Japan Online Furniture Market Size, Share, Industry Growth & Report 2025-2033

Key Highlights

-

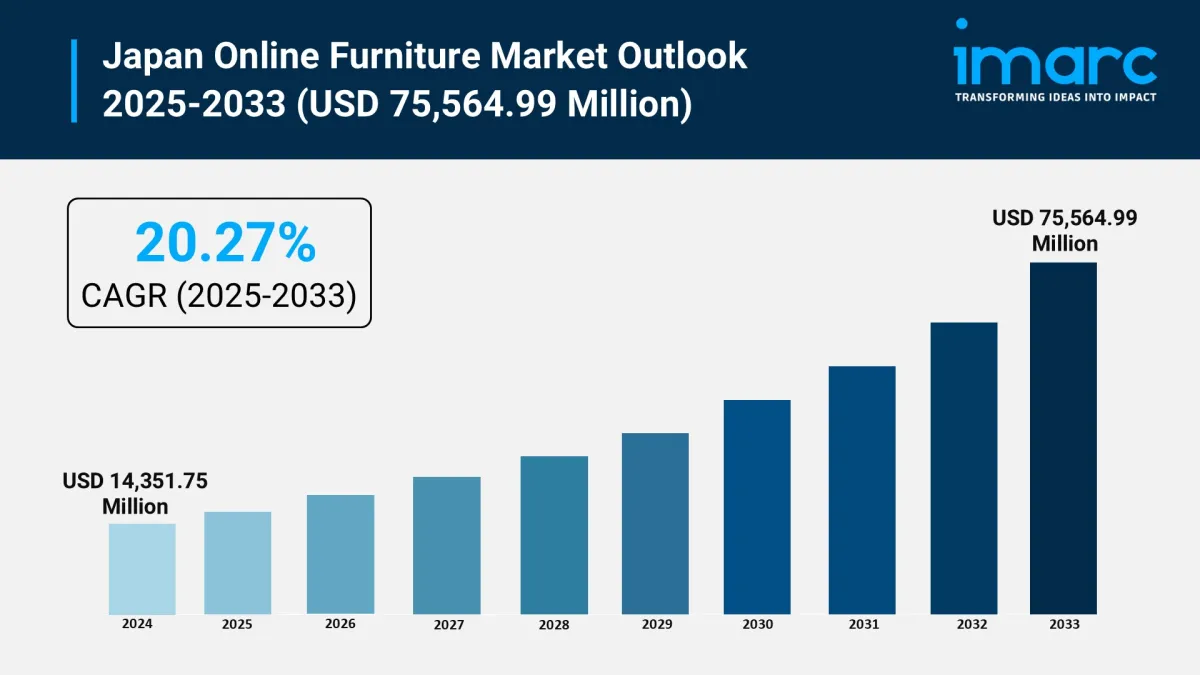

Market size (2024): USD 14,351.75 Million

Forecast (2033): USD 75,564.99 Million

CAGR (2025–2033): 20.27%

Increasing adoption of e-commerce, preference for multifunctional and space-saving furniture, and rising interest in sustainable, customizable designs are key trends.

Growth is driven by urbanization, busy lifestyles, easy online accessibility, home delivery convenience, and rising disposable income among Japanese consumers.

Living room furniture dominates the market, led by strong demand for sofas, storage units, and modular seating solutions.

How Is AI Transforming the Online Furniture Market in Japan?

-

Driving Design Innovation: AI tools enable Japanese furniture brands like Nitori to experiment with thousands of layout and style combinations, creating unique, space-efficient furniture quickly.

Streamlining Inventory Management: AI forecasts demand for popular furniture items, helping companies such as IKEA Japan minimize overstock and enhance distribution efficiency across multiple warehouses.

Boosting Manufacturing Productivity: AI-integrated production lines optimize assembly processes, with Itoki reducing furniture build time by around 25% through intelligent automation technologies.

Ensuring Quality and Compliance: AI tracks material sourcing and manufacturing steps, helping Japanese furniture makers meet safety standards, sustainability guidelines, and regulatory requirements.

Tailoring Customer Interactions: AI analyzes shopping behavior and preferences, allowing brands to deliver personalized recommendations, virtual room setups, and curated furniture experiences to consumers nationwide.

Grab a sample PDF of this report: https://www.imarcgroup.com/japan-online-furniture-market/requestsample

Japan Online Furniture Market Trends and Drivers

-

Urban Lifestyle Trends: Smaller living spaces and compact apartments are increasing demand for multifunctional and space-saving furniture solutions.

E-Commerce Growth: Online platforms provide convenience, variety, and home delivery options, boosting furniture sales across Japan.

Sustainability Focus: Consumers prefer eco-friendly, recycled, and responsibly sourced materials, encouraging brands to offer greener furniture products.

Virtual Experience Tools: AR and VR applications help shoppers visualize furniture placement, enhancing confidence in online purchases.

Personalized Offerings: AI-driven recommendations and customizable designs allow brands to tailor products to individual tastes and preferences nationwide.

Japan Online Furniture Industry Segmentation:

The report has segmented the market into the following categories:

Raw Material Insights:

-

Wood

Metal

Plastic

Jade

Glass

Product Insights:

-

Living Room Furniture

Bedroom Furniture

Office Furniture

Kitchen Furniture

Others

Application Insights:

-

Residential

Commercial

Regional Insights:

-

Kanto Region

Kansai/Kinki Region

Central/ Chubu Region

Kyushu-Okinawa Region

Tohoku Region

Chugoku Region

Hokkaido Region

Shikoku Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Japan Online Furniture Market

-

February 2025: Nitori launched AI-powered virtual room planners, enabling customers to visualize furniture placement, increasing online engagement by 35% across major Japanese cities.

March 2025: IKEA Japan introduced smart inventory systems using AI analytics, reducing stock shortages and delivery delays, improving order fulfillment efficiency by 28% nationwide.

June 2025: Itoki implemented automated production lines with robotics and AI, cutting assembly time by 25% while maintaining quality, setting new benchmarks for Japanese furniture manufacturing.

Request a Customized Report for Deeper Insights: https://www.imarcgroup.com/request?type=report&id=34757&flag=E

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact:

Street: 563-13 Kamien

Area: Iwata

Country: Tokyo, Japan

Postal Code: 4380111

Email: sales[@]imarcgroup.com

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment