Why FPPS Isn't A Free Ride For Bitcoin Miners: Understanding The Real Costs

To mitigate this challenge, pool mining was established. Consider a solo miner running a relatively modest operation. Out of the 52,560 annual blocks, he might expect to find one, given his share of the network hash rate is 1/52,560. Essentially, this means he could anticipate discovering one block each year. However, his electricity bills are due every month, and waiting an entire year for revenue would lead him to financial ruin. Recognizing the imbalance between his continual expenses and sporadic income, he devises a plan. He looks for 499 other miners with similar setups and proposes working together as a unified operation, sharing mining rewards based on individual contributions each time a block is located. With 500 miners collectively holding 1/52,560 of the network hash rate each, they can expect to mine a block approximately twice weekly. This pooled approach ensures that individual efforts are rewarded much more frequently, enabling all miners to cover their bills monthly and collectively avoid bankruptcy by year-end. Despite this, payout variability remains a concern.

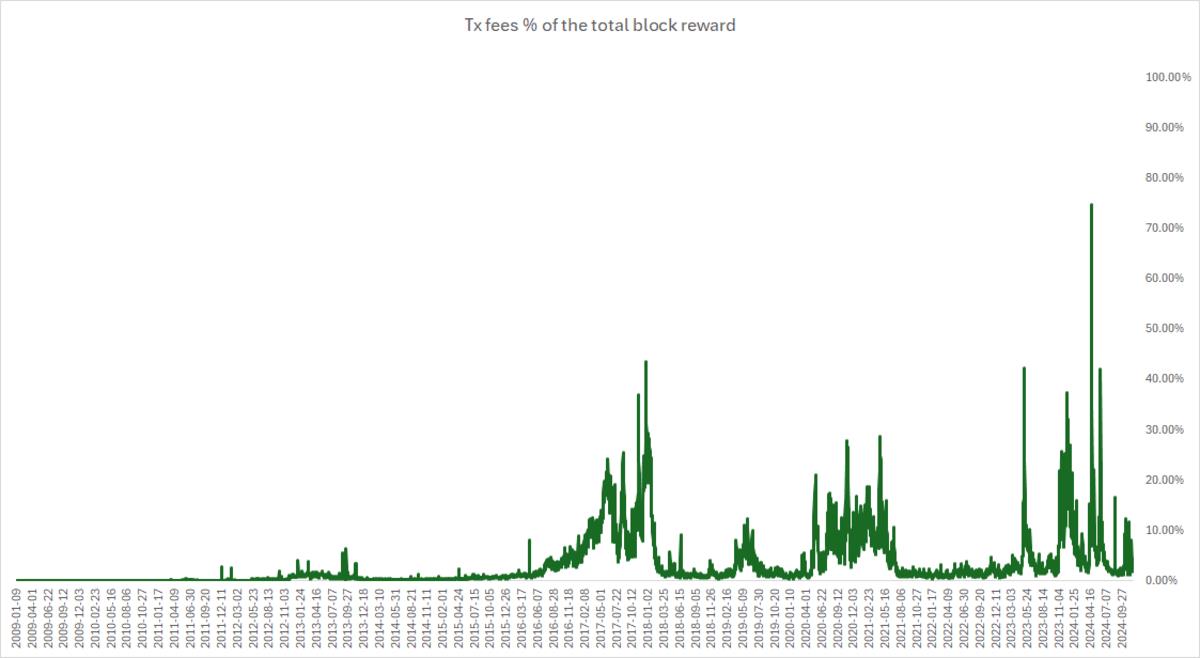

Pool mining ensures miners receive payments more consistently compared to mining alone; however, it does not guarantee predictable earnings relative to each miner's hashing capacity. This issue is commonly referred to as the pool's luck risk. Returning to the earlier example, while 500 miners together are expected to find about 500 blocks annually, they might discover just 480, 497, or even 520. The unpredictability of the pool's mining success means their actual yield may differ from expectations. Pool luck is assessed by comparing the number of blocks mined to the anticipated figure based on the pool's total hash rate. For instance, if a pool mines 480 blocks when 500 were anticipated, its luck stands at 95%. Fluctuations in earnings can occur in brief periods due to luck risk, but over time, payouts tend to adjust to align with expected distributions based on the pool's hash rate. Two primary factors, with one wielding greater influence than the other, contribute to the variance in miners' earnings. The first and most significant is transaction fees. These fees can vary greatly, as seen in recent years. Post the last halving, transaction fees from mined blocks accounted for over 50% of overall block rewards for the first time in Bitcoin 's history. Currently, as of block height 883208, several non-full blocks were mined within the preceding week after the transaction backlog cleared multiple times. Such a significant fluctuation in a short span is noteworthy. The second factor links to the variance in the time intervals between discovered blocks; when a block is found quickly after another, it reduces the opportunity for transactions to accumulate in the mempool, resulting in lower transaction fees. Conversely, a longer interval allows more transactions to form, increasing fees.

During the 2024 halving, daily transaction fees paid to miners exceeded the block subsidy for the very first time in Bitcoin 's history.

Uncertainty can be distressing, particularly when substantial capital is at stake. Therefore, many miners prefer to have steady, predictable, and less volatile payouts to recover their significant investments. This demand brings us to the Full Pay Per Share (FPPS) payment model utilized by mining pools. FPPS acts much like a traditional insurance product, offering a pure risk transfer. Irrespective of the number of blocks mined or the transaction fees on those blocks, miners receive a payout reflective of their hashing power's expected value. The pool shoulders all the associated risks. The level of predictability that FPPS offers is unmatched by any competing methods, which is why this model has become the predominant standard for pool payouts, albeit not without a hefty price tag.

However, FPPS is not without its drawbacks. To hedge against any bad luck periods and navigate the risks entwined with the FPPS model, mining pools must maintain substantial capital reserves. These requirements can lead to increased costs, which are inevitably passed on to miners through higher fees. As previously noted, miners must recognize that FPPS operates essentially as an insurance policy. Policy frameworks depend on the reliability of counterparties, and failures to meet obligations can occur, much like during the 2008 Global Financial Crisis. Miners need to trust that the pool will uphold its commitments under the insurance contract. While larger pools present a reduced risk, they may also implement strategies to redistribute risk away from their operations. Yet, a fundamental tenant of Bitcoin is reducing trust and counterparty risk wherever feasible, which suggests that the ethos of Bitcoin has yet to fully permeate the pool mining segment.

Moreover, miners benefiting from FPPS must forgo any potential revenue spikes related to transaction fees. The FPPS payout calculation is based on analyzing transaction fees from the previous n blocks to determine an expected value for fees, which the pool then utilizes to compute payments for that fee portion of the miners' shares. Consequently, when transaction fees rise sharply, the payout is based on past data when such spikes were absent. It doesn't require advanced mathematical understanding to see that these rewards typically end up in the pool's coffers instead of those of the miners. Even in the event of a recent transaction surge, pools often cannot adjust their payout calculations accordingly, as their data suggests such surges may be outliers. Essentially, pools avoid including unpredictable fee spikes in miner payouts, as doing so poses a risk of insolvency.

The Sustainability Challenge of FPPS Payout ModelsA closer examination reveals that the FPPS payout model resembles various unsustainable government pension systems. As it currently operates, FPPS is on a collision course for collapse. Over time, transaction fees will likely make up an increasing portion of total miner payouts. This evolution, compounded by inherent fluctuations, will lead to a dramatic increase in total payout variance, thereby escalating the insurance costs for FPPS pools exponentially. With ongoing halvings of the Coinbase reward, the volatility of block rewards will likely soar. As the variance grows, so does the risk linked to maintaining this insurance model for miners, prompting premiums to rise accordingly. Consequently, FPPS pools will have to assume greater risks while committing to fixed payments for miners. The extent to which pool fees must increase to sustain the FPPS insurance product remains speculative. Only insurance actuaries can accurately calculate this figure. One truth is certain: it will be costly-indeed, it already is.

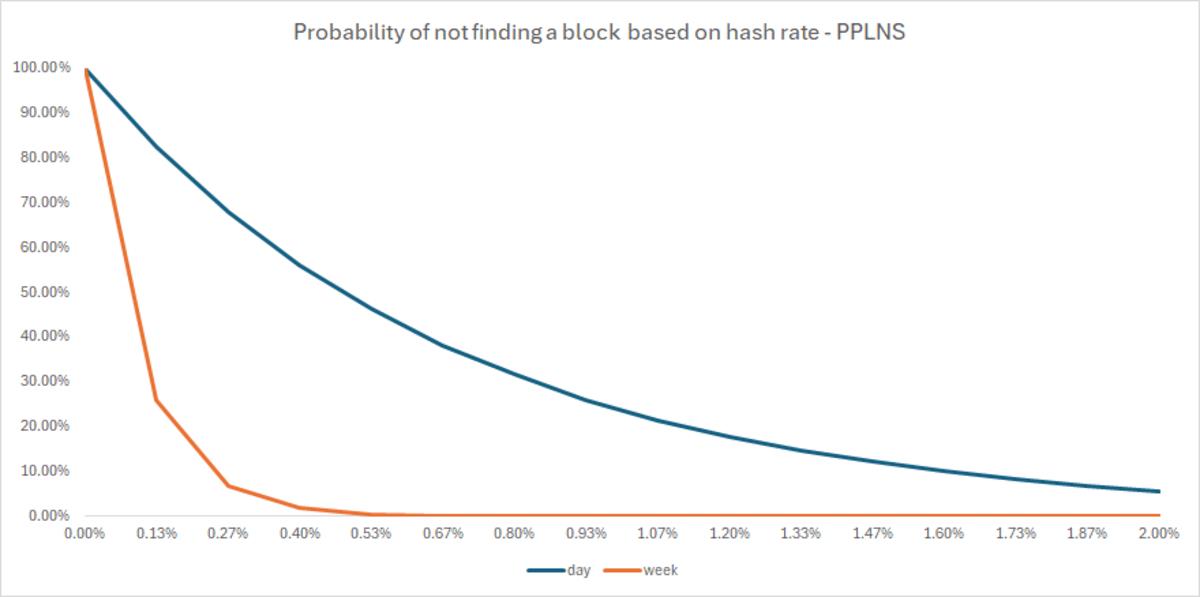

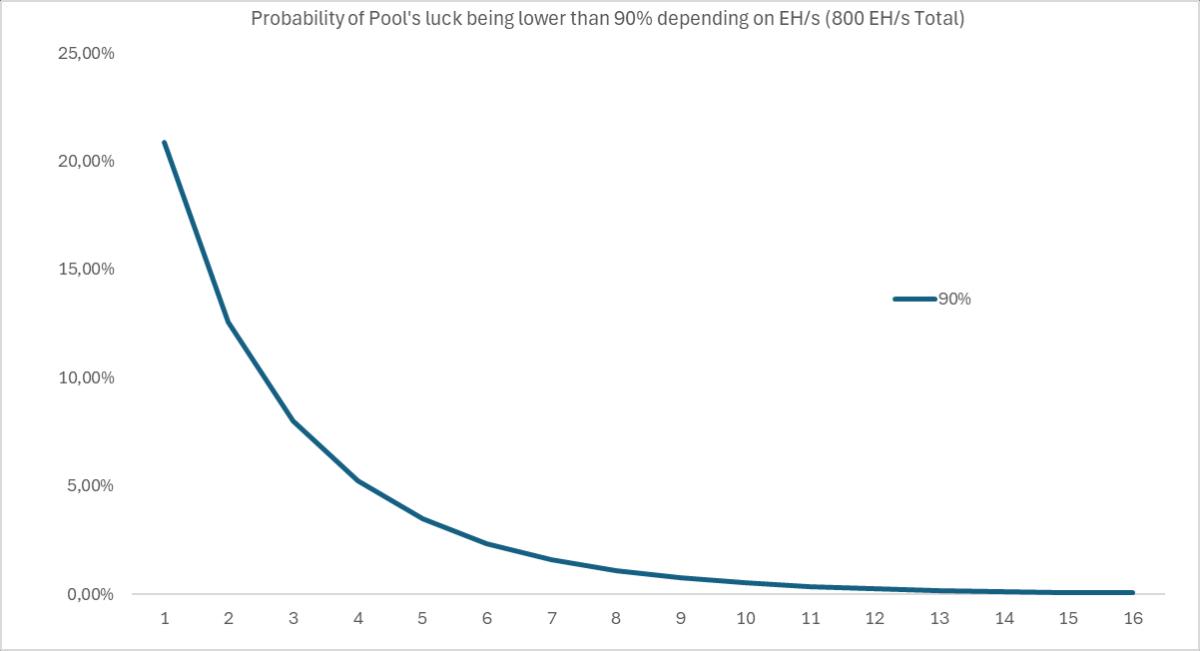

Higher pool fees associated with the reliable and predictable payouts offered by FPPS will likely make the Pay Per Last N Shares (PPLNS) method more attractive for miners eager to maximize profitability, particularly as the dynamics surrounding block composition evolve. Under the PPLNS framework, miners receive payments once the pool finds a block. When a block is discovered, the pool calculates the contributions made by each miner throughout a determined period encompassing the last N blocks found, thereby distributing payouts accordingly. This specific timeframe is known as the PPLNS window. However, a notable drawback of this payment method is the risk tied to the pool's potential for luck below 100%, as well as the chance that there could be stretches during which the pool fails to find a block, resulting in no payments for miners. Nevertheless, a pool controlling only 1% of the hash rate sees just a 0.0042% probability of missing a block within a week, while the risk of achieving sub-90% luck yearly falls around 1.09%.

A PPLNS pool with over 1% of the total hash rate faces negligible risk of failing to find a block for extended periods.

The likelihood of a PPLNS pool with more than 1% of the hash rate experiencing luck below 90% is under 1%. (These calculations assume that the number of blocks discovered by the pool follows a Poisson distribution with λ representing the anticipated number of blocks mined annually.)

Is there a viable market emerging for FPPS pool services at a suitable price that compensates pools for all the variability tied to total block rewards? It remains uncertain. What is evident, however, is that pool fees will have to be exorbitant. The financial sacrifices miners would need to make would likely outweigh the benefits of eliminating the uncertainties tied to timely and consistent payments. As more sophisticated participants, like energy companies, enter the Bitcoin mining realm, we can anticipate the development of diversified risk management tools to help miners hedge against numerous risks. Innovative pool payment structures are expected to emerge as these tools become accessible to a broader audience.

The revenue potential and overall profitability for miners will heavily be influenced by the concepts discussed in this article. Those aiming to optimize returns must explore alternative pool payment arrangements and risk mitigation strategies. While the FPPS payout model may still offer benefits to miners today, its long-term viability seems increasingly tenuous in the ever-evolving Bitcoin landscape.

This article is a guest contribution by Francisco Quadrio Monteiro. The views expressed reflect his own opinions and do not necessarily correspond with those of BTC Inc or Bitcoin Magazine.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk.

Don't invest unless you're prepared to lose all the money you invest.

This is a high-risk investment, and you should not expect to be protected if something goes wrong.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment