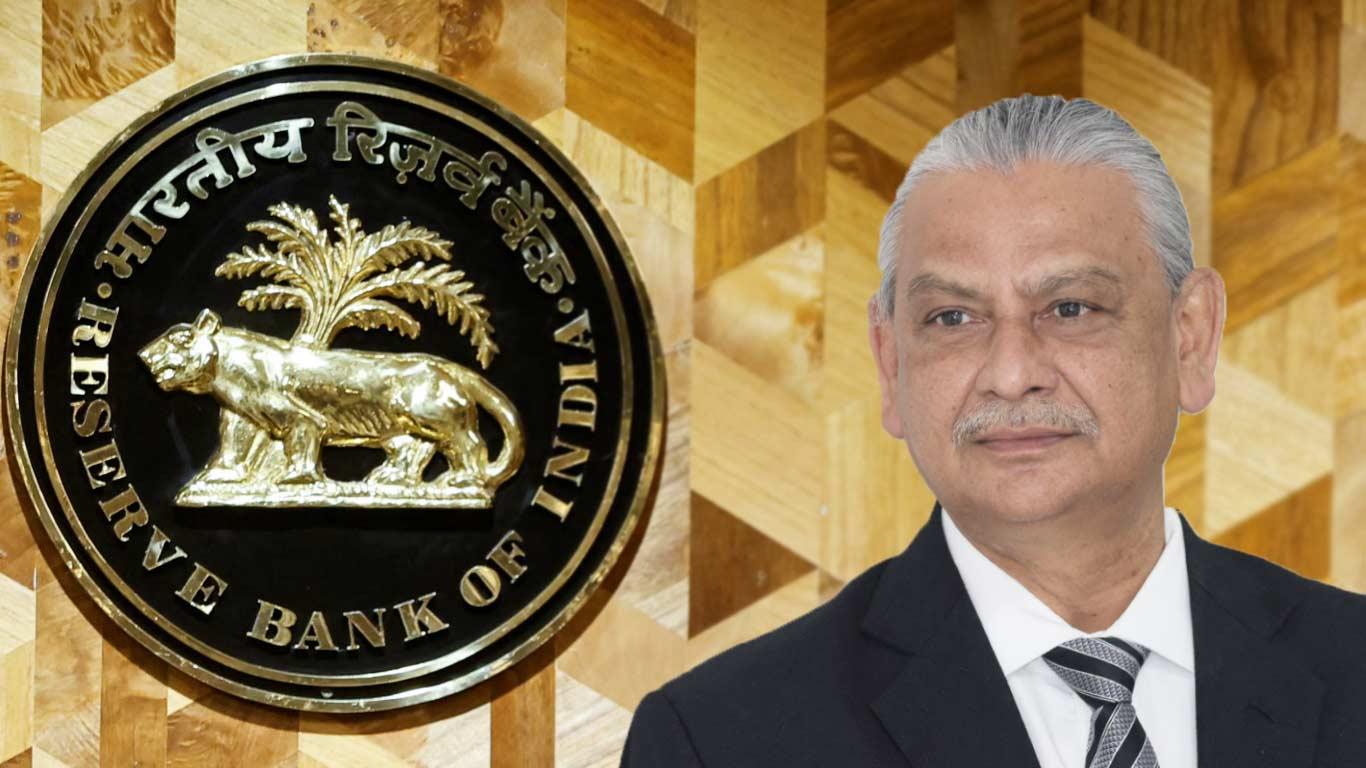

RBI Reallocates Deputy Governor Portfolios Following Patra's Departure

Deputy Governor M Rajeshwar Rao, who oversees banking regulation, has been assigned the crucial monetary policy department and department of economic and policy research, key portfolios previously managed by Patra.

The central bank, which maintains four deputy governor positions, has distributed Patra's other responsibilities among the remaining deputy governors.

The position of deputy governor in charge of monetary policy carries particular significance as it includes membership in the monetary policy committee (MPC), the bank's rate-setting panel.

The government has initiated the search for Patra's successor, with reports indicating that a high-level panel consisting of RBI Governor Sanjay Malhotra, Cabinet Secretary T V Somanathan, and Department of Financial Services Secretary M Nagaraju will conduct candidate interviews this week.

The timing of the appointment is crucial, with the next MPC meeting scheduled for February 5-7, and the monetary policy department traditionally being led by an economist.

Patra's tenure at the RBI was marked by significant service, beginning with his appointment as deputy governor in January 2020 for a three-year term, which was subsequently extended twice, in 2023 and 2024.

His association with the central bank dates back to 1985, during which he served as executive director and was a founding member of the MPC in 2016.

Notably, Patra played a crucial role as member secretary of the Expert Committee to Revise and Strengthen the Monetary Policy Framework, established in 2014 under then-deputy governor Urjit Patel.

This committee's recommendations led to the establishment of the monetary policy committee and the implementation of the flexible inflation target framework, marking significant reforms in India's monetary policy structure.

(KNN Bureau)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment