environment. The use of immersive reality in enhancing combat training, collaboration, and medical response is developing as a significant commercial trend. Virtual Reality (VR) allows soldiers to participate in activities that are difficult, costly, and dangerous to mimic in real life.

The widespread adoption of virtual prototyping and design is accelerating revenue growth. Traditionally, military manufacturers relied on physical prototypes, actual safety margins, and test-and-learn methods, which usually resulted in longer timelines, higher costs, and inefficiencies. Immersive reality enables product development engineers to test performance, manufacturing capability, safety, and operational efficiency throughout the early stages of development.

However, tariffs have a direct influence on the electronics and components supply chain, which is crucial for producing hardware such as head-mounted displays (HMDs), projectors and display walls (PDW), gesture tracking devices (GTD), semiconductors, and sensors.

The majority of these components are acquired overseas. Manufacturers cannot easily switch suppliers without causing significant problems.

Get Exclusive Report Insights Here:

Segment market overview and growth Insights:

The Mixed Reality (MR) segment is expected to register the fastest revenue growth of 24.1% by 2032. The rapid use of mixed reality (MR) in military training has contributed to the segment's expansion. Mixed Reality (MR) brings together data visualization, real-time communication, and combat awareness. This allows soldiers to see past barriers, follow targets, and better coordinate with their groups. The growing need for simulation-based training provides opportunities for new investments.

Hardware contributed a significant revenue share in 2024. In virtual reality environments, hardware devices provide continuous situational awareness, mission warm-up realism, and extended deployment cycles, enabling training objectives to coincide with evolving operational imperatives. Military financing and funding are pushing the need for AI-powered devices that are completely durable, scalable, and fidelity-rich. The MOD has awarded a contract to cXRAI Glass of Canada worth USD 13,268. In addition, on May 19, 2025, Rivet Industries began manufacturing of its new Hard Spec augmented reality (AR) glasses, which were particularly designed for defense applications.

Regional market overview and growth insights:

North America registered the highest market share in the immersive reality for the defense market. Key competitors have secured large contracts from defense departments to provide immersive reality systems that combine spatial computing, artificial intelligence operations, and augmented reality. Sigma Defense, for example, has raised USD 4.7 million to develop the Army's Operator Maintainer Immersive Virtual Reality Environment (OMIVE) for intelligence training.

Europe contributed a substantial revenue share in 2024. NATO's defense budget for 2035 will generate significant possibilities in Europe for immersive reality, AR/VR training, and digital defense technologies, driving innovation and procurement demand. NATO member states agreed on June 25, 2025, to increase defense and security spending to 5% of yearly GDP by 2035.

In response, numerous significant competitors in Europe are investing and growing their production capabilities, which is driving market share growth.

Competitive Landscape and Key Competitors:

The Immersive Reality for Defense Market is characterized by numerous players, with major players competing across segments and regions. The list of major players included in the Immersive Reality for Defense Market report is:

• Northrop Grumman Corporation

• Lockheed Martin Corporation

• General Dynamics Corporation

• L3Harris Technologies, Inc.

• BAE Systems plc

• Leonardo S.p.A.

• Thales Group

• Saab AB

• Elbit Systems Ltd.

• Anduril Industries, Inc.

• RTX Corporation

• QinetiQ Group

• Takeaway Reality Ltd.

• Varjo Technologies Oy

• Sigma Defense Systems

• CM Labs

• BANC3 Inc.

• VRAI Simulation

• XRAI Inc.

Buy Your Exclusive Copy Now:

Major strategic developments by leading competitors

Kopin Corporation: On 11th April 2025, Kopin Corporation entered into a strategic investment agreement valued at USD 15.0 million with Theon International Plc. Theon is committing an USD 8.0 million investment into Kopin’s subsidiary in Dalgety Bay, Scotland, to advance jointly developed products aimed at Europe, Southeast Asia, and NATO member nations, fostering collaborative projects across critical global markets.

Unlock the Key to Transforming Your Business Strategy with Our Immersive Reality for Defense Market Insights –

• Download the report summary:

• Request Customization:

Navistrat Analytics has segmented the Immersive Reality for Defense Market by type, component, deployment, application, end-use, and region:

Type Outlook (Revenue, USD Billion; 2022-2032)

• Virtual Reality (VR)

• Augmented Reality (AR)

• Mixed Reality (MR)

Component Outlook (Revenue, USD Billion; 2022-2032)

• Hardware

• Software

• Services

Deployment Model Outlook (Revenue, USD Billion; 2022-2032)

• On-Premise

• Cloud-Based

• Hybrid

Application Outlook (Revenue, USD Billion; 2022-2032)

• Training & Simulation

• Mission Planning & Rehearsal

• Emergency Services

• Product Design & Engineering

• Sales & Marketing

• Others

End-Use Outlook (Revenue, USD Billion; 2022-2032)

• Defense Forces

• Homeland Security

• Intelligence Agencies

• Defense Research Organizations

Original Equipment Manufacturers (OEMs)

Regional Outlook (Revenue, USD Billion; 2022-2032)

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East & Africa

Get a preview of the detailed segmentation of market:

These significant instances strengthen army training through establishing combat resilience targets, which encourages defense companies to use more modern and realistic training techniques. Immersive reality technologies including Virtual Reality (VR), Mixed Reality (MR), and Augmented Reality (AR), provide real-time, scenario-based warfare training.

Immersive reality simulates vehicles, battle settings, and operational scenarios to develop critical abilities in a controlled, realistic environment. The use of immersive reality in enhancing combat training, collaboration, and medical response is developing as a significant commercial trend. Virtual Reality (VR) allows soldiers to participate in activities that are difficult, costly, and dangerous to mimic in real life.

The widespread adoption of virtual prototyping and design is accelerating revenue growth. Traditionally, military manufacturers relied on physical prototypes, actual safety margins, and test-and-learn methods, which usually resulted in longer timelines, higher costs, and inefficiencies. Immersive reality enables product development engineers to test performance, manufacturing capability, safety, and operational efficiency throughout the early stages of development.

However, tariffs have a direct influence on the electronics and components supply chain, which is crucial for producing hardware such as head-mounted displays (HMDs), projectors and display walls (PDW), gesture tracking devices (GTD), semiconductors, and sensors.

The majority of these components are acquired overseas. Manufacturers cannot easily switch suppliers without causing significant problems.

Get Exclusive Report Insights Here:

Segment market overview and growth Insights:

The Mixed Reality (MR) segment is expected to register the fastest revenue growth of 24.1% by 2032. The rapid use of mixed reality (MR) in military training has contributed to the segment's expansion. Mixed Reality (MR) brings together data visualization, real-time communication, and combat awareness. This allows soldiers to see past barriers, follow targets, and better coordinate with their groups. The growing need for simulation-based training provides opportunities for new investments.

Hardware contributed a significant revenue share in 2024. In virtual reality environments, hardware devices provide continuous situational awareness, mission warm-up realism, and extended deployment cycles, enabling training objectives to coincide with evolving operational imperatives. Military financing and funding are pushing the need for AI-powered devices that are completely durable, scalable, and fidelity-rich. The MOD has awarded a contract to cXRAI Glass of Canada worth USD 13,268. In addition, on May 19, 2025, Rivet Industries began manufacturing of its new Hard Spec augmented reality (AR) glasses, which were particularly designed for defense applications.

Regional market overview and growth insights:

North America registered the highest market share in the immersive reality for the defense market. Key competitors have secured large contracts from defense departments to provide immersive reality systems that combine spatial computing, artificial intelligence operations, and augmented reality. Sigma Defense, for example, has raised USD 4.7 million to develop the Army's Operator Maintainer Immersive Virtual Reality Environment (OMIVE) for intelligence training.

Europe contributed a substantial revenue share in 2024. NATO's defense budget for 2035 will generate significant possibilities in Europe for immersive reality, AR/VR training, and digital defense technologies, driving innovation and procurement demand. NATO member states agreed on June 25, 2025, to increase defense and security spending to 5% of yearly GDP by 2035.

In response, numerous significant competitors in Europe are investing and growing their production capabilities, which is driving market share growth.

Competitive Landscape and Key Competitors:

The Immersive Reality for Defense Market is characterized by numerous players, with major players competing across segments and regions. The list of major players included in the Immersive Reality for Defense Market report is:

• Northrop Grumman Corporation

• Lockheed Martin Corporation

• General Dynamics Corporation

• L3Harris Technologies, Inc.

• BAE Systems plc

• Leonardo S.p.A.

• Thales Group

• Saab AB

• Elbit Systems Ltd.

• Anduril Industries, Inc.

• RTX Corporation

• QinetiQ Group

• Takeaway Reality Ltd.

• Varjo Technologies Oy

• Sigma Defense Systems

• CM Labs

• BANC3 Inc.

• VRAI Simulation

• XRAI Inc.

Buy Your Exclusive Copy Now:

Major strategic developments by leading competitors

Kopin Corporation: On 11th April 2025, Kopin Corporation entered into a strategic investment agreement valued at USD 15.0 million with Theon International Plc. Theon is committing an USD 8.0 million investment into Kopin’s subsidiary in Dalgety Bay, Scotland, to advance jointly developed products aimed at Europe, Southeast Asia, and NATO member nations, fostering collaborative projects across critical global markets.

Unlock the Key to Transforming Your Business Strategy with Our Immersive Reality for Defense Market Insights –

• Download the report summary:

• Request Customization:

Navistrat Analytics has segmented the Immersive Reality for Defense Market by type, component, deployment, application, end-use, and region:

Type Outlook (Revenue, USD Billion; 2022-2032)

• Virtual Reality (VR)

• Augmented Reality (AR)

• Mixed Reality (MR)

Component Outlook (Revenue, USD Billion; 2022-2032)

• Hardware

• Software

• Services

Deployment Model Outlook (Revenue, USD Billion; 2022-2032)

• On-Premise

• Cloud-Based

• Hybrid

Application Outlook (Revenue, USD Billion; 2022-2032)

• Training & Simulation

• Mission Planning & Rehearsal

• Emergency Services

• Product Design & Engineering

• Sales & Marketing

• Others

End-Use Outlook (Revenue, USD Billion; 2022-2032)

• Defense Forces

• Homeland Security

• Intelligence Agencies

• Defense Research Organizations

Original Equipment Manufacturers (OEMs)

Regional Outlook (Revenue, USD Billion; 2022-2032)

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East & Africa

Get a preview of the detailed segmentation of market:

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- United States Lubricants Market Growth Opportunities & Share Dynamics 20252033

- UK Digital Health Market To Reach USD 37.6 Billion By 2033

- Immigration Consultancy Business Plan 2025: What You Need To Get Started

- United States Animal Health Market Size, Industry Trends, Share, Growth And Report 2025-2033

- Latin America Mobile Payment Market To Hit USD 1,688.0 Billion By 2033

- United States Jewelry Market Forecast On Growth & Demand Drivers 20252033

Comments

No comment