Bitcoin's Price Stays Above $104K As Analyst Predicts Future Moves Using Funding Rates

Despite the pause in the price movement, bitcoin 's performance has reignited interest in the market. Analyst Burak Kesmeci from CryptoQuant recently shared insights on Bitcoin 's price behavior and market indicators, offering valuable perspectives on potential future developments.

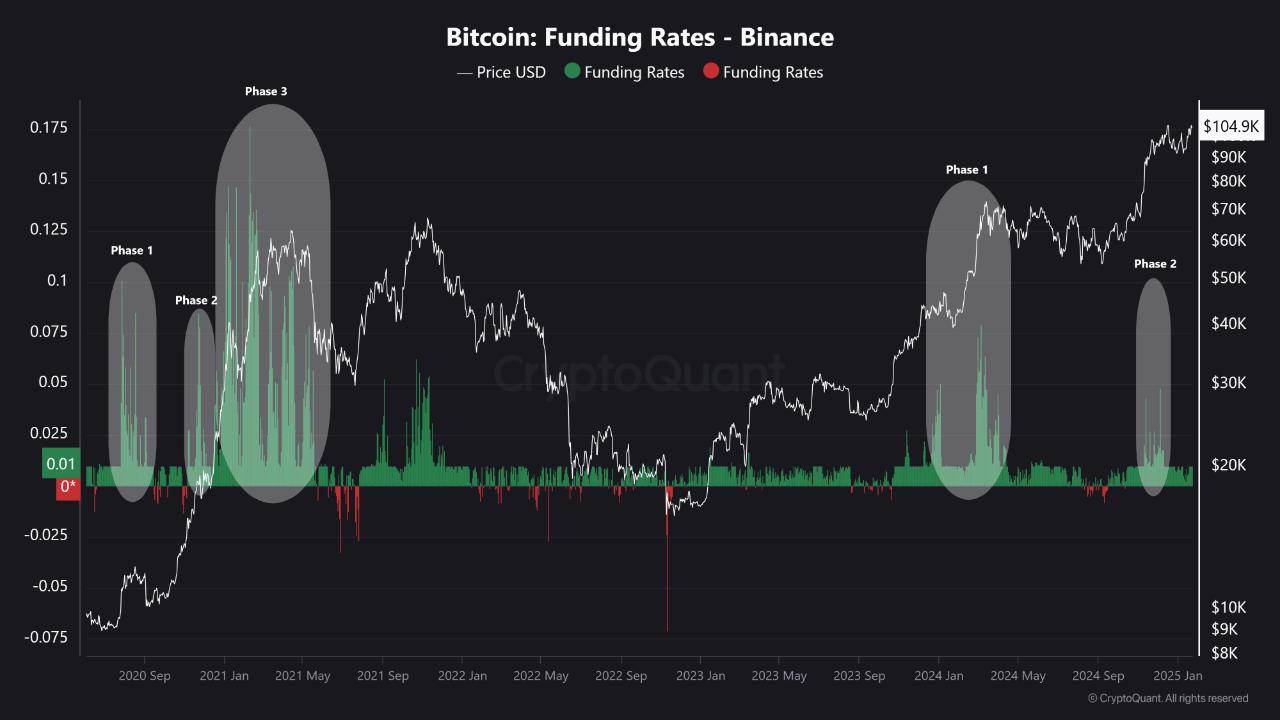

Kesmeci's analysis on the Binance Bitcoin Funding Rates highlights key phases observed during previous bull cycles, providing a framework for understanding the current market conditions.

Bitcoin's Future Based on Funding RatesDuring the 2020-2021 bull run, the Binance Bitcoin Funding Rates went through three distinct phases:

Phase 1 (July 2020): Funding rates remained stable before demand surged, propelling Bitcoin from $9,000 to $12,000 as rates rose to 0.10.

Phase 2 (November 2020): Bitcoin corrected after an initial rally, with funding rates supporting its climb from $12,000 to $19,000.

Phase 3 (December 2020): As Bitcoin hit new highs above $60,000, funding rates reflected strong market support.

Currently, Kesmeci notes the Binance Bitcoin Funding Rates are at baseline levels, indicating the early stages of a new bull cycle. The analyst anticipates potential future market movements based on funding rates exceeding 0.01.

Elevated funding rates may signal increased futures market activity and potentially lead to another significant price surge. However, Kesmeci warns that such high rates are often unsustainable and could trigger corrective events in the market.

Market Metrics and DivergencesAnother CryptoQuant analyst, TraderOasis, delved into critical metrics like the Coinbase Premium Index, open interest, and funding rates to assess Bitcoin 's market health and potential trajectory.

TraderOasis highlighted discrepancies between the Coinbase Premium Index and Bitcoin 's price movement, raising concerns about the sustainability of the current price trend despite reaching new highs.

Furthermore, a misalignment between open interest and price suggests a lack of solid foundation for continued upward momentum, indicating potential market instability.

Examining funding rates, TraderOasis noted a bearish sentiment among traders, which could precede sharp price movements. This sentiment could lead to an initial price spike followed by a pullback, setting the stage for a more stable long-term uptrend.

Featured image created with DALL-E, Chart from TradingView

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk.

Don't invest unless you're prepared to lose all the money you invest.

This is a high-risk investment, and you should not expect to be protected if something goes wrong.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment