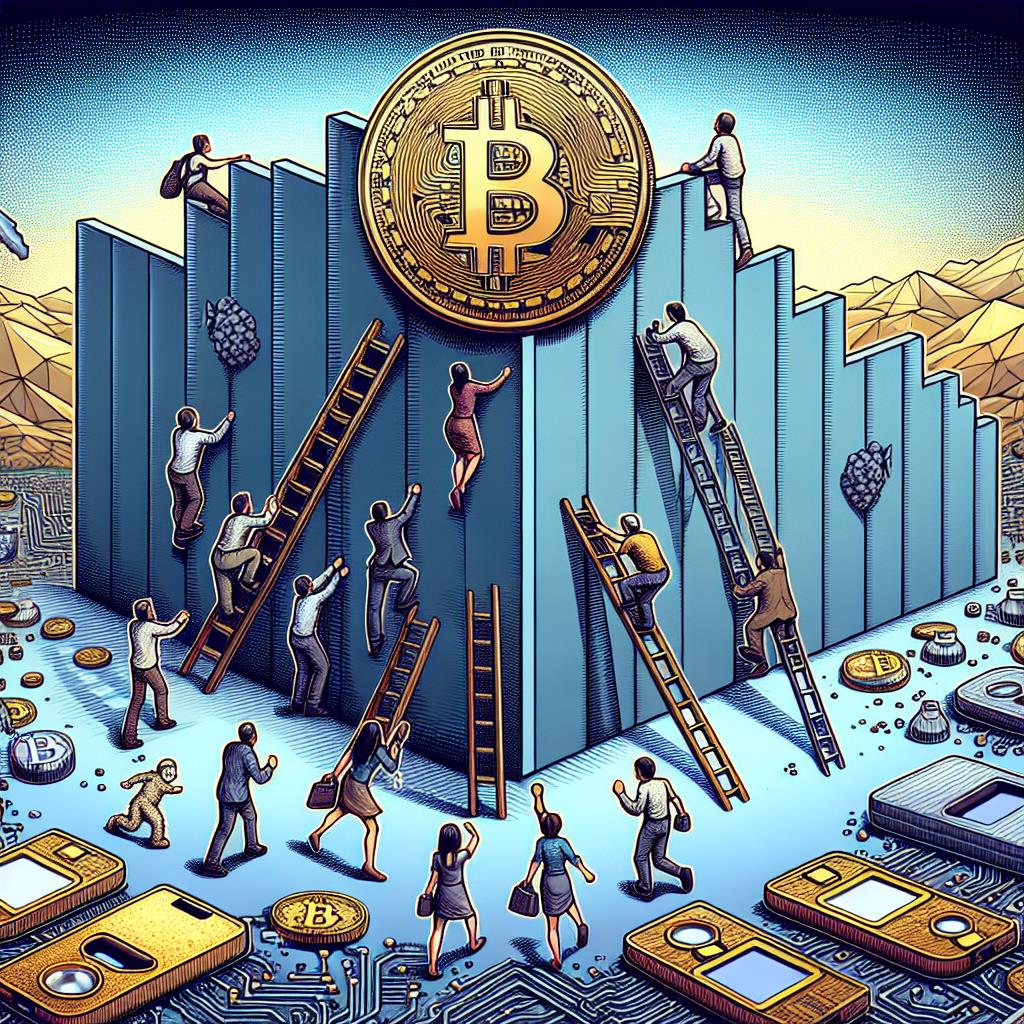

Overcoming The Biggest Barrier To Bitcoin Adoption: The Role Of Hardware Wallets

Hardware Wallets: Bitcoin's Biggest Adoption Barrier

Globally, there are approximately 500 million cryptocurrency enthusiasts, and estimates suggest that a mere 2.5% are utilizing hardware wallets . Although this percentage is quite small, I find a sense of relief in knowing it's not larger.

Wondering why? My vision is for billions of individuals to embrace Bitcoin , ensuring that everyone has a secure method of self-custody. The consumer hardware wallet sector stands as a significant barrier to realizing this vision. This issue extends beyond merely Bitcoin acceptance; the entire decentralization movement faces peril if we fail to address the critical vulnerabilities existing in many of the most popular wallets today.

The Status Quo of WalletsIn a previous article, Lucien Bourdon commemorated“a decade of wallet innovation .” While I share many of his sentiments, one glaring shortcoming is evident. With few exceptions, the so-called 'leading' consumer hardware wallets have seen minimal innovation over the past ten years. Security experts are well aware that stagnation equates to regression.

The challenge isn't merely the emergence of new threats; it's that the ways people utilize Bitcoin are evolving swiftly. Cryptocurrencies are no longer solely seen as stores of value; they are evolving into mediums for diverse and increasingly intricate transactions. Yet, the foundational technology behind hardware wallets has not significantly advanced since their inception, when their primary function was to securely store keys offline. User experience also remains outdated, as users continue to be required to jot down seed phrases and squint at tiny screens to approve transactions.

This issue transcends Bitcoin alone. The future landscape of security will hinge on how we protect our most valuable digital assets and sensitive information through cryptographic keys. The entire decentralized economy rests on the contents of these wallets – it's time to examine them closely.

Trust without Verification?Lucien rightly emphasized Bitcoin 's strength lies in its dedication to open-source principles. However, I strongly contest the claim that“most of the wallet industry” has embraced open-source.

The reality is that many top-tier hardware wallets are built on closed-source, proprietary frameworks, which users cannot fully examine. Without inspection, verification becomes impossible; if verification isn't achievable, why should users trust the manufacturers' assertions?

My suspicion is rooted in the notion that many hardware wallets act as“black boxes” because they have something to conceal – particularly the outdated smart card technologies that underpin many wallets where Bitcoin users store their keys . This technology is archaic, inadequate for today's crypto demands, and certainly not suitable for a future focused on decentralized security, where we will rely on keys to protect everything from our digital identities to access credentials.

Challenges to Innovation... and Widespread AdoptionThe ongoing dependence of hardware wallets on closed, proprietary systems is not only a security disaster but is also detrimental to Bitcoin innovation and broader adoption.

Current wallets function as restricted ecosystems where developers must adhere to stringent regulations without the freedom to offer customizations for users. This isn't simply about control for control's sake-it often results from the constraints of the underlying technology. For instance, devices such as Ledger require every application to access the master seed, necessitating meticulous reviews before any app is approved (if they're approved at all).

If the App Store operated like this, we would still be using Nokia 3310s today. Instead, we witnessed the emergence of open ecosystems, vibrant developer communities, healthy competition, and a plethora of innovative applications.

This is the future I aspire for wallets. When developers can create without restrictions, they will not only provide inventive functionalities and improved user experiences but will also play a crucial role in the evolution of wallets to accommodate and protect the expanding complexities of Bitcoin applications.

Wallets ought to be centers of innovation-a space for developers to generate groundbreaking applications that drive Bitcoin and blockchain service adoption. In reality, a platform like Ledger is more like the“anti-App Store,” stifling decentralized innovation rather than propelling it forward.

Unlock Your WalletThe remedy is both straightforward and vital: transparency. Just as robust encryption relies on publicly reviewed, open-source algorithms for security, the devices responsible for storing cryptographic keys should adhere to similar principles. Open-source hardware and software empower security researchers, developers, and individual users to audit and verify security protocols, diminishing reliance on the manufacturers' claims and bolstering overall trustworthiness.

New, more secure options are already available. Hardware wallets utilizing open-source microkernel architectures provide a stronger security framework, allowing for independent validation of their safety. These designs ensure that no single company holds dominion over the security of users' cryptographic keys, mitigating the risk of concealed vulnerabilities and encouraging innovation.

The encouraging news is that only 1 in 40 crypto users currently possesses a hardware wallet. Let's strive to equip the remaining 39 with a genuinely secure method for self-custodying their digital futures and foster the innovative developments that will draw billions more into cryptocurrency adoption.

This is a guest post by Zach Herbert. The views presented are those of the author and do not necessarily mirror the opinions of BTC Inc or Bitcoin Magazine.

This article Hardware Wallets: Bitcoin's Biggest Adoption Barrier first appeared on Bitcoin Magazine and is authored by Zach Herbert .

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk.

Don't invest unless you're prepared to lose all the money you invest.

This is a high-risk investment, and you should not expect to be protected if something goes wrong.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment