OPEC+ Enforces New Output Cuts To Counter Overproduction

OPEC+ has announced a revised schedule for seven member nations to implement additional oil output cuts, aiming to compensate for previous overproduction. These measures are set to overshadow the planned production increases slated for next month.

The updated plan mandates monthly reductions ranging from 189,000 to 435,000 barrels per day , with the cuts extending until June 2026. This initiative seeks to address the excess output that has occurred despite the group's ongoing efforts to stabilize the oil market.

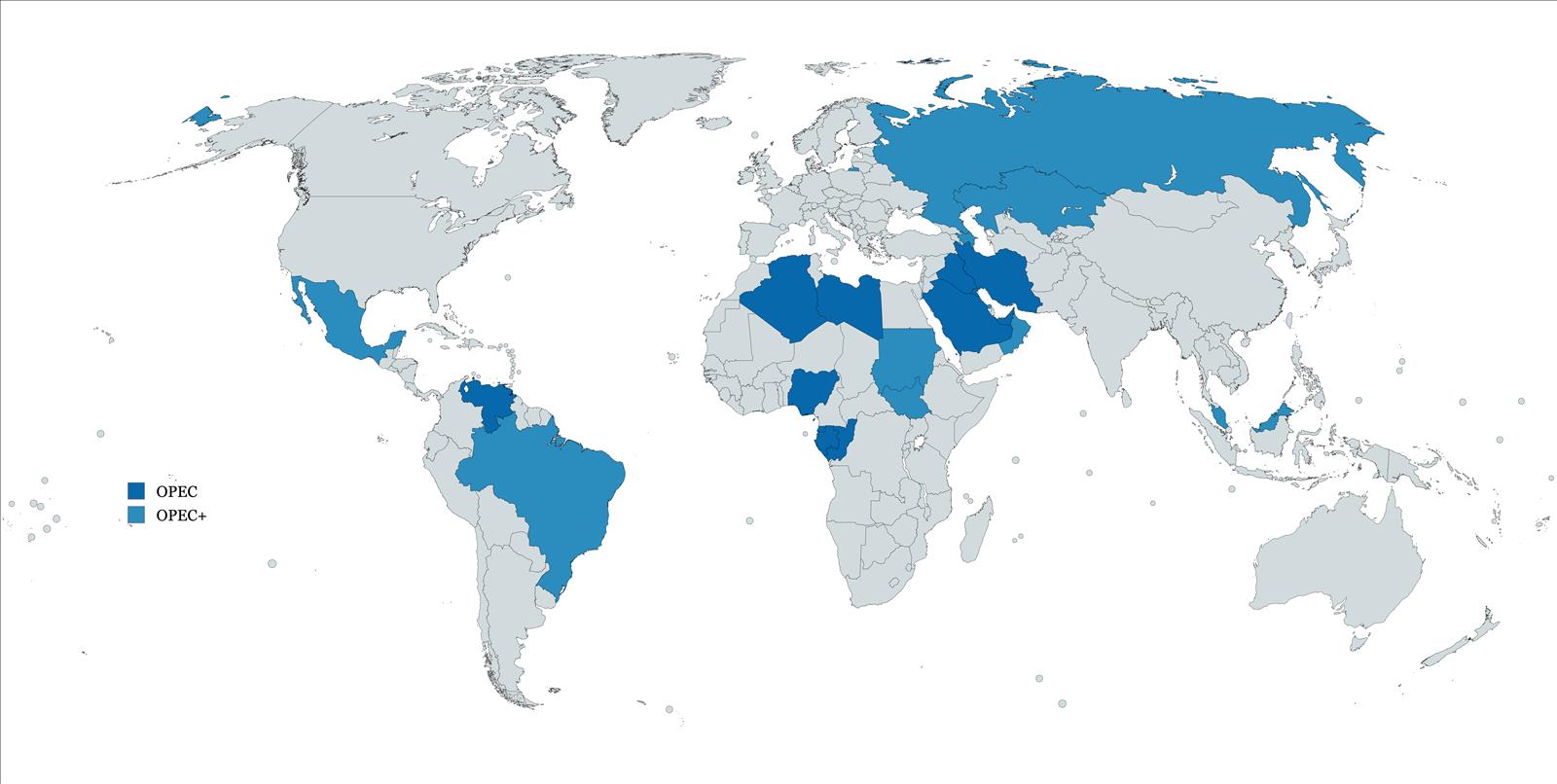

Since 2022, OPEC+, which includes members of the Organization of the Petroleum Exporting Countries along with Russia and other allies, has been implementing output cuts totaling 5.85 million bpd, approximately 5.7% of global supply. These cuts were introduced in phases to support market stability amid fluctuating demand and geopolitical tensions.

Despite these efforts, certain member countries have exceeded their production quotas. Kazakhstan, for instance, has seen a significant production surge due to Chevron's expansion at the Tengiz oilfield, leading to output levels surpassing its OPEC+ quota.

To address this imbalance, the new compensatory cuts will require substantial contributions from Iraq, Kazakhstan, and Russia, with Saudi Arabia also making smaller adjustments. These measures are designed to offset the previous overproduction and align the group's output with agreed targets.

Concurrently, OPEC+ has decided to proceed with a modest production increase of 138,000 bpd starting in April, citing healthier market conditions. This marks the beginning of a series of monthly hikes intended to gradually restore a total of 2.2 million bpd over the next 18 months, following repeated delays since 2022.

See also Dubai's Private Jet Activity Reaches Historic HeightsHowever, the introduction of compensatory cuts raises questions about the net effect on global oil supply. The scheduled reductions are expected to more than offset the planned production hikes, potentially tightening the market further. This development comes amid new U.S. sanctions targeting Chinese entities involved in supplying Iranian oil, which have contributed to a recent uptick in oil prices.

As of Friday, Brent crude futures rose 0.3% to $72.21 per barrel, and U.S. West Texas Intermediate crude futures increased 0.4% to $68.32 per barrel. Both benchmarks were set to rise about 2% for the week, marking the largest weekly gains since early 2025.

The International Energy Agency has noted that increasing global trade tensions and new U.S. tariffs are negatively impacting oil demand and economic growth, creating uncertainty. The IEA revised its oil-demand growth estimates down to 1.03 million bpd from an earlier 1.1 million bpd, while OPEC projects higher growth at 1.45 million bpd.

With OPEC+ set to raise output beyond April and increased production in regions like Kazakhstan, Iran, and Venezuela, the IEA expects global oil supply to exceed demand, foreseeing a surplus of approximately 600,000 bpd. Total supply could average 104.5 million bpd by 2025, driven by non-OPEC+ production growth.

Also published on Medium .

Notice an issue? Arabian Post strives to deliver the most accurate and reliable information to its readers. If you believe you have identified an error or inconsistency in this article, please don't hesitate to contact our editorial team at editor[at]thearabianpost[dot]com . We are committed to promptly addressing any concerns and ensuring the highest level of journalistic integrity. Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment