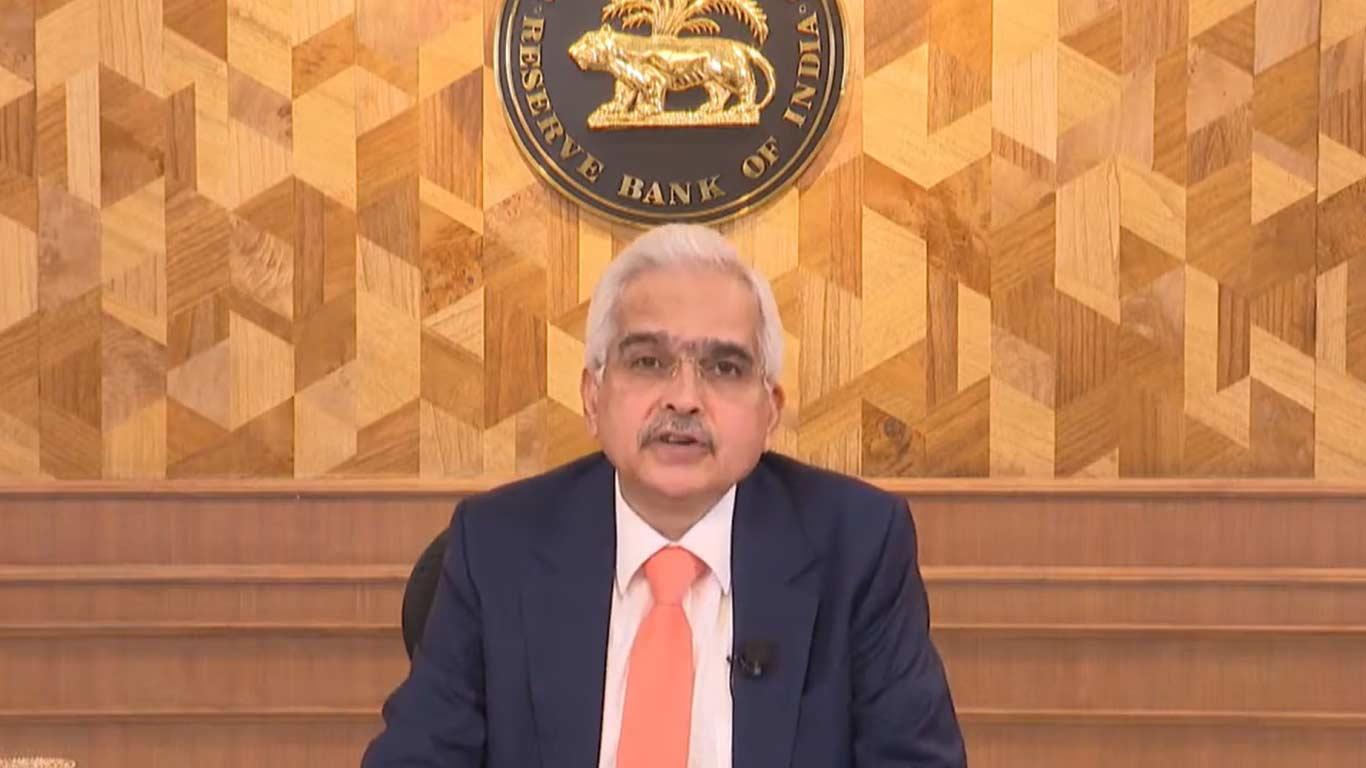

RBI Holds Firm On Interest Rates As Inflation Set To Rise: Governor Das

This announcement came during a Bloomberg-hosted fireside chat on Friday, where Das emphasised that implementing rate cuts at this juncture would be both 'premature' and fraught with risk.

For nearly two years, the RBI has maintained its key repo rate-the rate at which banks borrow from the central bank-at 6.5 per cent.

This policy stance persists despite recent rate reductions by the U.S. Federal Reserve and central banks in other nations.

The repo rate serves as a crucial tool for the RBI in managing inflation, which reached a nine-month peak in September.

Typically, lowering interest rates can stimulate borrowing, boost consumption, and invigorate economic activity.

However, Governor Das expressed caution about such a move given the current economic landscape.

He pointed out that with inflation at 5.2 per cent and projections indicating another high figure in the upcoming report, coupled with robust economic growth, a rate cut could pose significant risks.

Das further elaborated on the RBI's position, stating, "We will not miss the (global) party. We will wait and watch and join the party when inflation figures are durably aligned."

This statement underscores the central bank's commitment to a measured approach, prioritising economic stability over hasty policy shifts in response to global trends.

(KNN Bureau)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment