403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Qatar's 2025 Budget Balances Key Investments With Conservative Projections: Oxford Economics

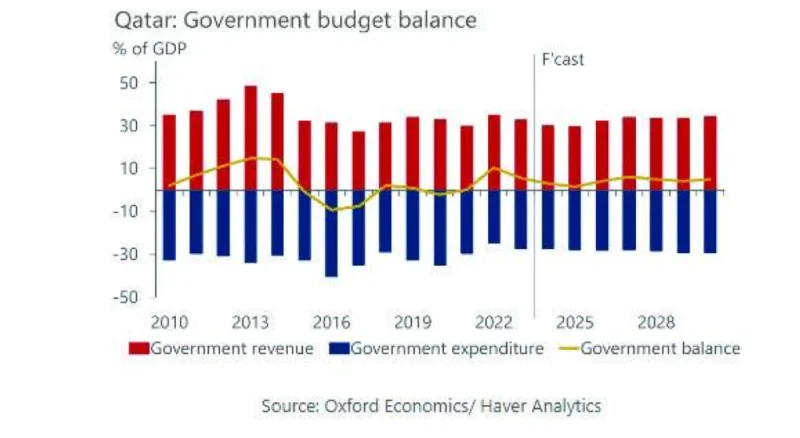

(MENAFN- Gulf Times) Qatar's conservative oil price assumption of $60/barrel“underscores the country's fiscal discipline and sustainable policies”, Oxford Economics said in a report released Thursday.

Qatar has announced its 2025 budget, focusing on education, healthcare, and sustainability, with total expenditure set at QR210bn.

The municipality and environment sector is allocated QR21.9bn, while the sports sector will receive QR6.6bn.

The budget forecasts revenue of QR197bn, resulting in a projected deficit of QR13.2bn, which Oxford Economics noted is due to conservative oil price assumptions.

“This supports Qatar's strong credit rating, but we believe these oil price assumptions are conservative since Qatar has maintained a budget surplus over the past three years. We expect a surplus of around QR25bn for 2024, narrowing to QR12bn in 2025. These projections underscore Qatar's fiscal discipline and sustainable policies,” Oxford Economics said.

In a recent report, Oxford Economics estimated Qatar's non-energy economy would grow by 2.4% in 2024 (versus its previous projection of 2.5%), up from 1.1% in 2023.

Growth in the non-energy sector improved at the end of last year, picking up to 1.7% year-on-year (y-o-y) in Q4, from an average of 0.8% in the preceding three quarters.

Performance was mixed across sectors at the end of last year, with positive trends in the wholesale and retail and hospitality-related sectors offset by drags spanning administrative and professional services, finance and insurance, and information and communications technology.

Tourism has provided a key support to non-energy activities and will remain a driver of future growth.

Data show the number of foreign arrivals neared 3mn in the year to July, on track to meet the researcher's forecast of 4.5mn overnight visitors this year.

The launch of the pan-GCC visa should help extend the positive performance in 2025.

Oxford Economics sees Qatar's energy sector growing just 1% in 2024, amid the weak performance of industry year-to-date, before strengthening to 2% next year.

The authorities have doubled down on the North Field gas expansion project, which will have a positive medium-term impact. The target liquefied natural gas (LNG) capacity was raised to 142mn tonnes per year (mtpy) by the end of 2030, up nearly 85% from 77 mtpy currently and 13% on the intermediate target of 126 mtpy by 2027.

Last year, Qatar awarded a $10bn contract for the second phase of the project, North Field South, which will include the delivery of two LNG trains.

Qatar is also making progress in contracting future gas output. The government has signed long-term supply contracts with India, China, France, Germany, Hungary, Kuwait, and Taiwan and is negotiating a deal with South Africa, Oxford Economics noted.

Qatar has announced its 2025 budget, focusing on education, healthcare, and sustainability, with total expenditure set at QR210bn.

The municipality and environment sector is allocated QR21.9bn, while the sports sector will receive QR6.6bn.

The budget forecasts revenue of QR197bn, resulting in a projected deficit of QR13.2bn, which Oxford Economics noted is due to conservative oil price assumptions.

“This supports Qatar's strong credit rating, but we believe these oil price assumptions are conservative since Qatar has maintained a budget surplus over the past three years. We expect a surplus of around QR25bn for 2024, narrowing to QR12bn in 2025. These projections underscore Qatar's fiscal discipline and sustainable policies,” Oxford Economics said.

In a recent report, Oxford Economics estimated Qatar's non-energy economy would grow by 2.4% in 2024 (versus its previous projection of 2.5%), up from 1.1% in 2023.

Growth in the non-energy sector improved at the end of last year, picking up to 1.7% year-on-year (y-o-y) in Q4, from an average of 0.8% in the preceding three quarters.

Performance was mixed across sectors at the end of last year, with positive trends in the wholesale and retail and hospitality-related sectors offset by drags spanning administrative and professional services, finance and insurance, and information and communications technology.

Tourism has provided a key support to non-energy activities and will remain a driver of future growth.

Data show the number of foreign arrivals neared 3mn in the year to July, on track to meet the researcher's forecast of 4.5mn overnight visitors this year.

The launch of the pan-GCC visa should help extend the positive performance in 2025.

Oxford Economics sees Qatar's energy sector growing just 1% in 2024, amid the weak performance of industry year-to-date, before strengthening to 2% next year.

The authorities have doubled down on the North Field gas expansion project, which will have a positive medium-term impact. The target liquefied natural gas (LNG) capacity was raised to 142mn tonnes per year (mtpy) by the end of 2030, up nearly 85% from 77 mtpy currently and 13% on the intermediate target of 126 mtpy by 2027.

Last year, Qatar awarded a $10bn contract for the second phase of the project, North Field South, which will include the delivery of two LNG trains.

Qatar is also making progress in contracting future gas output. The government has signed long-term supply contracts with India, China, France, Germany, Hungary, Kuwait, and Taiwan and is negotiating a deal with South Africa, Oxford Economics noted.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment