India Vegan Food Market Size, Share, Top Brands, Industry Growth, Trends And Forecast 2025-2033

Key Highlights

-

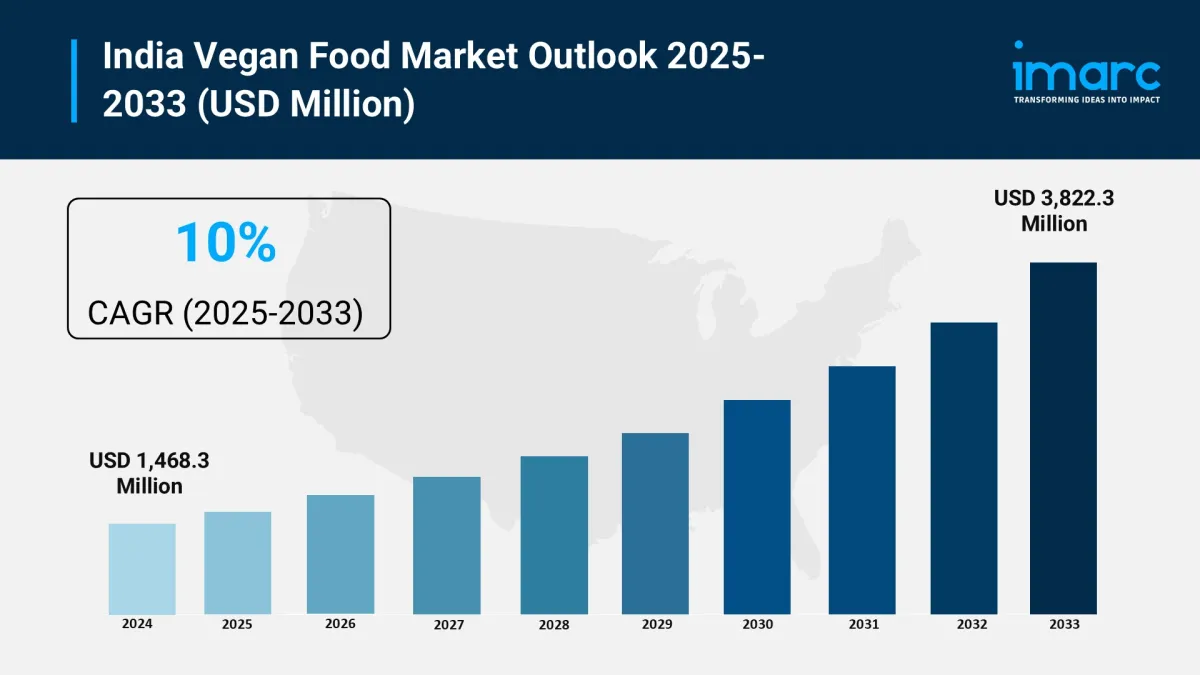

Market size (2024): USD 1,468.3 million

Forecast (2033): USD 3,822.3 million

CAGR (2025–2033): 10%

Rising awareness of health benefits (reduced risks of heart disease, diabetes, certain cancers) is a major propeller.

Increasing environmental consciousness about climate change and the ecological impact of animal agriculture is encouraging consumers towards plant-based products.

Widespread popularity of vegan food among the rising Indian millennial population, driven by their willingness to explore innovative food choices.

Rapid advancements in food technology are leading to the development of plant-based alternatives that closely mimic the taste and texture of animal-based products.

Request Free Sample Report: https://www.imarcgroup.com/india-vegan-food-market/requestsample

How Is AI Transforming the Vegan Food Market in India?

AI is revolutionizing the vegan food market in India by enabling:

-

AI-Driven Product Innovation and Personalized Nutrition: AI is assisting in developing data-driven products that cater to unique tastes and nutritional preferences. Algorithms can create new recipes for high-protein, probiotic, or allergen-free vegan options, leading to customized products that align with individual health aspirations.

Optimized Product Characteristics: Machine learning is leveraged to enhance fundamental product attributes like texture, flavor, and mouthfeel in plant-based formulations, making them more competitive with traditional animal-based products. This streamlines R&D, reduces costs, and improves product quality.

Smart Packaging and Supply Chain Optimization: AI is enhancing sustainability and efficiency through smart packaging solutions that monitor product freshness and provide environmental impact information. AI-driven supply chain optimization improves manufacturing processes, reduces costs, and ensures optimal product distribution, minimizing waste.

Demand Forecasting and Waste Reduction: AI systems analyze historical sales data, seasonal trends, consumer sentiment, and economic indicators to predict demand accurately. This helps manufacturers stock optimal inventory levels, reduce overproduction, and minimize food wastage.

Quality Control and Food Safety: AI-powered vision systems can rapidly inspect vegan food products for defects, contamination, or inconsistencies, ensuring high quality standards and minimizing recalls.

Key Market Trends and Drivers

-

Rising Health Consciousness: Consumers are increasingly adopting plant-based diets due to growing concerns about lifestyle diseases and a perception of vegan diets as healthier alternatives.

Ethical and Environmental Concerns: A growing awareness of animal welfare and the significant impact of animal agriculture on climate change, deforestation, and water consumption is driving consumers towards sustainable vegan choices.

Expansion of Vegan Offerings in Foodservice and Retail: The increasing availability of vegan options across restaurants, cafes, and retail stores, including dedicated vegan menus and specialized plant-based product sections in supermarkets and online platforms.

Growing Millennial and Gen Z Influence: These demographics are more open to exploring innovative food choices, experimenting with new flavors, and embracing ethical and sustainable lifestyles.

Advancements in Food Technology: Continuous innovation in developing realistic plant-based meat substitutes, dairy-free alternatives (like almond, soy, oat, and coconut milk, yogurts, and cheeses), and egg substitutes is boosting acceptance.

Increasing Lactose Intolerance: A significant portion of the population experiencing lactose intolerance is actively seeking plant-based dairy alternatives.

Urbanization and Global Food Trends: Increased urbanization and exposure to global food trends are leading to a shift in dietary preferences, with more international vegan brands and cuisines entering the Indian market.

Market Segmentation

The report has segmented the market into the following categories:

Breakup by Product:

-

Dairy Alternatives

-

Cheese

Dessert

Snacks

Others

-

Tofu

TVP

Seiten

Quorn

Others

Breakup by Source:

-

Almond

Soy

Oats

Wheat

Others

Breakup by Distribution Channel:

-

Supermarkets and Hypermarkets

Convenience Stores

Specialty Stores

Online Stores

Others

Breakup by Region:

-

North India

West and Central India

South India

East India

Contact Our Analysts for Brochure Requests, Customization, and Inquiries Before Purchase: https://www.imarcgroup.com/request?type=report&id=4670&flag=C

Latest Development in the Industry

-

In June 2025, BlueSpoon Robotics launched YogBotTM , an AI agent-powered yogurt kiosk robot that prepares personalized vegan yogurt bowls on demand, revolutionizing foodservice with efficiency and hygiene.

In July 2024, Danone partnered with Microsoft to integrate AI into its yogurt production and supply chain, aiming to enhance efficiency and upskill employees in predictive forecasting. Danone's subsidiary Silk also launched a new range of Greek-style, pea-protein-based plant-based yogurt in Canada in February 2024, indicating continued product innovation in dairy alternatives.

In July 2024, Terra Verde Foods' brand Plantaway introduced India's first plant-based chicken fillet , made from pea protein and soy-free, delivering 19 grams of protein, showcasing the increasing sophistication and nutritional value of meat substitutes.

The Food Safety and Standards Authority of India (FSSAI) is actively developing and refining regulations specifically for vegan food products, including allergen labeling and certification programs, to ensure safety and ethical standards.

The market continues to see a proliferation of diverse vegan products, from dairy alternatives like oat milk with regional flavors to plant-based meat innovations, enhancing both variety and accessibility across physical and online retail channels.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Japan Halal Food Market Size To Surpass USD 323.6 Billion By 2033 With A CAGR Of 8.1%

- BTCC Summer Festival 2025 Unites Japan's Web3 Community

- Red Lions Capital And Neovision Launch DIP.Market Following ADGM Regulatory Notification

- Thrivestate Launches“Fly Before You Buy” Program, Enabling International Buyers To Explore Dubai Before Committing

- Quinoa Seeds Market Size To Expand At A CAGR Of 5.5% During 2025-2033

- The Dubai Insiders Club Expands Access To Australia And Asia Amid Surge In International Investor Demand

Comments

No comment