Semiconductor Market: Top Players, Emerging Trends, And Future Opportunities

January 8, 2025 by Mark Allinson

The semiconductor industry is the backbone of modern technology, powering devices and innovations that are reshaping our world.

From smartphones and laptops to autonomous vehicles and advanced robotics, semiconductors enable the functionality of nearly every modern device.

As the market evolves, so do its key players, technologies, and competitive dynamics. For investors and technologists, understanding these changes is critical to staying ahead.

Top 10 largest semiconductor companies by market capitalisationAs of late 2023, the semiconductor industry has witnessed dramatic shifts in market leadership. Here are the top 10 companies ranked by market capitalisation:

Nvidia : A leader in GPUs, Nvidia has capitalised on the explosion of AI, data centres, and high-performance computing. Taiwan Semiconductor Manufacturing Company (TSMC) : The largest contract chipmaker globally, producing chips for tech giants like Apple and Nvidia. Intel : Long a cornerstone of the semiconductor industry, Intel specialises in CPUs but has struggled with manufacturing delays. Samsung Electronics : Beyond consumer electronics, Samsung is a major player in memory chips and semiconductor fabrication. Advanced Micro Devices (AMD) : Known for its Ryzen processors and Radeon GPUs, AMD has been gaining market share against Intel. Qualcomm : A key supplier of mobile chipsets and a leader in 5G technology. Broadcom : Offering a diverse portfolio spanning networking, broadband, and storage chips. Texas Instruments : Specialising in analog chips and embedded processors, TI serves a wide array of industries. Micron Technology : A leader in memory solutions, including DRAM and NAND flash memory. ASML : Not a chipmaker but essential to the industry, ASML's lithography machines are critical for semiconductor fabrication. Top manufacturers by revenue and unit salesWhile market capitalisation reflects investor confidence, revenue and unit sales highlight operational scale:

TSMC : Dominates the contract manufacturing market, producing chips in vast quantities for multiple clients. Samsung Electronics : Its memory chip business generates substantial revenue. Intel : Remains a top producer of CPUs for PCs and servers despite recent setbacks. SK Hynix : A major player in memory chip production. Micron : Focused on memory chips, Micron ranks high in unit sales. The Nvidia v Intel paradigm shiftNvidia's ascent to become the largest semiconductor company by market capitalisation underscores how quickly the industry can change. Several factors have driven Nvidia's growth:

AI and machine learning : GPUs optimised for parallel processing make Nvidia's products essential for AI applications.

-

Autonomous vehicles : Partnerships with automakers for self-driving technologies have expanded Nvidia's reach.

Robotics and automation : Nvidia's platforms enhance robotic vision and decision-making.

Cryptocurrency mining : While volatile, the crypto boom created significant demand for GPUs.

In contrast, Intel has struggled to keep pace. Delays in advancing to smaller nanometer processes allowed competitors like TSMC and AMD to gain ground. Losing Apple as a client and slower adoption of AI-specific hardware have further affected Intel's standing.

The role of AI chips What are AI chips?AI chips are processors designed to handle the unique demands of machine learning tasks. Unlike traditional CPUs, they excel at parallel computations and are optimised for neural network operations.

How are they different?-

Architecture : AI chips focus on tensor operations, which are central to AI tasks.

Energy efficiency : They perform complex calculations with lower power consumption.

Customisation : Many are tailored for specific applications like natural language processing or image recognition.

AI capabilities are increasingly integrated into various chip types, but specialised AI chips still dominate high-performance applications. As AI becomes more pervasive, the line between traditional and AI chips may blur.

Quantum chips: The next frontierQuantum computing represents a potential leap in processing power. Quantum chips, still in their infancy, promise exponential increases in computational capabilities.

Current leaders-

Google : Achieved quantum supremacy with its Sycamore processor.

IBM : Leading research in scalable quantum systems.

Intel : Investing heavily in quantum computing technologies.

Timeline : While significant breakthroughs are expected within a decade, widespread commercial availability may take longer.

Can TSMC become a consumer brand?Traditionally a contract manufacturer, TSMC has operated behind the scenes. However, its technological leadership positions it as a potential brand in its own right.

Challenges include the need for consumer-facing marketing and distribution networks, which differ from its current B2B model.

Apple's chip strategyApple's transition to in-house chips, starting with the M1 and M2 series, has been a resounding success. These chips deliver exceptional performance and efficiency, allowing Apple to reduce reliance on third-party suppliers.

Future plans : Apple may extend in-house development to additional product lines. Its exploration of custom modems, GPUs, and AI processors highlights its ambition to control more of its supply chain.

Other chips in Apple devices-

Qualcomm modems : Used in iPhones, though Apple is developing its own.

Specialised chips : Apple sources sensors and controllers from various suppliers.

-

Consumer electronics : Smartphones, laptops, and gaming consoles dominate demand.

Automotive : Autonomous vehicles and advanced driver-assistance systems (ADAS).

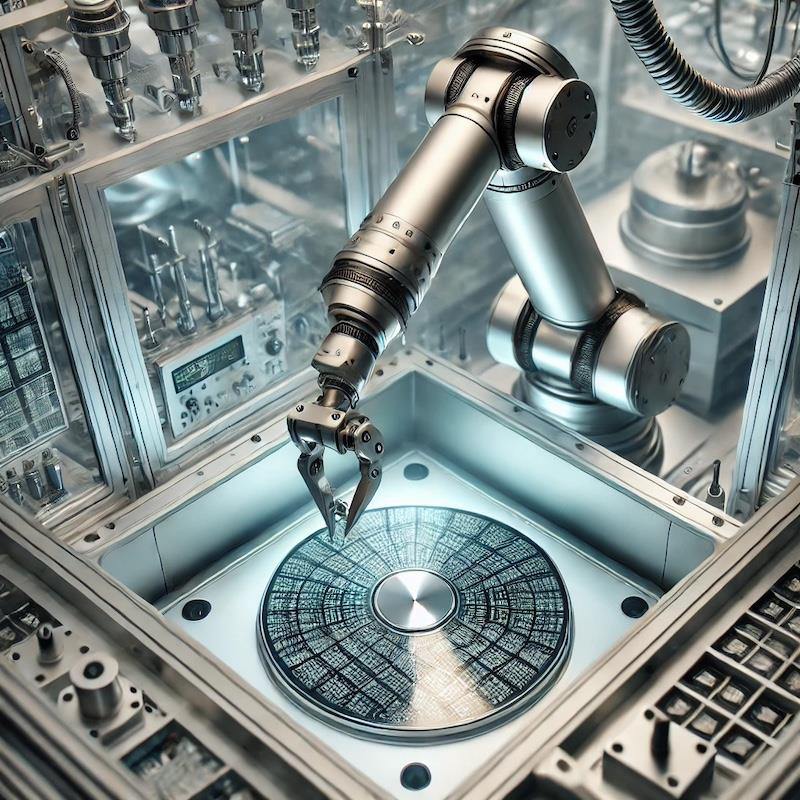

Industrial automation : Robotics and IoT devices in manufacturing.

Data centres : AI training and cloud computing drive significant demand.

To achieve growth, chipmakers must target high-potential technologies and markets.

-

Robotics and humanoids : Increasing demand for AI-enabled robots in various sectors.

Space exploration : Radiation-hardened chips for satellites and spacecraft.

Internet of things : Billions of connected devices require efficient, low-power chips.

Artificial intelligence : Continued expansion of AI applications across industries.

Sustainability : Developing energy-efficient chips to meet environmental standards.

The semiconductor industry is in a state of transformation, with shifting market leadership and rapid technological advancements.

Nvidia's rise highlights the importance of aligning with emerging trends, while Intel's challenges underscore the risks of complacency.

As AI, quantum computing, and robotics drive demand for new capabilities, chipmakers must innovate continuously to remain competitive.

For investors and technologists alike, the semiconductor sector offers immense opportunities – and navigating its complexities will be key to success in the coming decade.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment