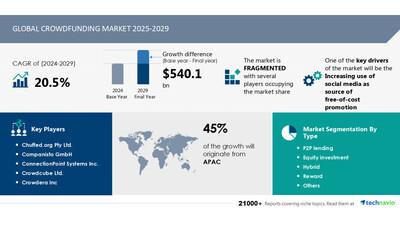

Crowdfunding Market To Grow By USD 540.1 Billion (2025-2029), Boosted By Increasing Use Of Social Media For Free Promotion, AI-Driven Market Trends - Technavio

| Crowdfunding Market Scope |

|

| Report Coverage |

Details |

| Base year |

2024 |

| Historic period |

2019 - 2023 |

| Forecast period |

2025-2029 |

| Growth momentum & CAGR |

Accelerate at a CAGR of 20.5% |

| Market growth 2025-2029 |

USD 540.1 billion |

| Market structure |

Fragmented |

| YoY growth 2022-2023 (%) |

16.0 |

| Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

| Performing market contribution |

APAC at 45% |

| Key countries |

Australia, US, China, Japan, UK, Germany, India, France, Canada, and Italy |

| Key companies profiled |

Chuffed Pty Ltd., Companisto GmbH, ConnectionPoint Systems Inc., Crowdcube Ltd., Crowdera Inc, Crowdfunder Ltd., DonorsChoose, FUELADREAM Online Ventures Pvt. Ltd., Fundable LLC, Fundly, GGF Global Ltd., GoFundMe Inc., Indiegogo Inc., Ioby Inc., Ketto Online Ventures Pvt. Ltd., Kickstarter PBC, Kiva Microfunds, Patreon Inc., Republic, and Wishberry Online Services Pvt. Ltd. |

Market Driver

Entrepreneurs, businessmen, creators, filmmakers, musicians, and artists turn to crowdfunding as an alternative capital source. The public supports projects through online platforms, connecting fundraisers with individual investors and startup firms. This trend challenges traditional channels like banks and venture capitalists. Regulations vary by location and investor net worth, impacting fundraising goals and financial risks. Crowdfunding trends span media & entertainment, real estate, healthcare, and tech sectors. Technology, including AI and machine learning, influences platforms' efficiency. Equity crowdfunding allows investors for a stake in the business. Donor decisions are influenced by project creators' reputation and credibility. Social media and social networking sites expand the global audience, increasing potential investors. However, risks include fraud, misuse of funds, and credit score checks. Awareness and transparency are crucial for success. Business platforms prioritize customer satisfaction and product development. Crowdfunding sites cater to charities and various influencing variables.

In traditional product development and customer acquisition, there was limited interaction with customers prior to product launch. With the advent of crowdfunding campaigns, entrepreneurs can now engage with their target audience to gauge product interest and expectations. This interaction provides valuable insights into the demand for a product, allowing campaign owners to adjust strategies accordingly. Previously, post-purchase behavior was the primary indicator of demand-pull or technology push factors. However, through crowdfunding, entrepreneurs can gather this information before investing in marketing efforts. This approach not only saves resources but also increases the likelihood of a successful product launch.

Request Sample of our comprehensive report now to stay ahead in the AI-driven market evolution!

Market Challenges

-

Entrepreneurs, businessmen, creators, filmmakers, musicians, and artists turn to crowdfunding markets for alternative capital when traditional channels like banks and venture capitalists fail to provide sufficient funding. The public plays a crucial role in this process by supporting projects through online platforms. Individual investors and startup firms contribute small amounts, aggregating to meet funding goals. However, challenges exist. Regulations, location, credit score, and net worth can influence an investor's decision. Large investments carry financial risks, and fraud and misuse of funds are concerns. Project creators must build credibility and reputation to attract potential investors. Business platforms use technology, including artificial intelligence and machine learning, to streamline the process. Crowdfunding is popular in sectors like technology, media & entertainment, real estate, healthcare, and the cultural sector. Equity crowdfunding allows investors to own a stake in a company. Donation-based crowdfunding supports charities and social causes. Social media platforms and crowdfunding sites expand the reach to a global audience. Influencing variables include investor behavior, project quality, and marketing efforts. Social networking sites can significantly impact a project's success. Despite these challenges, crowdfunding offers a valuable avenue for entrepreneurs and creators to bring their ideas to life.

Crowdfunding is a multi-stage process for entrepreneurs seeking initial investments to fund product development, marketing expenses, product registration, and compliance costs. These pre-launch activities can be time-consuming and may lead to project delays. Fixed deadlines set by individuals or companies create pressure to build a customer base. Delayed project delivery can result in investors withdrawing, refunds, and even complete refunds. Such occurrences in the global crowdfunding market can negatively impact investor confidence in future campaigns. Entrepreneurs must manage these risks to ensure successful crowdfunding projects.

Discover how AI is revolutionizing market trends- Get your access now!

Segment OverviewThis crowdfunding market report extensively covers market segmentation by

Type-

1.1 P2P lending

1.2 Equity investment

1.3 Hybrid

1.4 Reward

1.5 Others

-

2.1 On-premises

2.2 Cloud

-

3.1 APAC

3.2 Europe

3.3 North America

3.4 South America

3.5 Middle East and Africa

1.1 P2P lending- In the crowdfunding market, Peer-to-Peer (P2P) lending is a popular model where individuals lend money directly to borrowers without the need for intermediaries like banks. This market's growth is driven by several factors. First, P2P lenders often liquidate funds before loan terms end, enabling individuals to access funds quickly for planned activities. Second, online portals facilitate minor investments, benefiting small businesses. Third, interest earned through P2P lending falls under personal savings allowance, attracting customers. Fourth, entrepreneurs with a business plan and over two years of experience are likely to secure loans. Government initiatives also support market growth. However, the growth rate may remain slow due to fewer participants opting for P2P lending, particularly in MEA and APAC. Additionally, start-ups with little experience or large funding requirements may face challenges securing P2P loans.

Download a Sample of our comprehensive report today to discover how AI-driven innovations are reshaping competitive dynamics

Research AnalysisCrowdfunding is a revolutionary way for Entrepreneurs, Businessmen, Creators, Filmmakers, Musicians, Artists, and various individuals to raise funds for their projects or businesses. The public plays a crucial role in this process by providing Support through online platforms. Artificial intelligence and machine learning are increasingly being used to enhance the crowdfunding experience, analyzing trends and influencing variables to help Fundraisers reach potential Contributors. Startup companies and Investors also benefit from this market, with equity crowdfunding allowing for shared ownership. Social media platforms and Government efforts further amplify the reach of crowdfunding campaigns. Charities and Donors also utilize crowdfunding sites for philanthropic causes. Effective Marketing strategies and the power of Social networking sites can significantly impact a Donor's decision to contribute.

Market Research OverviewCrowdfunding is a revolutionary method for Entrepreneurs, Businessmen, Creators, Filmmakers, Musicians, Artists, and others to raise funds for their projects from the General Public. Online platforms serve as business platforms, connecting Project Creators with Potential Investors, including Individual Investors, Startup Firms, and Alternative Capital providers. Crowdfunding transcends Traditional Channels, such as Banks and Venture Capitalists, offering access to a Global Audience. Technology and Social Media Platforms play a significant role, enabling Artificial Intelligence and Machine Learning to influence Donor's decisions. However, this alternative capital source comes with Financial Risks, Regulations, and potential Fraud or Misuse of Funds. Factors like Location, Credit Score, and Net Worth influence an Investor's decision to contribute. Project creators must ensure Funding Goals are realistic, and Customer Satisfaction is prioritized. Equity Crowdfunding and Donation-based models cater to various sectors like Media & Entertainment, Real Estate, Health care, and the Cultural Sector. Pre-seed and Seed Capital are common funding goals, with large investments possible for promising projects. Investors should consider the Reputation and Credibility of the Project Creator before making a commitment. Charities also benefit from this approach, reaching a wider audience through Social Networking Sites. In summary, Crowdfunding offers a unique opportunity for Creators and Entrepreneurs to secure funding, but it requires careful planning, transparency, and a strong online presence.

Table of Contents:1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation

-

Type

-

P2P Lending

Equity Investment

Hybrid

Reward

Others

-

On-premises

Cloud

-

APAC

Europe

North America

South America

Middle East And Africa

7 Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

ContactsTechnavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: [email protected]

Website:

SOURCE Technavio

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment