Asia Week Ahead: The Bank Of Japan Meeting And Lots Of Inflation Data

We expect the bank of Japan to continue to remain on pause and leave the policy rate unchanged when it meets in October. And you can read more about what Min Joo expects here . In a nutshell, we think the BoJ expected to reiterate its core message that if the Economy develops in line with the Bank's forecast, it will continue to normalise monetary policy. Markets will pay particular attention to the BoJ's quarterly outlook report. We believe that the inflation outlook for the whole of 2024 could be revised upwards, but no major changes are expected for the coming year, while the GDP outlook for FY24 should be revised downwards, reflecting recent production declines related to the auto sector and natural disasters.

Industrial production is expected to rebound to 2.0% MoM sa, following the normalisation of auto production since mid-September and the end of production disruptions from mega earthquake warnings. Retail sales growth is also expected to remain strong, driven by strong growth in car sales.

South Korea: IP and trade dataIndustrial production is expected to show a second month of solid growth as auto production normalises and semiconductor production rebounds. Meanwhile, October trade is certainly in focus. Early October export data suggests slower growth here, but mostly due to the unwinding of favourable base effects. Chip exports will remain a key driver of growth, but we see some signs of weakening in petrochemicals and steel exports.

Australia: Inflation data moving to targetHeadline YoY inflation should fall in the third quarter, finally dropping to within the 2-3% target band for the first time since mid-2021. Lower gasoline and electricity price rebates are driving that. However, core inflation is expected to remain well above 3%, given the still tight labour market conditions, suggesting rate cuts are unlikely in the RBA's November meeting.

Indonesia: CPI data set to remain muted

Headline inflation is expected to remain muted at levels below 2% largely driven by ample food supply and lower food prices, lower oil prices and a stronger rupiah. This should create room for Bank Indonesia to cut rates in the fourth quarter.

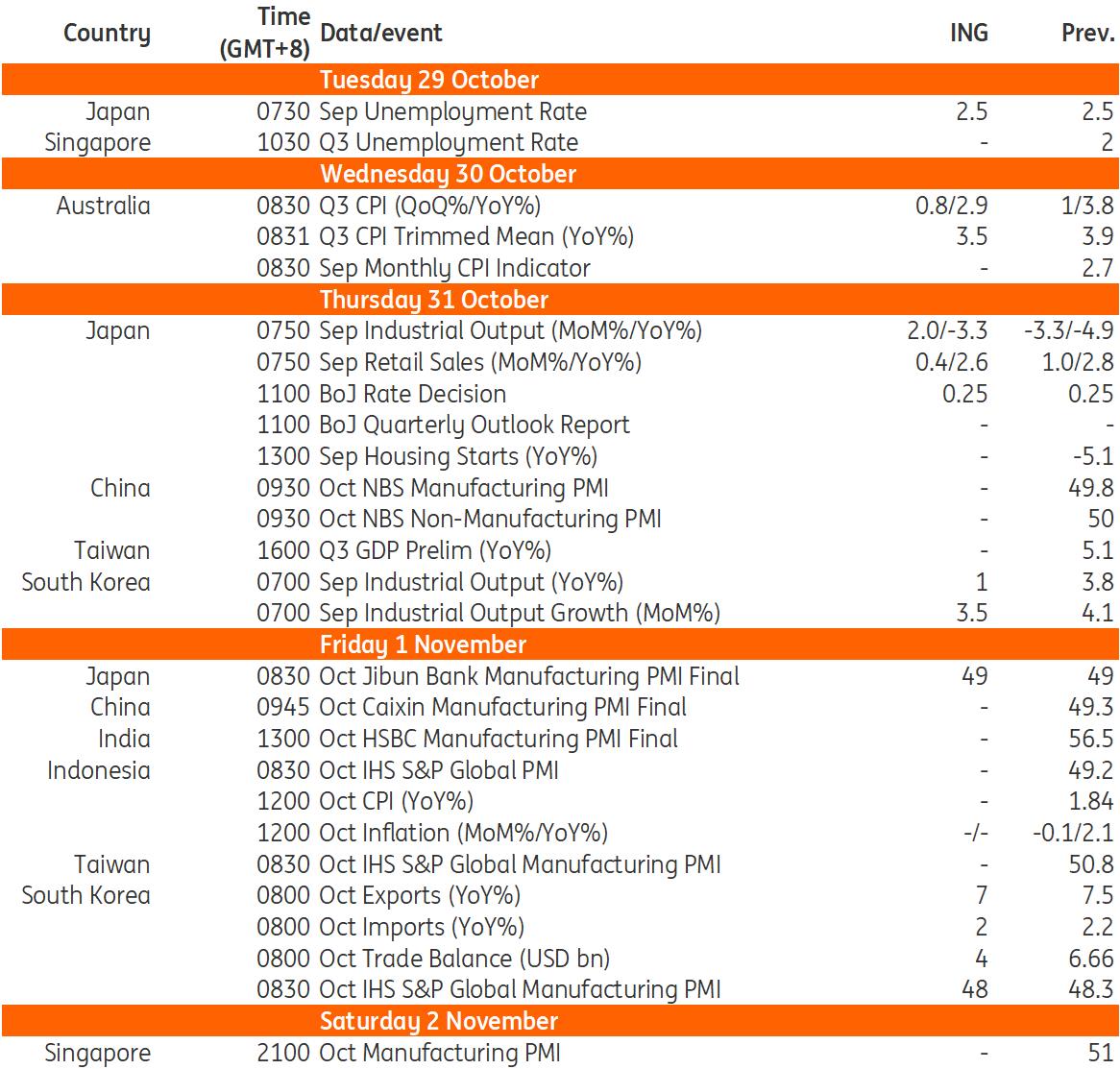

Key events in Asia next week

Source: Refinitiv, ING

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment