403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

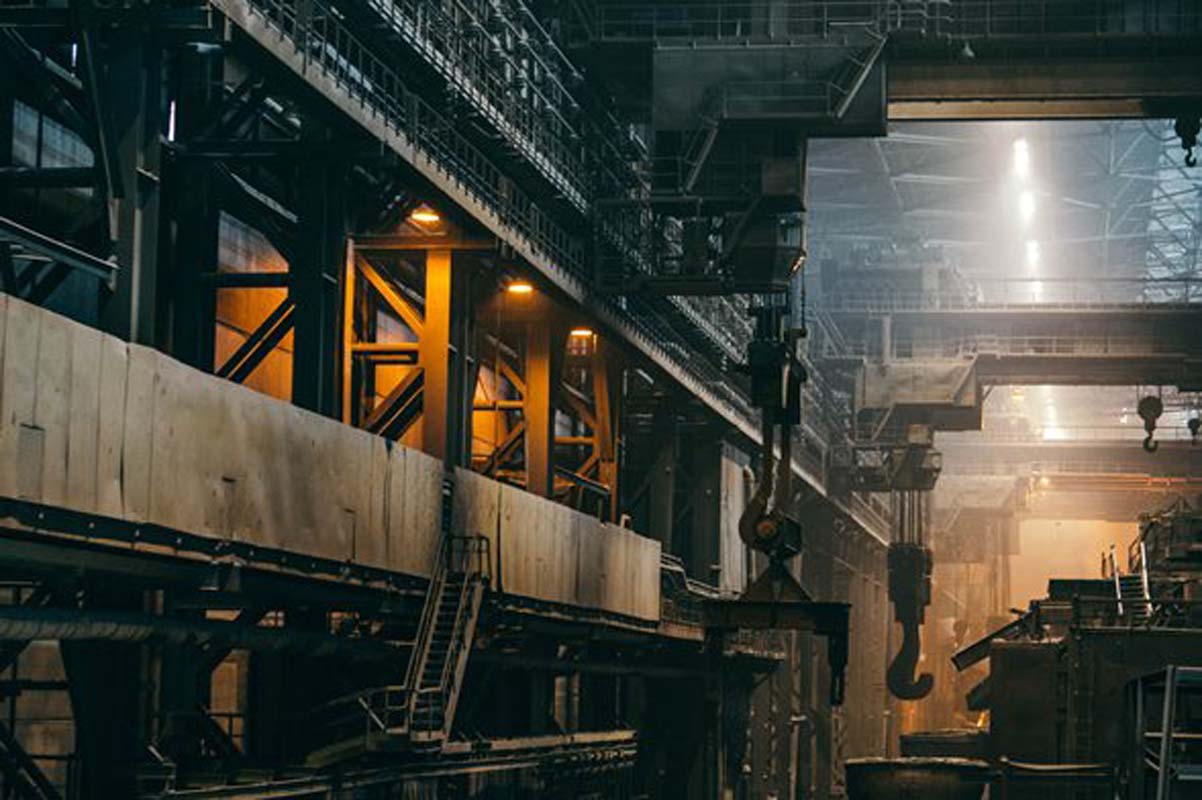

OECD Says Global Steel Industry Will Face Challenges

(MENAFN) The Organization for Economic Cooperation and Development (OECD) announced on Tuesday that the global steel sector is expected to face ongoing difficulties through 2025 and beyond.

According to the OECD, the challenges in the steel industry are unlikely to ease anytime soon.

While the steel sector’s production capacity is projected to increase by approximately 6.7 percent between 2025 and 2027, capacity utilization rates may decline due to escalating rivalry from Asian producers, as outlined in the OECD’s Steel Outlook 2025 report.

The report emphasized that "With demand growth expected to be sluggish at best, capacity utilization could once again decline towards 70%, putting enormous pressure on even highly competitive steelmakers."

This highlights the tough environment steel manufacturers will continue to face amid slow demand growth.

The OECD also pointed out that competition within the steel industry varies significantly between countries. Some governments heavily intervene with policies designed to foster industrialization, bolster or expand their domestic steel sectors, reduce reliance on imported steel, and indirectly support downstream manufacturing in higher value-added activities.

Specifically, the report noted, "China’s subsidization rate is ten times that of OECD countries. In addition to below-market borrowings, measures include subsidized energy prices, direct grants and preferential tax treatment."

Such substantial state support gives Chinese steel producers a considerable advantage over many competitors.

Due to the surge in steel exports from China, which hit a record high of 118 million tons in 2024, governments worldwide have felt pressured by low-cost exports from ASEAN countries and have implemented measures to defend their market shares.

In response, nineteen countries initiated 81 antidumping investigations targeting steel products in 2024. This level is close to the steel crisis seen in 2016 and represents a fivefold increase compared to 2023.

Almost 80 percent of these complaints were directed at Asian manufacturers, with China alone responsible for more than one-third of the cases.

According to the OECD, the challenges in the steel industry are unlikely to ease anytime soon.

While the steel sector’s production capacity is projected to increase by approximately 6.7 percent between 2025 and 2027, capacity utilization rates may decline due to escalating rivalry from Asian producers, as outlined in the OECD’s Steel Outlook 2025 report.

The report emphasized that "With demand growth expected to be sluggish at best, capacity utilization could once again decline towards 70%, putting enormous pressure on even highly competitive steelmakers."

This highlights the tough environment steel manufacturers will continue to face amid slow demand growth.

The OECD also pointed out that competition within the steel industry varies significantly between countries. Some governments heavily intervene with policies designed to foster industrialization, bolster or expand their domestic steel sectors, reduce reliance on imported steel, and indirectly support downstream manufacturing in higher value-added activities.

Specifically, the report noted, "China’s subsidization rate is ten times that of OECD countries. In addition to below-market borrowings, measures include subsidized energy prices, direct grants and preferential tax treatment."

Such substantial state support gives Chinese steel producers a considerable advantage over many competitors.

Due to the surge in steel exports from China, which hit a record high of 118 million tons in 2024, governments worldwide have felt pressured by low-cost exports from ASEAN countries and have implemented measures to defend their market shares.

In response, nineteen countries initiated 81 antidumping investigations targeting steel products in 2024. This level is close to the steel crisis seen in 2016 and represents a fivefold increase compared to 2023.

Almost 80 percent of these complaints were directed at Asian manufacturers, with China alone responsible for more than one-third of the cases.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- BC.GAME News Backs Deccan Gladiators As Title Sponsor In 2025 Abu Dhabi T10 League

- Solotto Launches As Solana's First-Ever Community-Powered On-Chain Lottery

- Betfury Is At SBC Summit Lisbon 2025: Affiliate Growth In Focus

- Solo Leveling Levels Up: Korean Billion-Dollar Megafranchise Goes Onchain With Story

- Ethereum-Based Defi Crypto Mutuum Finance (MUTM) Reaches 50% Completion In Phase 6

- Nigel Farage To Headline At UK's Flagship Web3 Conference Zebu Live 2025

Comments

No comment