Vietnam Automotive Engine Oils Market - Outlook, Trends & Latest Developments 2025-2033

Key highlights

-

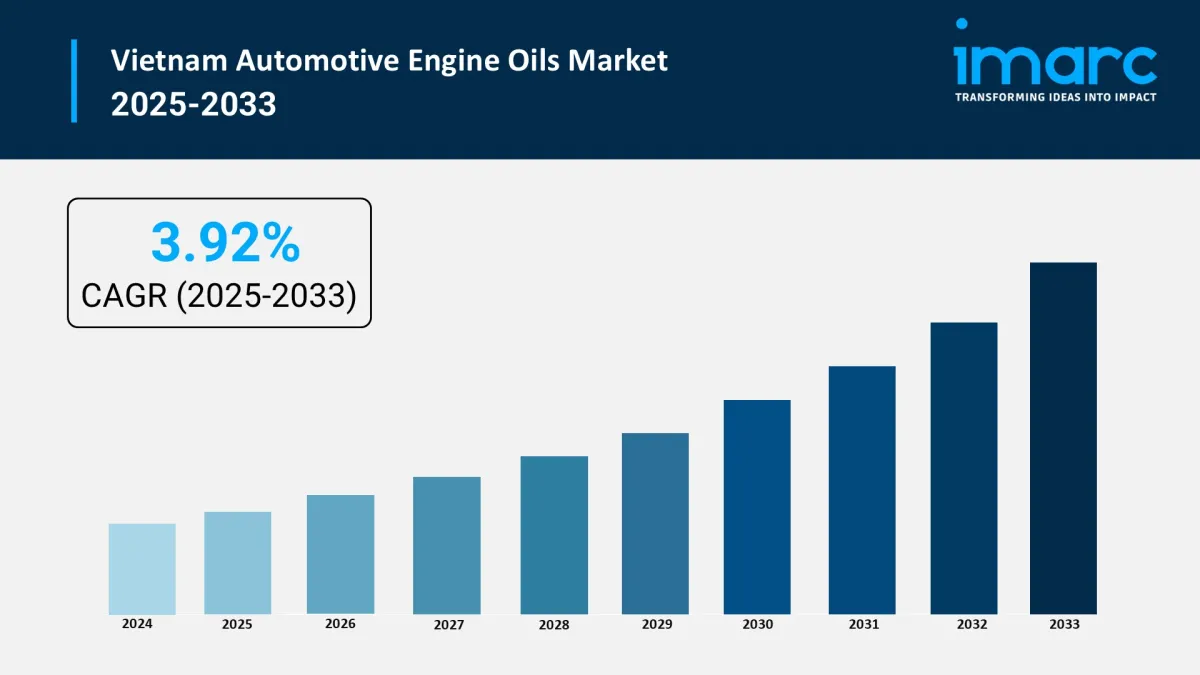

Projected growth (CAGR): 3.92% (2025–2033)

Primary demand drivers: rising vehicle ownership, logistics & e-commerce expansion, technological advances in engine/lubricant chemistry, consumer awareness of long-drain oils, and environmental regulations.

Leading players present in Vietnam: BP/Castrol (Castrol BP Petco JV), Shell (local blending & distribution), ExxonMobil/Mobil, Petrolimex, Mekong Petrochemical and several domestic blenders/distributors.

Market Trends:

-

Wider adoption of fully-synthetic and synthetic-blend engine oils (lower viscosity, improved shear stability, better fuel economy and longer drain intervals) is shifting demand away from conventional mineral oils.

Vehicle makers require specific viscosity grades and additive chemistries; as powertrains become downsized and turbocharged, demand for technically-matched oils increases.

Fleet operators increasingly combine telematics (engine runtime, fuel consumption, oil-condition sensors) with condition-based oil change schedules to cut costs and downtime - this increases uptake of premium, long-drain oils and associated services.

Low-emission additive packages and attention to used-oil collection/processing (for recycling or safe disposal) are getting more attention from regulators and large buyers.

As consumers and fleets prefer longer-drain, fuel-economy oils to lower total cost of ownership, the market will see a shift to synthetic and semi-synthetic grades - benefiting brands with OEM approvals and aftermarket reach. This is favorable for global majors and well-backed local players.

Request Sample For PDF Report: https://www.imarcgroup.com/vietnam-automotive-engine-oils-market/requestsample

Industry segmentation

Vehicle Type Insights:

-

Commercial Vehicles

Motorcycles

Passenger Vehicles

Regional Insights:

-

Northern Vietnam

Central Vietnam

Southern Vietnam

Latest industry developments

-

Castrol/BP's partnership with Petrolimex (Castrol BP Petco) remains a major distribution and production force in Vietnam - this long-standing JV underpins Castrol's market leadership in engine lubricants.

Shell and other majors operate local blending/distribution operations (Shell has a blending presence at Go Dau Industrial Zone) to serve domestic demand more efficiently. Local blending reduces logistic costs and supports product localization.

Import-tracking sources indicate robust shipments of premium imported oils (e.g., Castrol imports data) - reflecting demand for branded, high-performance lubricants.

Multiple market research houses track the Vietnamese engine-oils / lubricants market with varying forecasts (volumetric and value based). For example, Expert Market Research and reports note steady volume growth and mid-single digit CAGRs for the broader lubricants market.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Japan Halal Food Market Size To Surpass USD 323.6 Billion By 2033 With A CAGR Of 8.1%

- BTCC Summer Festival 2025 Unites Japan's Web3 Community

- Red Lions Capital And Neovision Launch DIP.Market Following ADGM Regulatory Notification

- Thrivestate Launches“Fly Before You Buy” Program, Enabling International Buyers To Explore Dubai Before Committing

- Quinoa Seeds Market Size To Expand At A CAGR Of 5.5% During 2025-2033

- The Dubai Insiders Club Expands Access To Australia And Asia Amid Surge In International Investor Demand

Comments

No comment